Traveling to amazing destinations around the world has become a new life goal for many millennials and Gen Z. A couple of decades ago, buying a house and getting the perfect SUV was a big deal. However, post-COVID-19, what people are looking for as a life goal has changed. People are more interested in creating memories than investing their life savings in a four-wheeled vehicle, which is a depreciating asset. (Image: Shutterstock)

A new study published in the Journal of Behavioral Decision-Making claims that people who spend money on experiences are happier than those who spend it on things. This means that buying a high-end luxury handbag that can cost around Rs 200,000 in India is less desirable and using that money for a trip to Europe is the new way to “achieve success in life.” (Image: Shutterstock)

However, for a salaried employee, arranging such funds can be difficult due to rising inflation and cost of living in our India. So how can a middle-class Indian living in a metropolitan city achieve this? Here are some financial tips that can make all the difference. (Image: Reuters)

Managing a travel fund | Setting aside a fixed amount of your income for travel will help you lay the groundwork for your next big trip. It can be an SIP of 5000 to 15000 in funds that can give you a return of 10-12%.

Salary distribution in 50-20-30 | For example, a person earns, say, Rs 50,000 and aims to save Rs 300,000 in 18 months for an international trip. Here’s what he or she can do: set aside Rs 25,000 (50%) for necessary expenses, Rs 14,000 (28%) for travel fund, and Rs 11,000 (22%) for long-term funds or debt repayment. (Image: Shutterstock)

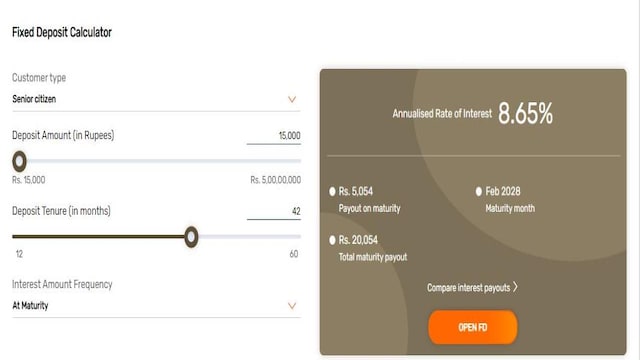

Electronic Fund Calculators | Performing retrospective calculations to manage your funds can be extremely beneficial. Be realistic about the time frame and how much you can save while maintaining all your liabilities.

Choose your funds according to your risk appetite | Keeping your goals at the core, choose your investment fund according to your risk tolerance. Some people dare to take the loss of stocks and equity, but if you are someone who does not have the courage to see your returns go negative, then savings options like mutual funds and investment funds are better options.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.