It’s rare for industry associations to write letters to each other. When they do, it’s usually because something is brewing. In fact, there is some unrest in the passenger car segment, where an association of car dealers and an association of car manufacturers are fighting with dealers over car inventory levels.

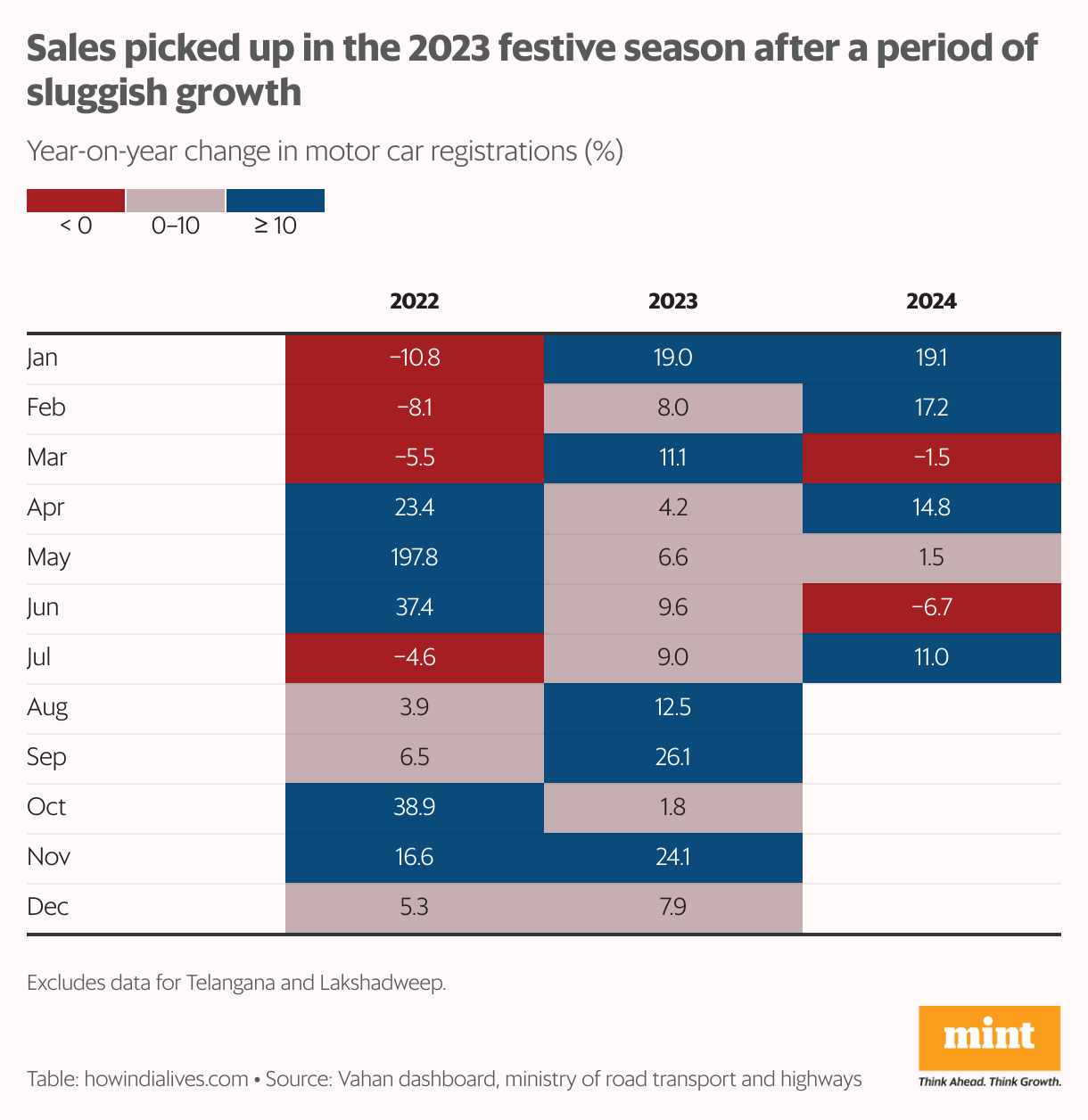

One factor contributing to this malaise is the slowdown in sales growth in the passenger car segment, which benefited from pent-up post-pandemic demand and new models. And the real test is yet to come: between September and November, during the festival season.

