There are several layers, from rent to sale to mortgage loans. For example, most of the rules that apply to a house or commercial property do not apply to land. If a landowner receives rent, lease or any other form of income from vacant land (without any buildings on it), that income is not considered rental income. It must be reported as income from other sources or profits from business activity.

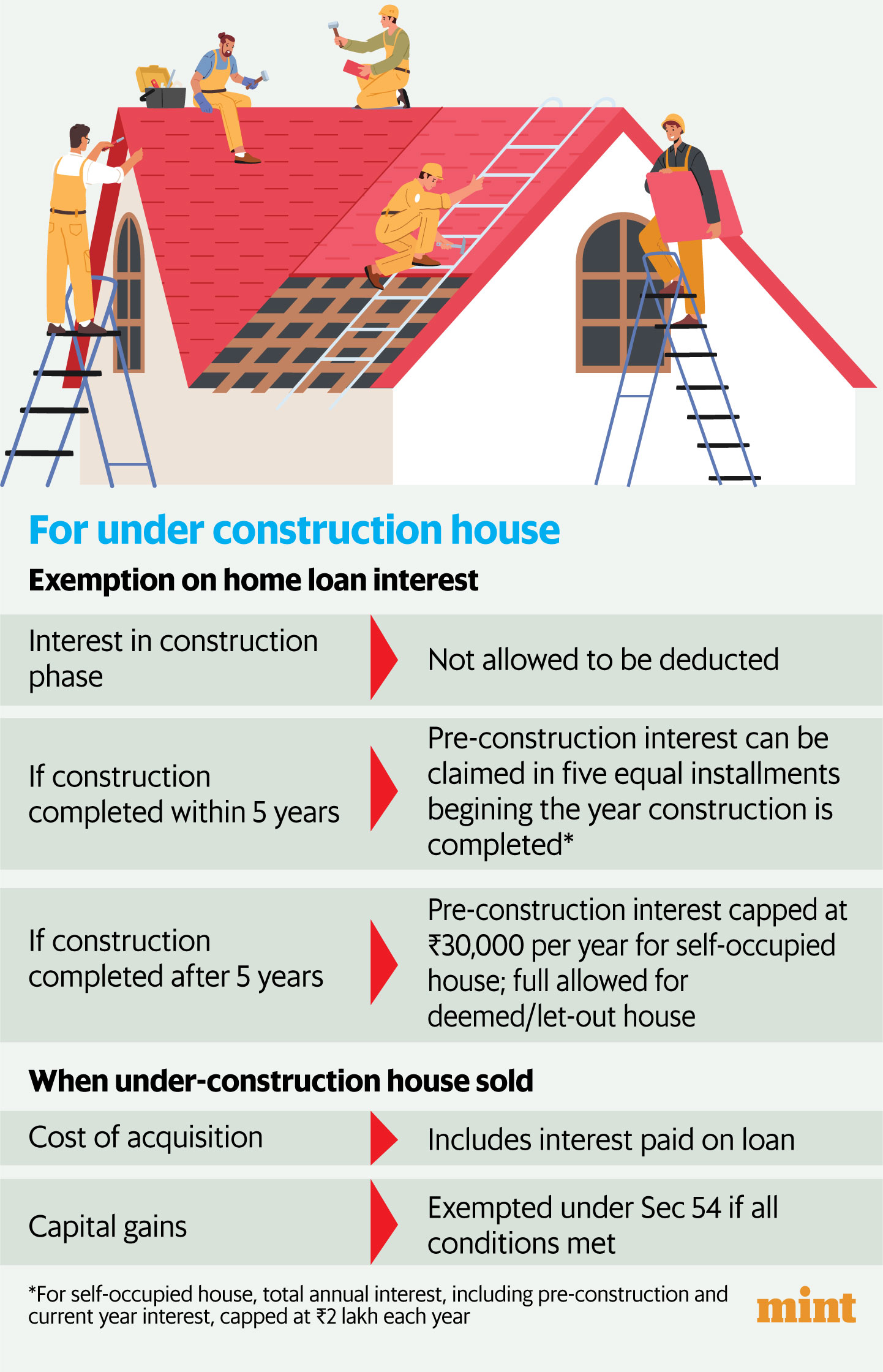

There are separate rules even for properties under construction. (see graph).

