According to various documents accessed by PTI, the issue of additional capital was approved by 99.99 per cent of the shareholders at an extraordinary general meeting held on August 8.

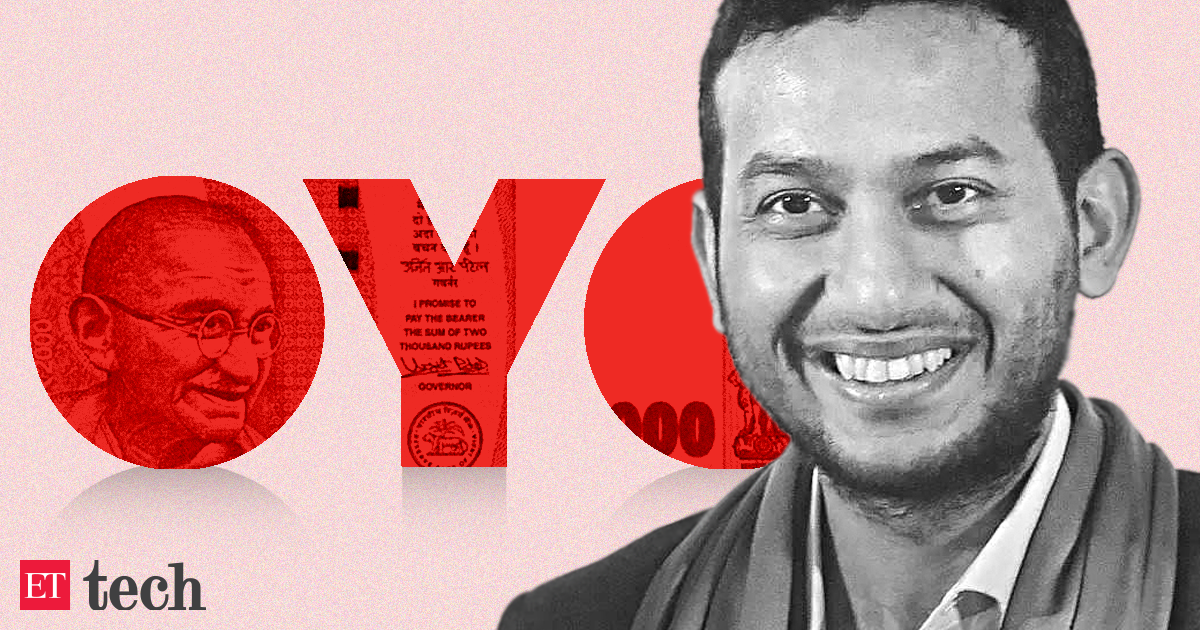

The capital will be used to support OYO’s growth and global expansion plans, the sources said.

The additional fundraising values the company at the same $2.4 billion valuation as the first tranche of the Series G issued to InCred in July, a source said.

Read also | Oyo completes Rs 1,000 crore fundraising from Indian family offices

The investment is being made through Mandatory Convertible Cumulative Preference Shares, each priced at Rs 29, in line with the valuation of the recent Series G issue.

Discover the stories that interest you

The funding round includes contributions from InCred Wealth, which led the recent fundraising, as well as J&A Partners, the family office of Pharmacy Humanity promoters and ASK Financial Holdings. 2,628,4483 shares will be issued to InCred, 4,137,9310 shares to J&A Partners, up to 4,827,586 shares to ASK Financial and 2,862,06897 shares to Patient Capital Investments Pte Ltd.

The total number of additional shares to be issued is 35,869,8276, priced at Rs 29 per share.

This would translate into an investment of about Rs 76 crore by InCred, in addition to the Rs 416.85 crore it invested recently. Serial investor Ashish Kacholia is also investing through InCred.

Additionally, Patient Capital is investing Rs 830 crore, J&A Partners Rs 120 crore and ASK Rs 14 crore. The Mankind Pharma family is investing through its family-owned firm J&A Partners, the sources said.

The shareholders also approved to increase the authorised share capital of the company from Rs 13,411,359,300 to Rs 16,311,359,300 at the Extraordinary General Meeting.

The appointment of Sumer Juneja, Managing Partner and Head of EMEA and India at SoftBank Investment Advisors, as a non-executive director on Oravel’s board was also presented at the EGM and approved with 99.99 percent of the votes.

Sumer will join Oravel’s board of directors as a Softbank Vision Fund candidate.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.