Vehicle registration data from government portal Vahan shows that between May and July 2024, car registrations rose by a meager 1.8% year-on-year. Most carmakers, big and small, felt the impact; the top four barely grew. This is making dealers uncomfortable and causing them to rant against manufacturers who are supposedly sending them more cars. The Federation of Automobile Dealers Associations has reportedly written twice in two months to the Society of Indian Automobile Manufacturers, alleging that manufacturers are selling their products to dealers.

The next three months will be a time of reckoning. Since 2019, monthly car registrations have crossed 300,000 in just six months, and three of those were September, October and November 2023. That is the baseline against which the four-wheeler segment will be measured this festival season. So, the stakes are high for demand to be strong. If demand falters, it could deepen the friction between dealers and manufacturers, and also trigger other second-order effects.

Impact of actions

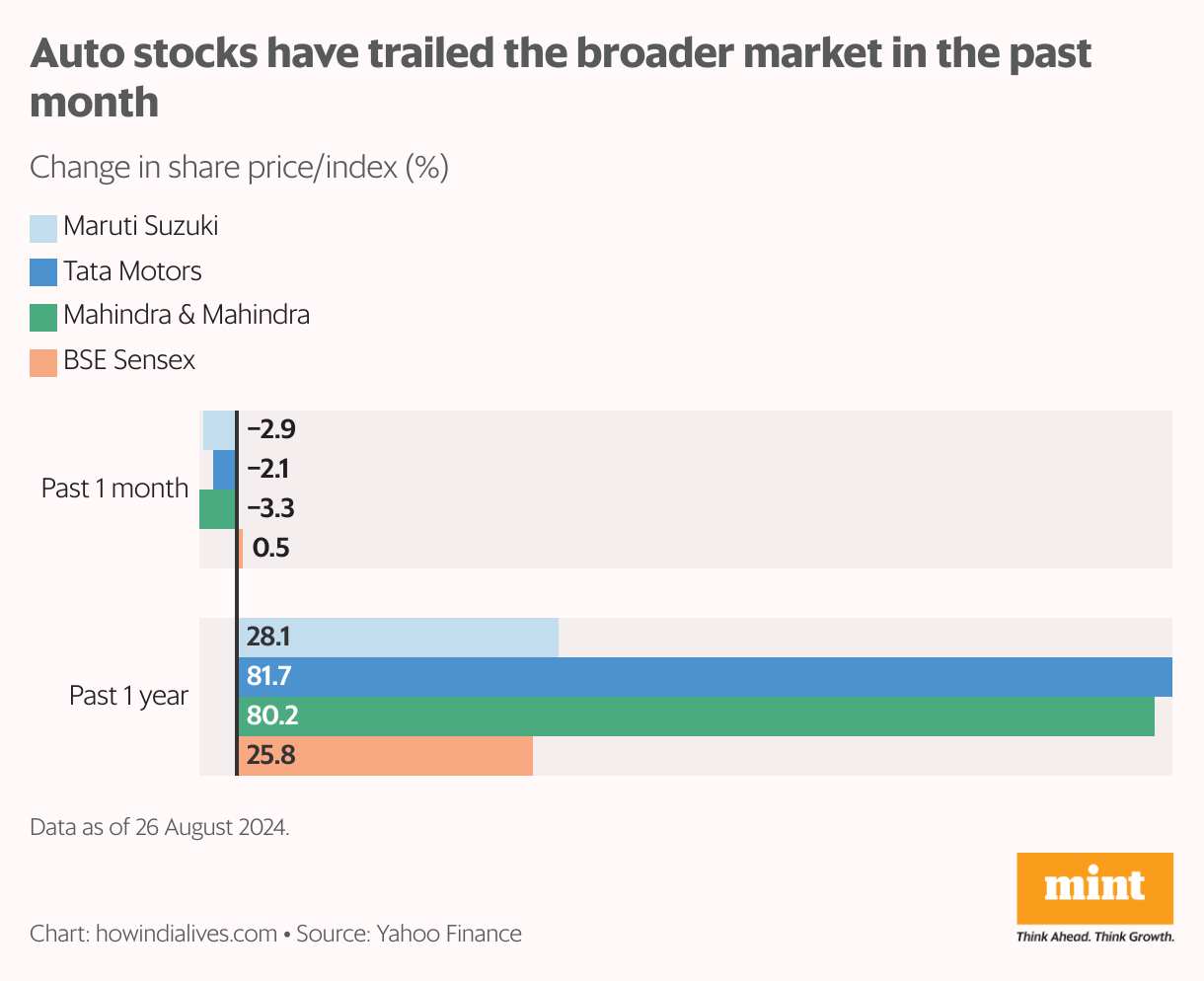

One of those second-order effects is the impact on the financial statements and stock prices of the automakers. Over the past three years, the shares of all three publicly traded automakers have delivered extraordinary returns, far outperforming the broader market. However, over the past month, all three have lagged the broader market, which is another sign of the current caution in the segment.

There are broader concerns, too. According to government data, private consumption, one of the four components of India’s economic output, grew just 4% in 2023-24, its lowest levels in the past 12 years, excluding the pandemic year of 2020-21. Current valuations of auto companies’ stocks are high and rooted in the expectation of strong earnings growth. Maruti Suzuki shares are trading at about 27 times earnings, Mahindra & Mahindra at 33 times and Tata Motors 36 times. If demand doesn’t meet expectations, earnings growth could suffer, and so could its stock.