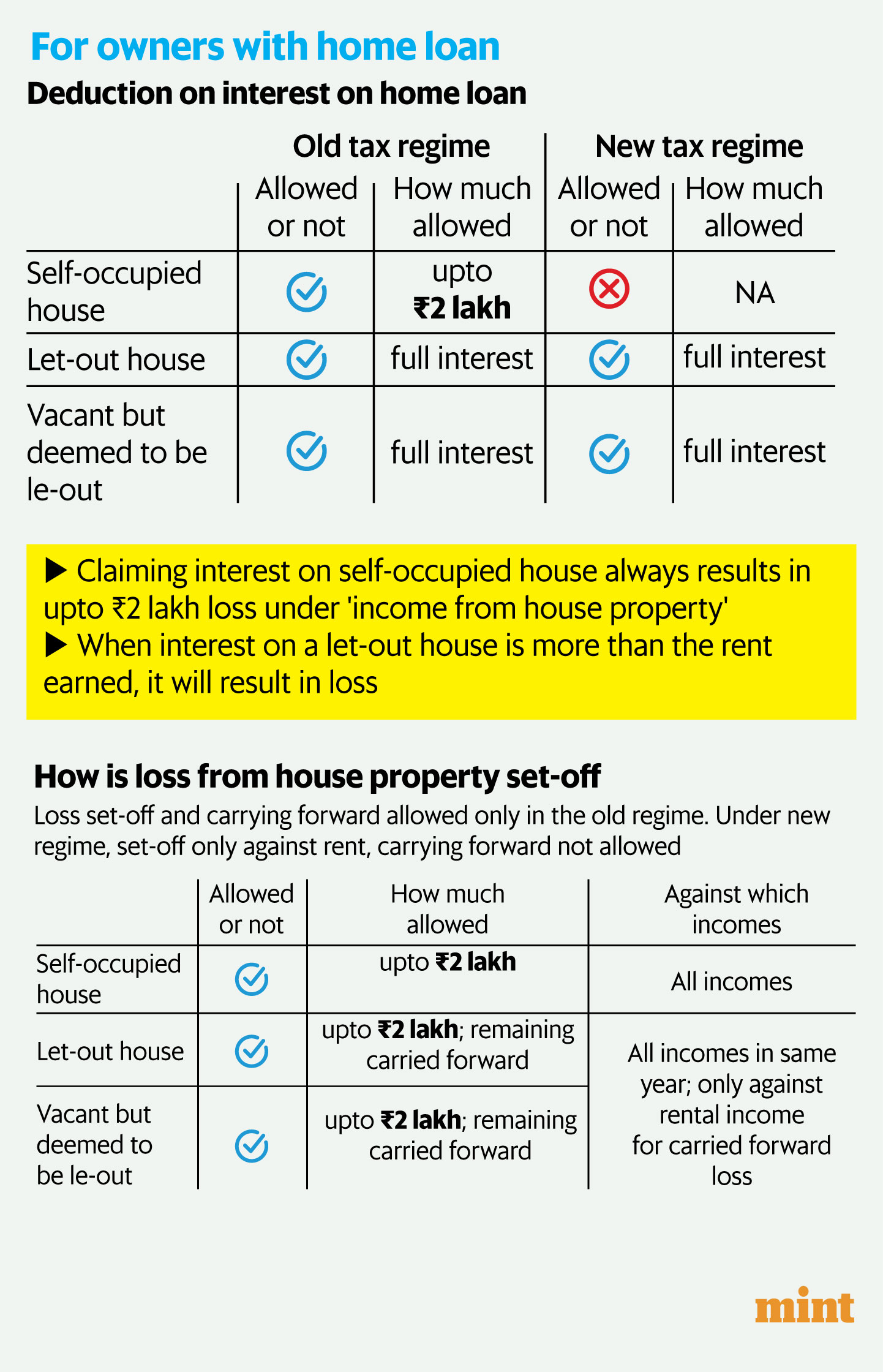

Furthermore, property is divided into three categories: self-occupied housing, rented housing and housing considered to be rented. However, the rules on the taxation of rent, the extent of interest that can be deducted and the offsetting of losses differ according to the categories (see chart).

The rules vary further depending on whether you opt for the new or old tax regime. For example, if a homeowner has a mortgage on the house they live in, they will have a loss of up to 10% each year. ₹2 lakh under the head ‘income from house property’. This is because, in the income tax return, one has to declare the rent from self-occupied property as nil and claim the interest paid on the loan as a deduction. This results in a net loss from the house property equivalent to the interest paid. This loss can be set off against all income, including salary. But only under the old regime. Therefore, homeowners living in their own houses will lose this benefit by opting for the new regime. In fact, under the new regime, set-off of losses is not allowed even for houses rented out and deemed to be rented out.

Mint has compiled a handy Q&A guide to help you navigate the property tax maze (see chart). The guide and homeowners with a mortgage loan.

