India’s smartphone exports are expected to surpass $15 billion in 2023-24, up from $11 billion a year earlier, according to data released by the government last month. A significant portion of this figure likely came from Apple’s manufacturing plants in India, with exports averaging $1.6 billion a month by early 2024.

But that doesn’t mean India is a great country. smartphone manufacturing center Like China, it still imports a large portion of the components used in smartphones.

India’s smartphone exports gained momentum in the latter part of 2020 and surpassed $1 billion per month by the end of 2022. According to media reports, Apple assembled 14% of its iPhones, worth $14 billion, in India last year. The government attributes this to the production-linked incentive (PLI) scheme, which began in 2020 and provides subsidies to companies that meet production targets.

Read also: Dixon is becoming the Foxconn of India

But much of the world’s electronics manufacturing does not take place in a single country, but is spread across the globe. It is therefore critical for Indian industry to be part of such “global value chains.” One quantitative metric used in this context is global value chain-related trade, where plants import raw materials, process them, and re-export them to their end markets. According to the World Bank, India’s total global value chain-related trade in the manufacturing sector accounts for about 50% of its total gross manufacturing trade. For electrical and optical equipment, the share is slightly lower, but it shows how intertwined such trade is. In the context of smartphones, Indian manufacturers are still importing critical parts rather than manufacturing them here.

Increase in value

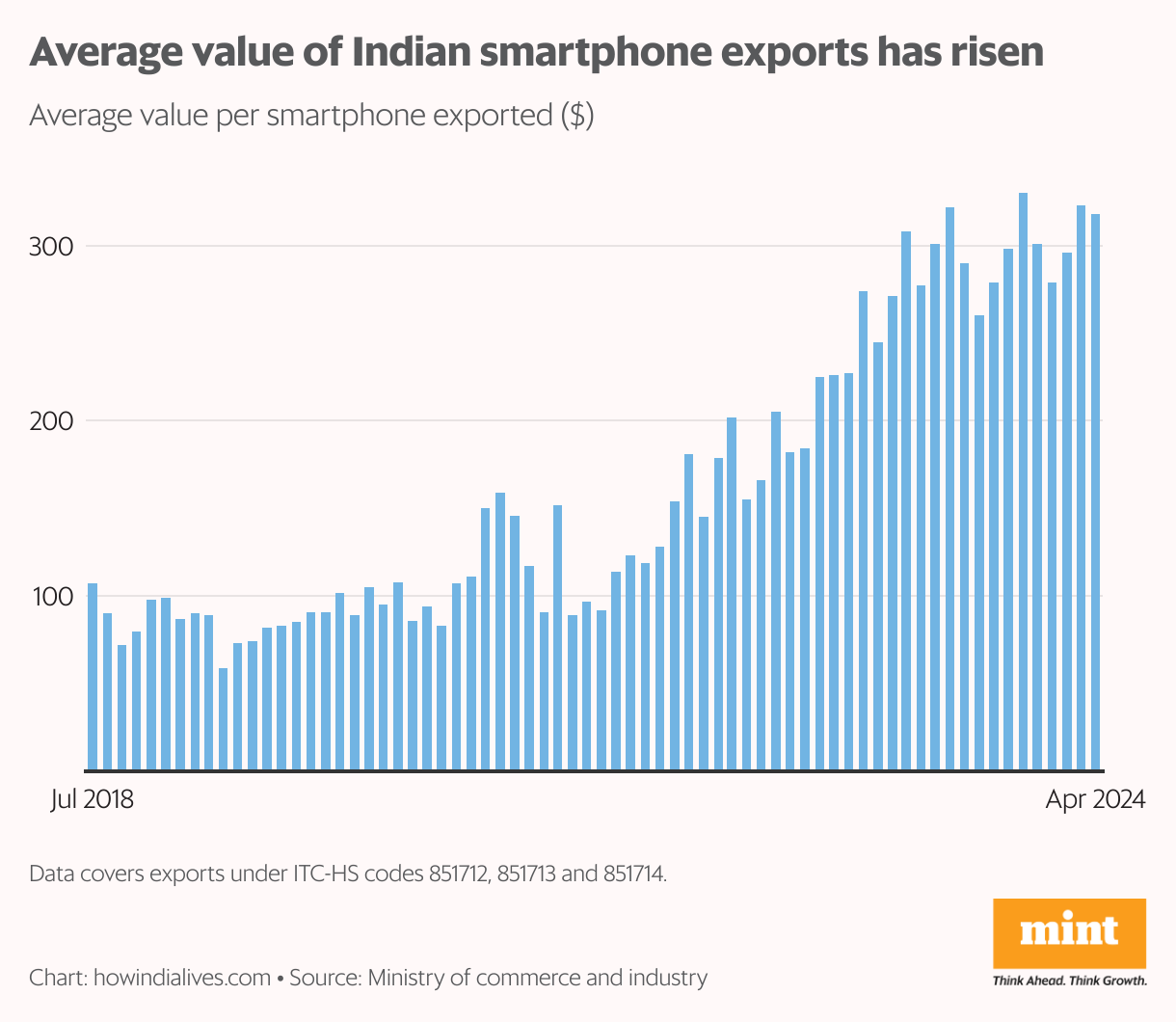

India’s smartphone exports have also increased in terms of volume. In 2023-24, the country exported around 52 million smartphones, up from 49 million in 2022-23 and 44 million in 2019-20. But perhaps more importantly, the average value of each smartphone exported has increased dramatically, from $85 per unit in 2019-20 to $296 per unit in 2023-24.