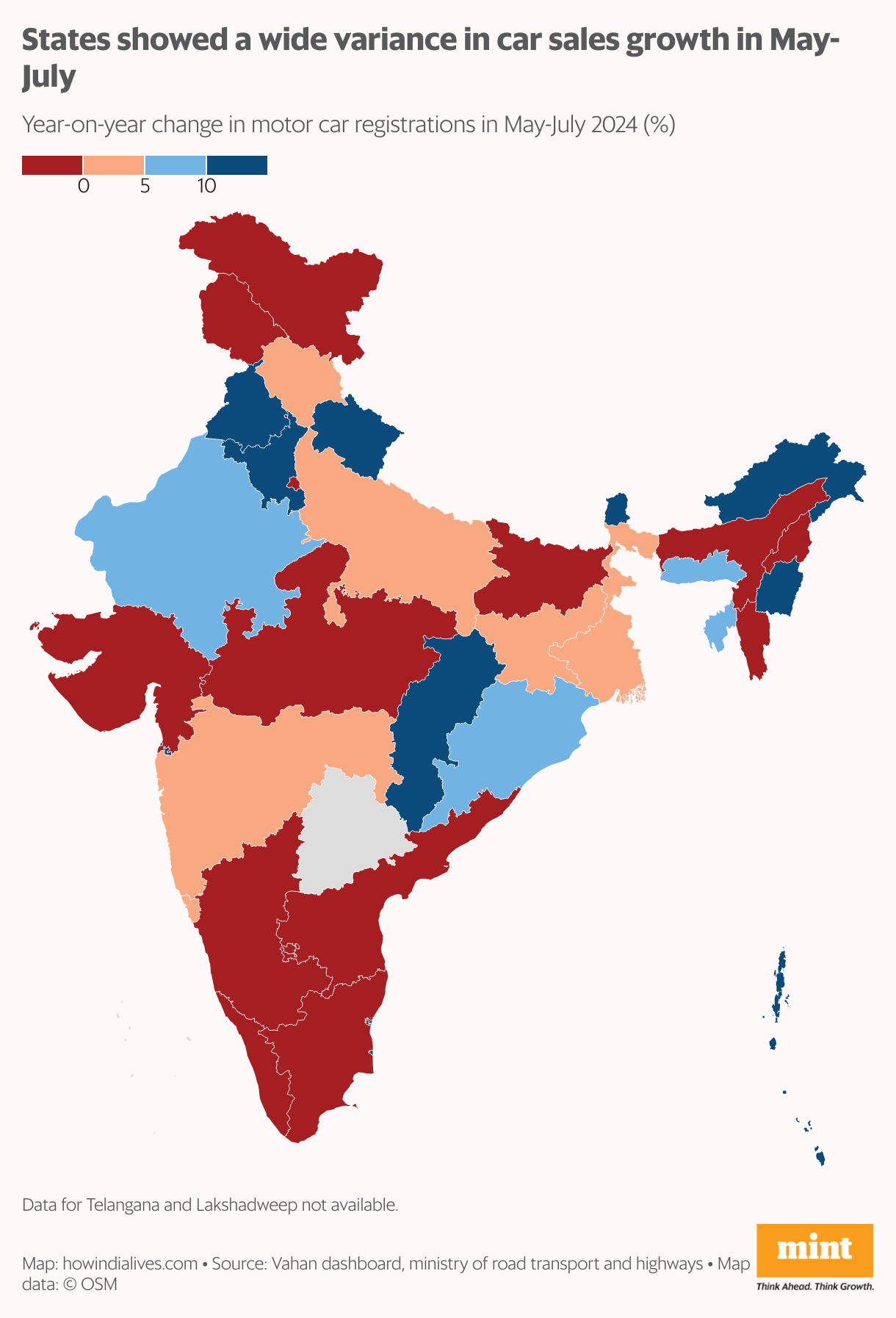

Variation of state

Another second-order impact of weak demand could be on vehicle loans. According to central bank data, in the three-year period to June 2024, Vehicle loans to individuals Loans outstanding (both for four-wheelers and two-wheelers) at banks have grown at a CAGR of 18%. Weaknesses on the demand side could not only dampen future growth but also strain the current portfolio.

In the three months from May to July 2024, while overall growth in four-wheelers has been moderate, states have shown wide variation. There are 14 states and Union Territories where registrations fell on a year-on-year basis. This includes major markets such as Tamil Nadu, Karnataka, Gujarat and Delhi. The two largest markets by registrations, Maharashtra and Uttar Pradesh, grew by just 1.6% and 1.9% respectively. At the other end of the spectrum, there are 10 states and Union Territories that grew by over 10% during this period, led by Punjab and Haryana.

