Bitcoin is currently experiencing price volatility and uncertainty, with the latest 10% correction causing concern among investors. While this drop is smaller than the 30% pullbacks seen in recent months, it is causing significantly more damage to market sentiment as investors are growing weary of the current market dynamics.

The overall mood is changing and many are feeling the strain of this prolonged uncertainty. Prominent investors and analysts are expressing that BTC is now at a crucial level. Data from CryptoQuant’s head of research Julio Moreno suggests that if the price falls below $56,000, it could trigger a deeper correction, potentially leading to a more prolonged bearish phase.

This sentiment has fueled caution among market participants, who are closely watching Bitcoin’s upcoming price movements to assess whether this support level will hold or give way to further declines, potentially exacerbating the current market tension.

Bitcoin Market Cycle Indicator in Bearish Phase

CryptoQuant’s head of research recently shared a Detailed Bitcoin Chart On X, a worrying trend stands out: BTC’s Market Cycle Indicator has once again moved into the bearish phase. This indicator is essential for traders and investors as it defines the strength and overall direction of the market, offering insights into potential price movements based on historical price action. According to the analysis, Moreno points out that $56,000 is a critical support level that the price must hold to avoid a deeper and more damaging correction.

The current market conditions are becoming increasingly confusing and risky, with investors finding it difficult to keep up with the rapidly changing dynamics of Bitcoin’s price. The recent volatility, coupled with this critical support level, has led to increased uncertainty among market participants. The unpredictable environment makes it difficult for traders to decide their next moves, adding to the overall market volatility.

If Bitcoin fails to hold the $56,000 level, the possibility of a more significant drop becomes increasingly likely. This potential drop would put further pressure on investors who are already dealing with the turbulent price action seen in recent weeks.

As the market continues to navigate these uncertain waters, Bitcoin’s ability to hold this crucial level will be a key focus for analysts and investors alike. The outcome at this level could determine Bitcoin’s next major move, either stabilizing the market or triggering a deeper correction that could extend the current bearish phase.

BTC Price Action

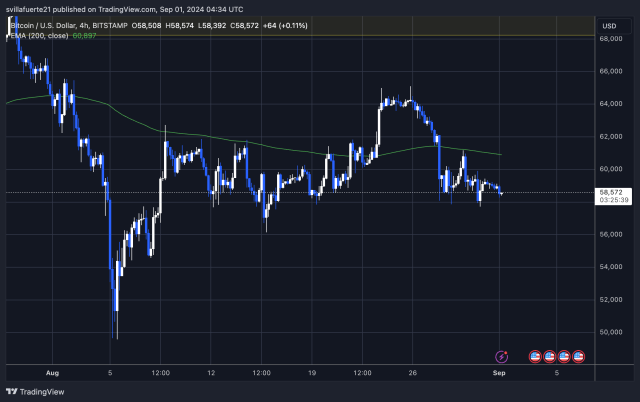

Bitcoin is currently trading at $58,467, after a steep 10% drop from its local high of $65,103. This drop has positioned BTC below the 200-day 4-hour exponential moving average (EMA), which is located at $60,895. For the bulls to regain control and push the price higher, it is crucial for Bitcoin to break out and reclaim this EMA level. Failure to do so could signal continued weakness and further declines.

On the downside, the $56,138 level is a critical support that needs to be defended. Losing this level could trigger a capitulation event, not just for Bitcoin but for the entire cryptocurrency market. Such a move would likely lead to panic selling and a deeper correction across the board. Given the current market dynamics, investors are closely monitoring these key levels as they may define the next phase of Bitcoin’s price action.

Cover image by Dall-E, charts by Tradingview.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.