View full image

I have two houses in the same city. I live in one house, while the second is empty. Will the second one be classified as self-occupied or considered rented?

According to Mayank Mohanka, founder, TaxAaram India and partner, SM Mohanka & Associates, the first two houses that are occupied by the owner or his family or are vacant are considered as self-occupied houses, irrespective of the city in which they are located compared to the city of residence of the owner. “This condition existed earlier, but now the rule is simple. The only condition is that it should not be rented out even partially during the year.”

I live on rent but own a house in the same city. Can I claim both HRA and home loan interest deduction?

If your property is located in a different city, you would be able to directly claim both the HRA exemption on the rent you pay and the interest on your property, regardless of whether it is occupied by your family, vacant or rented out. However, when your property is located in the same city, in most cases, you will not be allowed to claim the HRA exemption. If your office is far from the house you own and you can justify that the reason for renting is to be closer to the office and save the commute, you may be allowed to claim the HRA exemption.

View full image

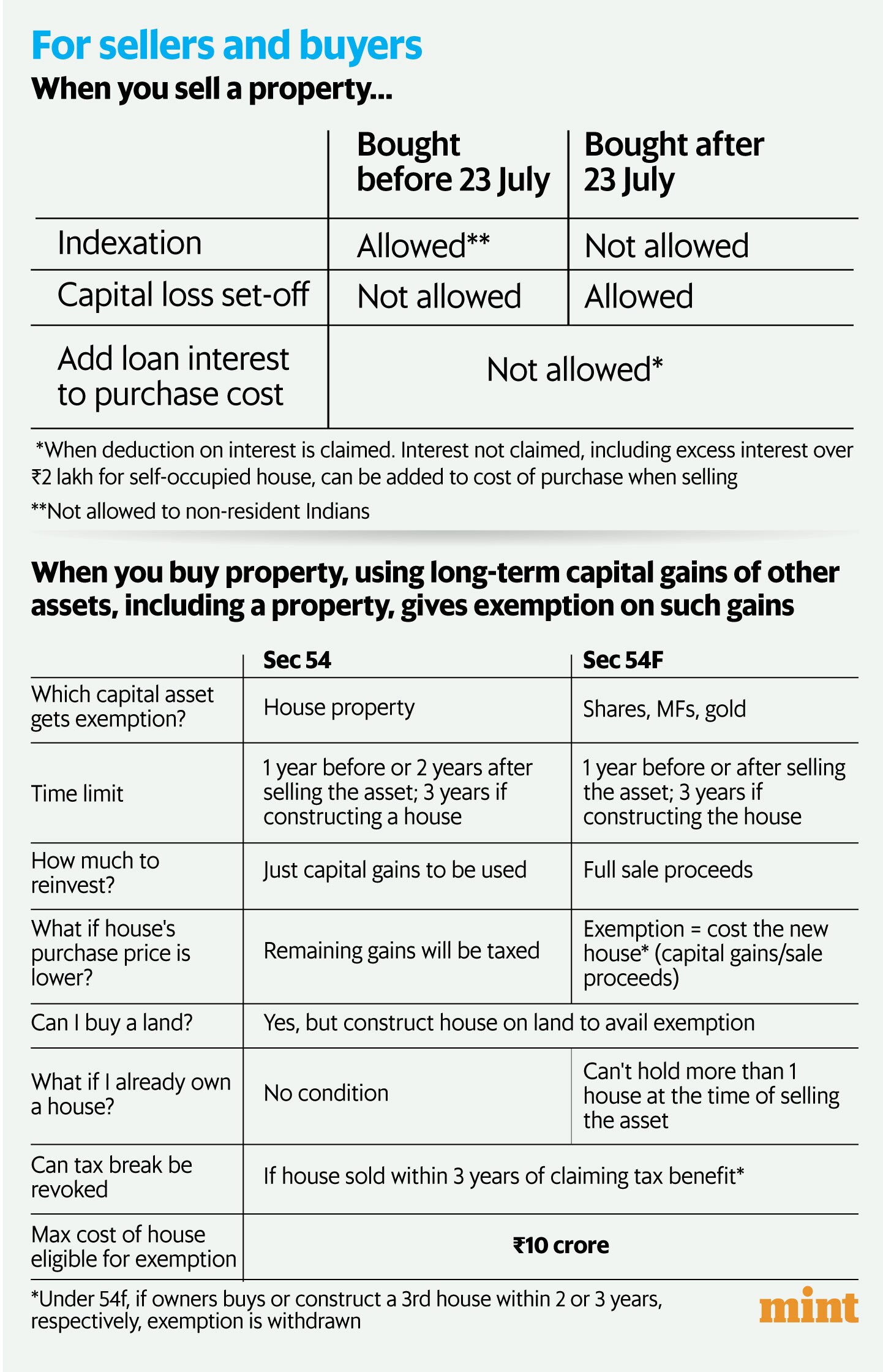

The EU budget has banned compensation for losses incurred when selling property purchased before 23 July. Does this also mean I cannot claim compensation? ₹2 lakh loss on self occupied house by claiming home loan interest?