This is almost certainly due to the fact that Apple has become a major smartphone exporter from India. It makes several models from the iPhone 12 to the iPhone 15 here, though not the high-end Pro and Pro-Max models, according to a Bloomberg report. Ultimately, Apple intends to make a quarter of its iPhones in India over the next few years. Moneycontrol ReportIt is also looking to move some of its iPad and AirPods manufacturing to India.

American primacy

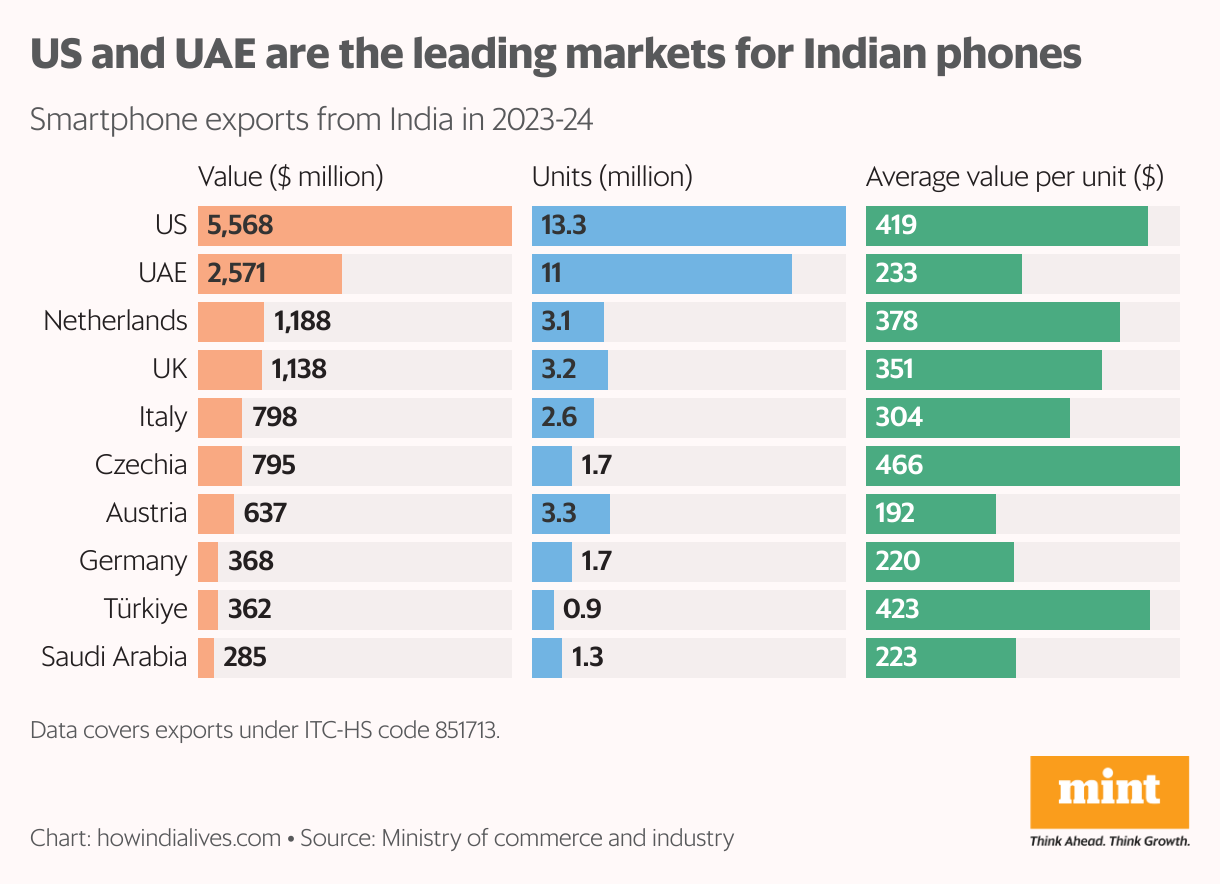

According to government data, in 2023-24, about one-third of India’s smartphone exports (about $5.5 billion, equivalent to about 13 million units) were destined for the US. This is a dramatic increase from 2019-20, when mobile phone exports to the US amounted to about $100 million. In that year, India’s top mobile phone export market was the United Arab Emirates (exports of $2 billion), followed by Russia ($496 million).