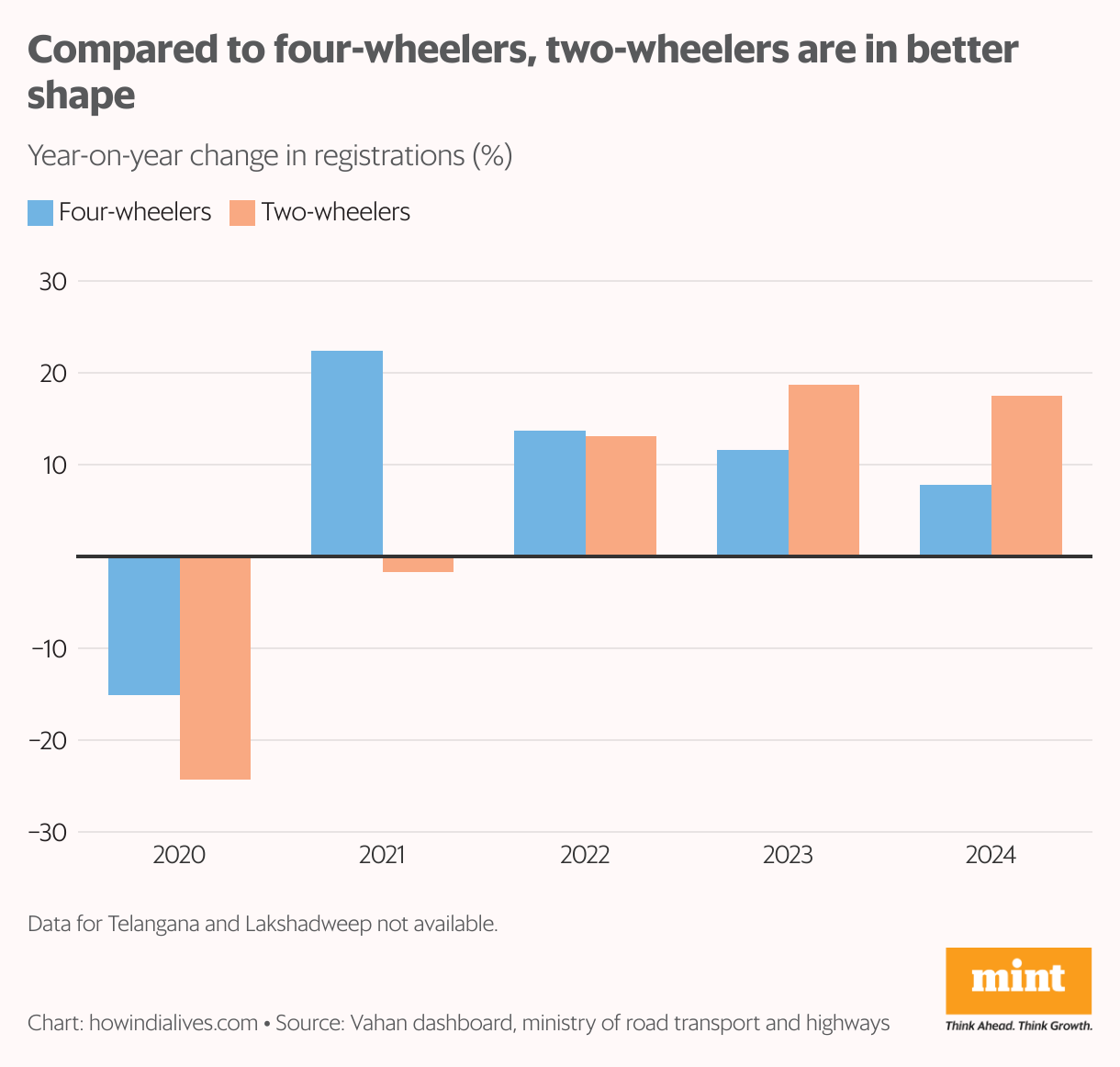

Two-wheeled solidity

While growth in the four-wheeler segment is stagnating, the two-wheeler segment appears to be in better shape. In 2024 through July, while registrations in the four-wheeler segment grew by 7.8%, the two-wheeler segment grew by 17.5%. While the industry registered fewer cars in two of those seven months on a year-on-year basis, that has not been the case for two-wheelers, which have grown every month.

However, the year-on-year growth shows a wide variation across the major two-wheeler manufacturers in the last three months (May to July 2024). While the registrations of Honda Two Wheelers Four-wheeler brands have grown by 32%, while TVS Motor’s brands have grown by 9%. Bajaj Auto and Hero MotoCorp are the weakest with a growth rate of 2.7% and -5.6%, respectively. While the upcoming festive season also holds significance for them, for the four-wheeler segment, it is shaping up to be a time of reckoning.

www.howindialives.com is a database and search engine for public data.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.