Demand for Bitcoin has seen a very steep decline since April. Reduced U.S. spot ETF purchases as well as declining whale holdings have contributed to this drop. Meanwhile, long-term holders continue to accumulate Bitcoin at record rates, while short-term holders, who bought during the 2024 rally, are now suffering unrealized losses. Furthermore, Bitcoin mining costs have increased after the halving, with operating expenses and increased mining difficulty pushing the cost of mining per Bitcoin to nearly $52,000. Despite these challenges, some analysts suggest that the worst may be over.

Bitcoin demand falls

Demand for Bitcoin has been on a steady decline since April, and recent data even shows it approaching negative levels. A report by Cryptoquantity revealed that the apparent demand for Bitcoin has fallen quite a bit, going from a 30-day growth of 496,000 BTC in April to a negative growth of 25,000 BTC.

This demand metric is calculated by analyzing the difference between the daily Bitcoin block subsidy and the daily change in the amount of Bitcoin that has been sitting idle for over a year.

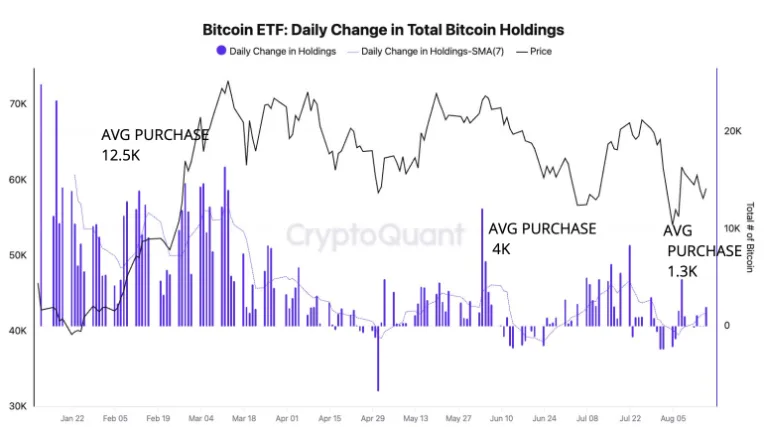

Naturally, the decline in demand has impacted the price of Bitcoinwhich fell from around $70,000 in April to a low near $51,000 in early August. Despite this correction, Bitcoin has still managed to record a return of over 30% year-to-date. One of the main drivers of this slowdown in demand appears to be a reduction in purchases by cash exchange-traded funds (ETF) in the United States. In fact, purchases fell from 12,000 BTC in March to an average of 1,300 BTC in the week of August 11-17.

Daily change in total Bitcoin holdings (Source: CryptoQuant)

The decline in demand for BTC is also demonstrated by the falling price premium for BTC trading on CoinbaseAfter reaching a 0.25% premium in early 2024, coinciding with the launch of the ETFs, the premium has since fallen to 0.01%. Now, analysis suggests that a recovery in spot ETF purchases could be instrumental in boosting demand for Bitcoin and potentially triggering a price rally.

Despite declining institutional demand, long-term Bitcoin holders have been accumulating the digital asset at an unprecedented pace. The total balance of addresses that have never spent or sold Bitcoin is increasing at a record monthly pace of 391,000 BTC. This surge in demand from long-term holders is surpassing levels seen in Q1 2024, when the Bitcoin price surpassed $70,000.

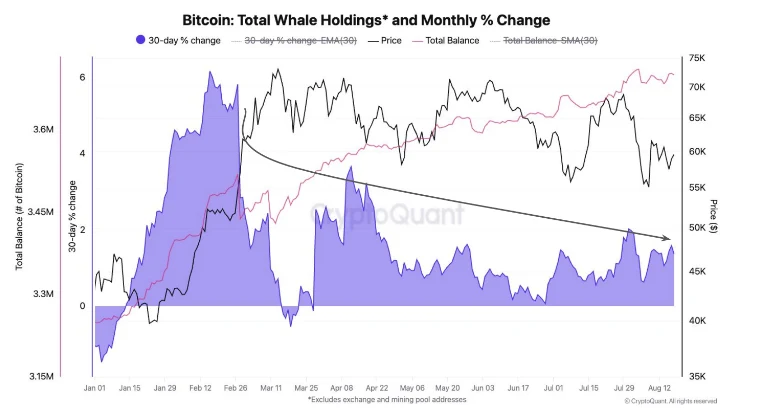

Total whale holdings (Source: CryptoQuant)

On the other hand, whales have reduced their total holdings. The 30-day percentage change in whale holdings has slowed from 6% in February to just 1% today. Historically, a monthly growth rate above 3% in whale holdings has been associated with rising Bitcoin prices.

