Economists at Nomura say the RBI could start cutting rates in October. | Photo: PTI

Slowing consumer demand in India and concerns about the global economy could push the central bank to consider interest rate cuts despite concerns about inflation, some economists say.

Industrial output has slowed and consumers are growing more pessimistic about job prospects, indicating that economic growth may come under pressure, according to economists at Nomura Holdings Inc. and Deutsche Bank AG. High borrowing costs are also dampening overall demand in the economy, preventing businesses from investing and slowing growth, they say.

The Reserve Bank of India has kept interest rates unchanged for more than 18 months, and Governor Shaktikanta Das said last week that food prices remain a concern and will keep inflation above its 4 percent target. While Monday’s data showed inflation dipped below that level in July, that was largely due to statistical reasons and is unlikely to prompt the RBI to ease rates.

German economist Kaushik Das said it was “time to focus on growth risks as well” as the economy showed increasing signs of stress.

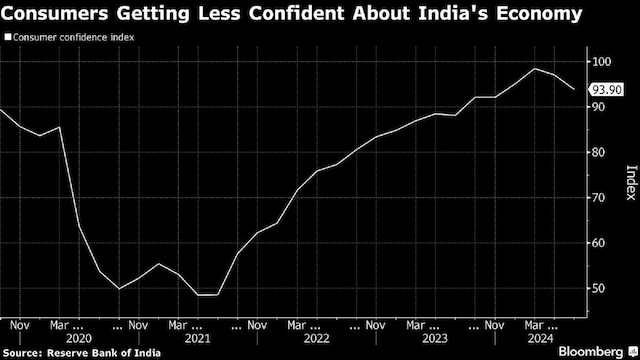

Industrial production figures released on Monday showed factory output slowing to 4.2 per cent in June from 6.2 per cent in the previous month. Last week, the RBI revised down its economic growth forecast for the April-June quarter to 7.1 per cent from 7.3 per cent, citing a slower pace of government spending and lower-than-expected corporate profitability. Separately, RBI data showed consumer confidence fell for the second consecutive month.

With private consumption accounting for 57-58% of gross domestic product, the decline in consumer confidence “deserves close monitoring,” said Deutsche Bank’s Das. Risks to global growth “have increased considerably,” he said, and the RBI needs to “fine-tune the monetary policy decision accordingly.”

Economists at Nomura say the RBI could decide to cut rates as early as October.

“The combination of softer growth and inflation, high real rates, along with greater degrees of freedom from the expected turn in the global monetary policy cycle, indicate that the October meeting is on track,” Nomura economists Sonal Varma and Aurodeep Nandi wrote in a note.

However, Morgan Stanley and UBS Group AG maintain that the RBI will keep its monetary policy unchanged even if the Federal Reserve starts cutting rates in September.

“A solid growth cycle is expected to continue with healthy productivity dynamics driven by capital spending, implying a higher neutral rate,” Morgan Stanley economists led by Chetan Ahya wrote in a note.

First published: August 13, 2024 | 20:21 IS

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.