Read also | Mint Explainer: Raghuram Rajan is right about India’s mobile phone exports

The UAE remains India’s second-largest market, but Russia is no longer in the top 10, which now includes a handful of European markets. Interestingly, the average export value of a smartphone differs significantly depending on the country it is shipped to. Among India’s top markets for smartphone exports, the average value in 2023-24 ranged from $192 for Austria to $419 for the US.

Import export?

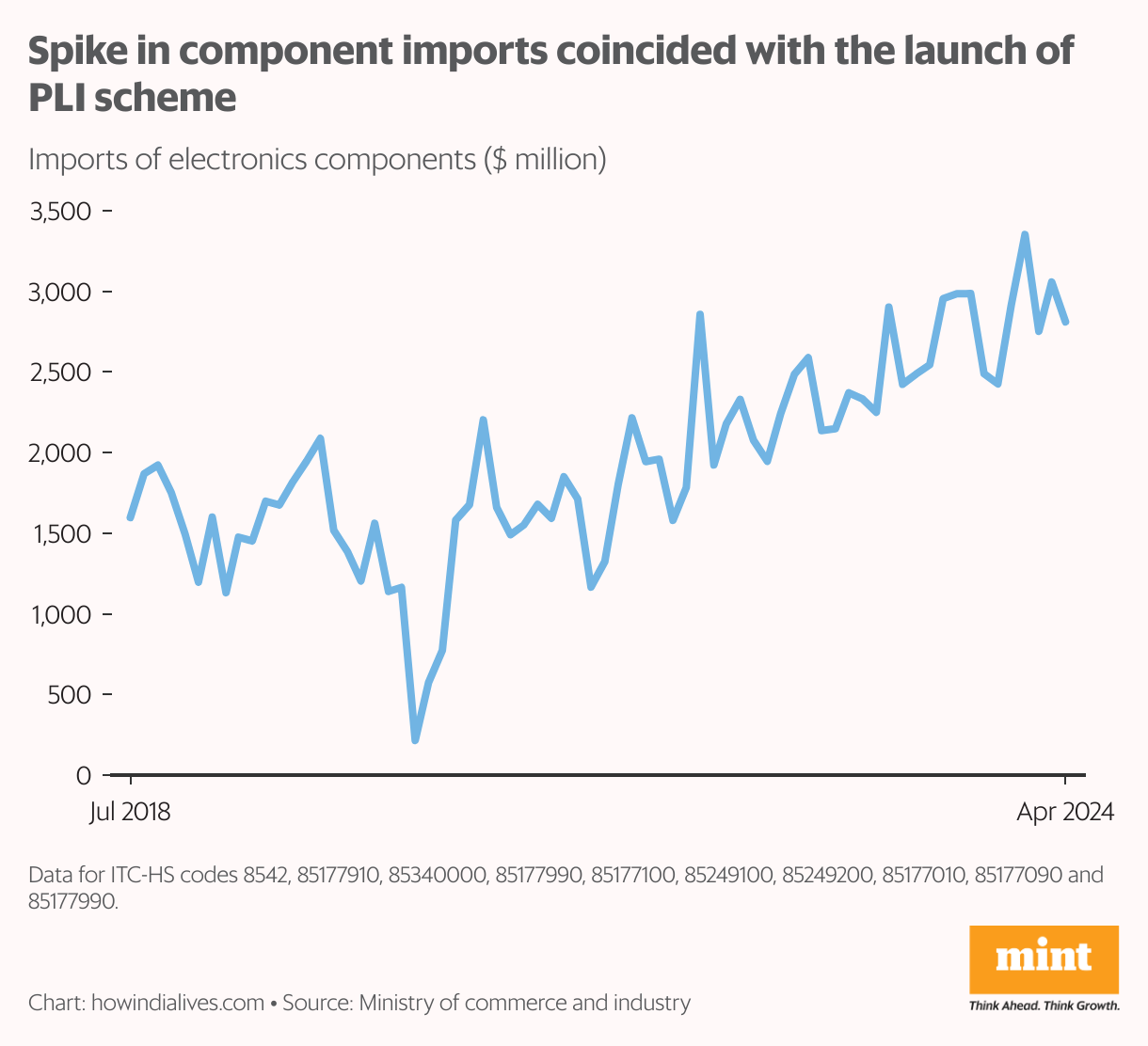

In a 2023 paper, Rahul Chauhan, Rohit Lamba and Raghuram Rajan noted that along with smartphone exports, imports of smartphone components had skyrocketed, showing that India was still just an assembly hub. In 2023-24, this trend is likely to continue, with imports of circuits and other electronic components worth $33 billion, or more than double exports of finished goods.

Read also: Google sees India as crucial to its overall business and cuts prices of Pixel phones

These components are likely to be used in other electronic devices as well, but the fact that the surge in their imports coincided with the PLI programme indicates that this import demand is being driven by PLI-linked manufacturers. The fact that India remains largely an assembly hub for finished smartphones is not necessarily a bad thing, but it does show that India still has a long way to go and needs to aim for increasing participation in global value chains for components used in electronic devices.

www.howindialives.com is a database and search engine for public data.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.