Short-term BTC holders suffer

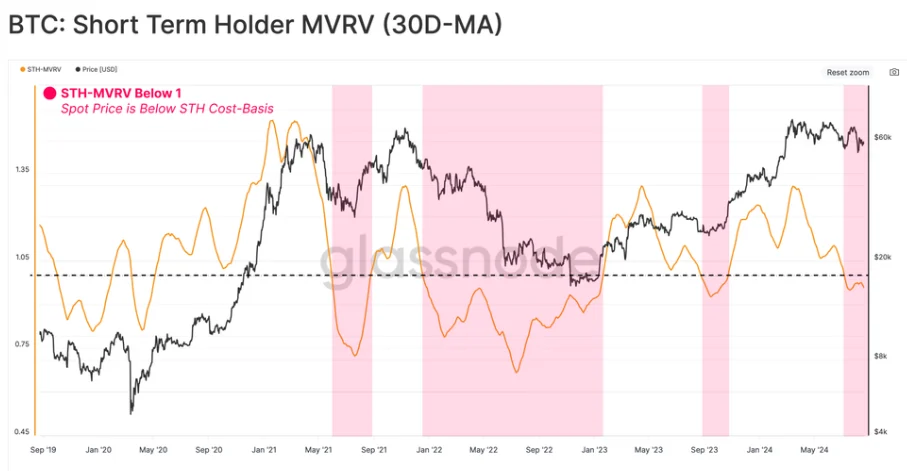

On August 5, the price of Bitcoin fell more than 15% to a six-month low of $49,050. Glass node Analysts described this correction as an “overreaction” by short-term holders, who have held Bitcoin for less than 155 days.

With the price of Bitcoin hovering around $58,800, these short-term holders are now holding onto their coins at an unrealized loss. This group largely includes investors who bought Bitcoin during the 2024 Rally When he arrived at a Historical maximum of $73,835 in March.

According to Glassnode’s report, short-term holders have borne the brunt of the losses during the recent downturn. The market cap-to-realized value (MVRV) ratio of this group has fallen below the breakeven value of 1.0, indicating that they have borne the brunt of the losses following the market correction. While this situation is common during bull markets, the report also warns that if the STH-MVRV remains below 1.0 for an extended period, it could lead to panic among investors that can potentially trigger a severe bear market.

Short-term headline MVRV 30D-MA (Source: Glass node)

Glassnode suggested that the recent price drop could have been an overreaction by new investors, driven by the high unrealized losses they were experiencing. The analysts examined the deviation between the short-term holding cost basis spent and their holding cost basis to assess the extent of this overreaction. They found only a slight deviation between these metrics throughout the current cycle, indicating that the market sell-off below $50,000 may have been a moderate overreaction.

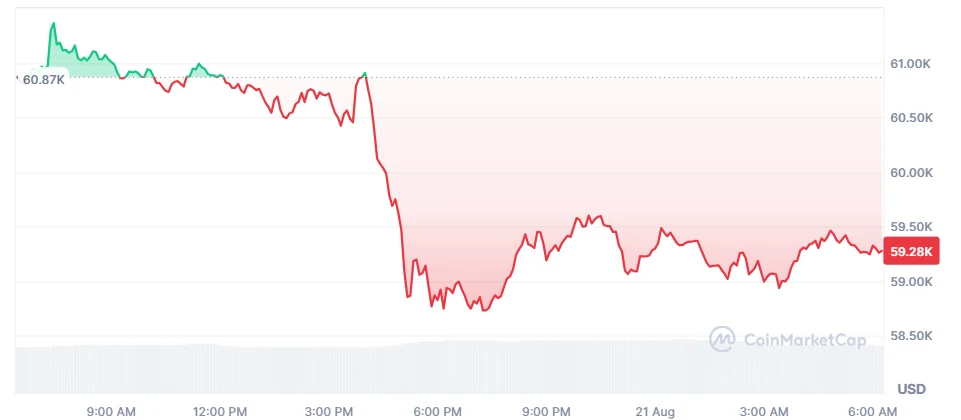

As long as the Bitcoin price remains below $59,000, short-term holders will likely continue to suffer losses. Bitcoin It is trading at $59,374.73 after its price dropped by more than 2% in the past 24 hours. BTC was also in the red by 2.6% on its weekly time frame.

Bitcoin 1D Price Chart (Source: CoinMarketCap)

Several factors, including the continued Bitcoin ETF cash outflowsBitcoin miners’ declining profitability and fears of negative consequences macroeconomic eventscould be contributing to BTC’s price struggle. The upcoming release of the weekly US jobless claims data and the preliminary purchasing managers’ index (PMI) on August 23 could play a crucial role in Bitcoin’s next price move.

Bitcoin mining costs are increasing

BitFuFu, a cloud mining company affiliated with Bitmain, recently released an unaudited financial and operational report. Second Quarter 2024 Reportwhich ended on June 30. The report revealed a huge increase in the cost of Bitcoin Mining.

The average cost of mining each Bitcoin rose to $51,887, which represents a huge jump from $19,344 during the same period in 2023. This sharp increase is mainly attributed to higher electricity and operating costs, as well as April 2024. Bitcoin price halving event, which increased mining difficulty and reduced Bitcoin rewards by 50%.

Despite rising costs, BitFuFu managed to expand its mining operations. The company’s mining capacity increased by 62.5%, reaching 24.7 exahashes per second (EH/s), compared to 15.2 EH/s in Q2 2023. This expansion translated into a nearly 70% increase in total revenue.

The company ended up earning $129.4 million in the second quarter of 2024, up from $76.3 million in the same period last year. The revenue growth is largely due to the company’s expansion. cloud mining services, which generated $77 million during the quarter.

In a recent interview In an interview with CNBC, Matthew Sigel, director of digital asset research at VanEck, suggested that the Bitcoin sell-off is now behind us. According to Sigel, the current state of the cryptocurrency market and the price of Bitcoin follow a “typical seasonal pattern” that is seen between one and three months after a halving event.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.