Loss carryforwards are not permitted in the case of capital losses incurred when selling a home. ₹Loss of `2 lakh arising on a self-occupied property by claiming interest on a home loan is treated as loss under the head ‘income from immovable property’. Denial of compensation of loss applies only to the former.

“Loss of home ownership and long-term capital loss are two different concepts. There is no change in the provisions related to loss of home ownership,” said Prakash Hegde, Chartered Accountant and Principal Consultant, Direct Taxes, Acer Tax & Corporate Services Llp.

I have transferred losses to the “real estate” category. If I opt for the new regime, can I offset them against other income?

According to Parizad Sirwalla, Partner and Head of Global Mobility and Tax Services at KPMG India, losses arising from “income from real estate” cannot be offset against any other income except rental income. Losses not offset cannot be carried forward to subsequent years either. This applies to losses carried forward from previous years as well.

“If there are accumulated losses from rented or deemed rented properties from previous years, they can only be offset against the current year’s rental income. But, if the current year’s rental is a net loss, then the prior year’s loss cannot be offset or carried forward. It becomes a total loss,” he said.

View full image

Please note that losses carried forward from a self-occupied home cannot be offset against rent either, as the deduction of interest on a self-occupied home is not allowed under the new regime.

To explain with an example, let’s say you had a loss of ₹1 lakh from a rented house in AY24 which was not fully computed and transferred. In AY25, if you opt for the new tax regime, you cannot offset this. ₹Loss of 1 lakh against any income except rent. If there is no rental income, ₹A loss of 1 lakh becomes a total loss. Also, while you can also claim a deduction for the interest on the same rented house in AY25, if it results in a loss, you cannot set it off or carry it forward to AY26.

Mohanka said once a loss carry forward becomes a dead loss, it cannot be offset in any subsequent year even if a salaried taxpayer reverts to the earlier regime.

In the same example, let’s say you had ₹A loss of $100,000 in AY25 that could not be offset or carried forward. Now, if you choose to return to the previous regime next year in AY26, you will not be able to recover the loss. ₹Loss of 1 lakh each from AY24 and AY25 as they could not be carried over to the next year.

I took out a mortgage loan for a house under construction. The builder gave me possession after seven years. How can I claim the interest for the years under construction?

Interest paid during the construction years accrues and can only be claimed after construction is complete. The total interest can be claimed in five equal installments over five years after construction is complete. However, for self-occupied homes, there are annual limits on the total interest that can be claimed, which includes accrued interest and current year interest. This threshold also varies depending on whether construction is completed within five years or not.

If construction is completed within five years from the end of the fiscal year in which the loan was taken, up to ₹2 lakh can be claimed in a year. If the construction is completed after five years, only ₹An amount of 30,000 interest per year can be claimed as a deduction.

Houses that are rented or considered rented are not subject to these conditions. Interest is deducted in full each year, regardless of when construction is completed. The only condition is that pre-construction interest is divided into five instalments.

View full image

Hegde said that the interest to be claimed each year will depend on whether the house is declared self-occupied or considered rented. Let us understand it with an example. Let us say the construction of a house is completed in 10 years and the total interest accrued prior to construction is ₹10 lakh every year ₹2 lakh interest is to be claimed in advance for five years. Now, let us say in the first year, the house is occupied by the owner. Therefore, only ₹30,000 interest can be claimed. But, in the second year, the house is put up for rent. So, in this year, ₹2 lakh pre-construction interest can be claimed along with the interest for the current year. In the subsequent three years also, the amount of interest to be claimed will depend on the occupancy status of the house.

I am selling a house under construction. Can I add the interest paid on the mortgage loan to the acquisition cost?

From the 2024 tax year, interest charged on a home loan is no longer allowed to be added to the cost of acquiring or improving a property to avoid double deduction of interest. “There were instances where taxpayers claimed interest on home loans as a deduction under the head ‘income from real property’ as well as the cost of acquiring or improving the property,” Hegde said. “The thing to note is that this resulted in double deduction, and that is why this amendment was introduced. In an under-construction property, since interest deduction is not allowed to be claimed, it can be added to the cost of acquisition if such property is sold while it is still under construction,” he added.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.