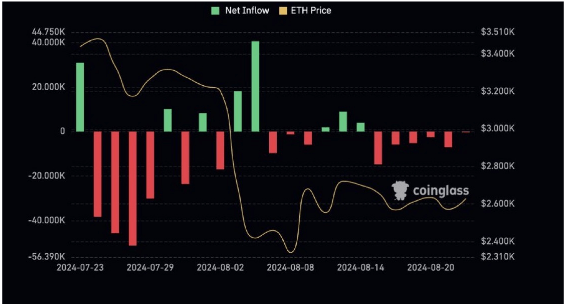

It’s been over a day and a month since Ethereum Spot Exchange Traded Funds (ETFs) appeared Releasedwhich marks an important milestone for the investment asset. During this short period, Ethereum Spot ETF have experienced varying levels of demand, with significant inflows during peak hours and low market interest at other times.

How Ethereum ETFs have fared since launch

According data According to Farside Investors, Ethereum Spot ETFs have seen more outflows than inflows since their launch on July 23. Despite expectations of strong demand And in terms of performance, these investment products have seen staggering outflows of $465 million.

These outflows have been led by Grayscale’s Ethereum Trust (ETHE), leading to Grayscale ETF Outflows to eclipse all inflows into Ethereum spot ETFs. On the day of launch alone, Grayscale recorded an outflow of $484.1 million, marking the highest daily outflow seen in the first month of the Ethereum spot ETFs launch.

On the contrary, BlackRock iShares Ethereum Trust ETF (ETHS) experienced a total inflow of over $1 billion. Notably, on July 23, Ethereum spot ETFs recorded the largest single-day inflows since launch, with BlackRock leading the way with a whopping $266.5 million in inflows.

In total, there are nine US Ethereum Spot ETFmainly BlackRock’s ETHS and Fidelity’s Ethereum Fund (FETH), which are leading the inflow gains. Although Bitcoin Spot ETF saw one of the most successful ETF launches in history, Ethereum ETFs have performed relatively disappointingly in comparison.

The decline in demand for spot Ethereum ETFs may be due to Investors’ preference for Bitcointhe largest and most popular cryptocurrency in the sector. Bitcoin’s dominant position in the cryptocurrency market is likely to drive the significant increase in demand for its ETF.

On the other hand, Ethereum (ETH) It ranks as the largest altcoin, but is generally considered less dominant than Bitcoin, both in price and overall market influence. Excluding the brief surge following its launch, recent demand for spot Ethereum ETFs has been unexpectedly low.

Farside Investors reported that since August 15, Ethereum Spot ETFs have seen mostly outflowswhile BlackRock and other ETFs have not seen any capital flows. This drop in demand underlines the weak overall investor interest and sentiment in these investment products.

Ethereum Spot ETFs Could Trigger an ETH Breakout

In a recent article on X (formerly Twitter) mailCryptocurrency analyst Ted Pillows said that Ethereum Spot ETF Outflows could be coming to an end. He highlighted that in recent days, Ethereum Spot ETFs have been performing significantly negatively, driven by outflows from Grayscale’s Ethereum ETF.

On a positive note, Pillows has observed a steady decline in ETHE outflows from Grayscale. As a result, he suggests that this trend could signal an impending Price breakout for Ethereum as outflows decline.

Featured image from Gadgets 360, chart from TradingView

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.