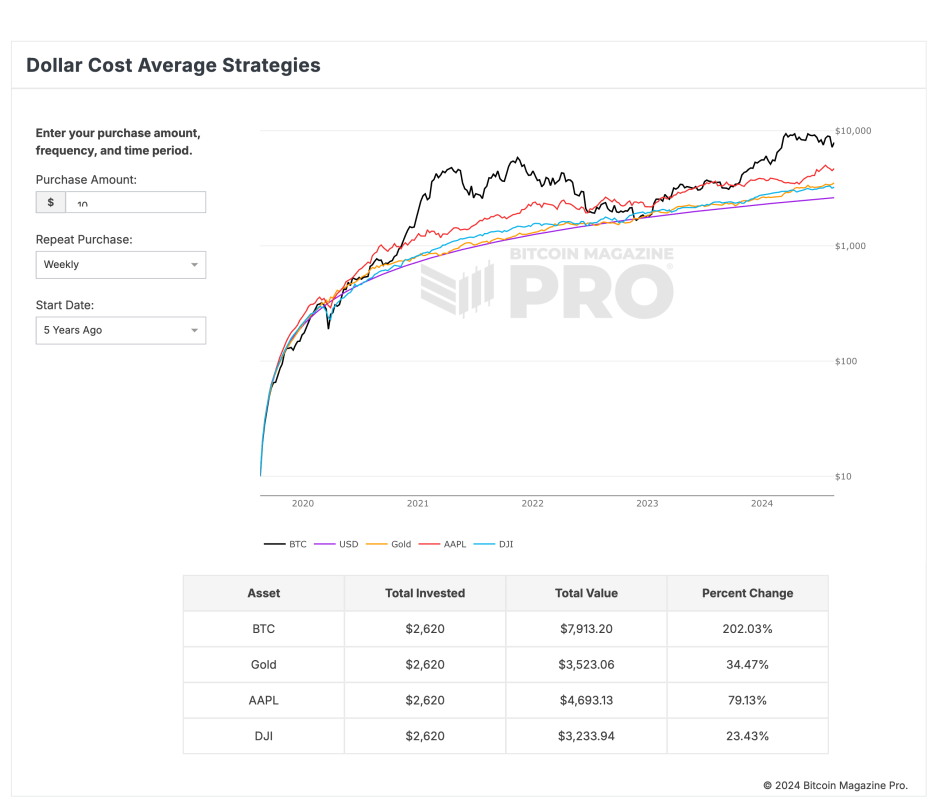

A recent analysis of Bitcoin Pro Magazine shows the power of dollar-cost averaging (DCA) in Bitcoin compared to traditional assets like gold, Apple stock, and the Dow Jones Industrial Average (DJI). The data reveals that consistently investing $10 per week in Bitcoin over the past five years would have seen the total investment of $2,620 grow to $7,913.20, reflecting a remarkable return of 202.03%.

In contrast, the same weekly investment of $10 in gold returned 34.47%, making the initial $2,620 rise to $3,523.06. Apple stock also performed well, returning 79.13%, making the $2,620 investment $4,693.13. Meanwhile, the Dow Jones returned the least, rising 23.43%, making the investment rise to $3,233.94.

This data underscores Bitcoin’s potential to be one of, if not the, best assets that investors can incorporate into their long-term investment strategies. The principle behind dollar-cost averaging — regularly investing a fixed amount of money regardless of price fluctuations — has proven particularly effective with Bitcoin, as it allows investors to accumulate wealth over time.

Saving $10 a week in Bitcoin through Dollar Cost Averaging (DCA) offers an affordable and accessible way for beginners to start investing in Bitcoin. This strategy is especially appealing to those who may be hesitant to invest large sums upfront or who are still learning about the volatile nature of the Bitcoin market. By investing a small, fixed amount on a regular basis, people can gradually increase their Bitcoin holdings, reducing the impact of market fluctuations and making it easier to adopt a long-term investment mindset. This approach allows for consistent growth over time, without the pressure of trying to time the market perfectly.

Bitcoin Magazine Pro’s Dollar Cost Average Strategies tool allows users to explore various investment strategies, optimizing their Bitcoin investments over different time horizons. The tool compares Bitcoin’s performance to other assets such as the US dollar, gold, Apple stock, and the Dow Jones, illustrating Bitcoin’s potential as a superior store of value in a complete investment portfolio.

For more detailed information, insights, and to register to access Bitcoin Magazine Pro data and analysis, please visit the official website here.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.