A CoinFlip Bitcoin ATM installed inside a convenience store in Sydney. Photographer: Brent Lewin/Bloomberg

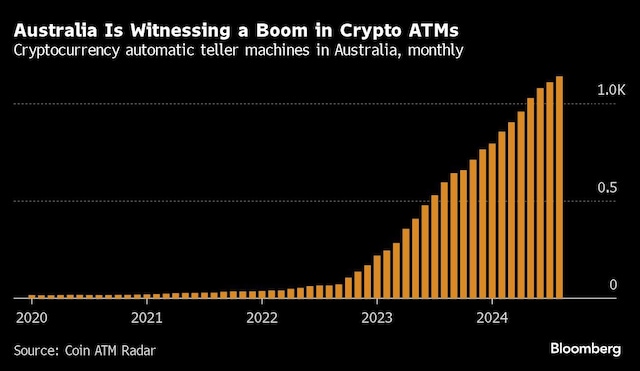

Bitcoin ATMs are arriving in droves in Australia, making the country the fastest-growing market for the kiosks and raising questions about where demand for the controversial service is coming from.

Users of these ATMs can insert cash to receive cryptocurrency into digital wallets or obtain physical banknotes from token sales. The United States accounts for the largest share of the market with around 32,000 machines, followed by Canada’s roughly 3,000, according to data compiled by Coin ATM Radar.

Australia ranks third with nearly 1,200 kiosks, up from 73 two years ago, and more are on the way. On an August call with analysts, U.S.-based Bitcoin Depot Inc. CEO Brandon Mintz said the company has more than 200 kiosks in Australia waiting to be rolled out pending a regulatory green light.

Data from Coin ATM Radar indicates that recent growth in Australia is leading the world. Operators argue that kiosks boost financial inclusion by offering easy access to cryptocurrencies. Critics point to risks such as money laundering and scams that trick users and cause them to lose money. ATMs are banned in countries such as the UK and Singapore, while Germany is in the midst of a crackdown on them.

US Export

North American vendors looking to expand have driven kiosk growth in Australia, where most operators have some compliance controls in place, said Angela Ang, senior policy adviser at blockchain intelligence firm TRM Labs. Still, Australian authorities have “identified cryptocurrency ATMs as a vulnerability to money laundering,” she said.

In a statement last year, police described the laundering technique: Illicit money is placed in an ATM in exchange for digital assets, which are then processed into many transactions until their origins are almost impossible to trace.

Cryptocurrency kiosks dominate the cash-to-crypto industry, which has processed at least $160 million in illicit volumes globally since 2019, according to TRM. Australia as a whole saw about $223 million of illicit activity involving digital assets between 2022 and 2023, consultancy Chainalysis Inc. estimates.

ATMs account for a small portion of global trading in the $2 trillion cryptocurrency market. In Australia, any digital currency exchange provider must register with the Australian Transaction Reports and Analysis Centre (Austrac).

Gaming culture

In response to questions about the risks of cryptocurrency ATMs, an Australian Taxation Office spokesperson said tackling technology-facilitated crime is a priority focus area for the ATO-led Serious Financial Crime Taskforce.

Another piece of the puzzle is the entrenched gambling culture in the country of 27 million people, whose per capita losses on legal forms of gambling are the highest in the world, according to estimates cited by the country’s health and wellness institute. That love of gambling extends to bets on volatile cryptocurrencies, some of which have surged in the past year.

Meanwhile, local banks have restricted the ability to transact with digital asset exchanges, making it difficult for some to trade cryptocurrencies. Commonwealth Bank of Australia, National Australia Bank Ltd., Australia & New Zealand Banking Group Ltd. and Westpac Banking Corp. have all imposed restrictions over fears of scams.

The restrictions have prompted more local cryptocurrency users to seek out “alternative financial platforms,” including overseas, said Caroline Bowler, chief executive of digital asset exchange BTC Markets Pty. New entrant CoinFlip is contributing to the rise of kiosks nationwide, she added.

‘Parallel’ system

Chicago-based CoinFlip said the value of digital asset transactions through its ATMs in Australia more than quadrupled in the past year. Since cryptocurrencies are a “parallel financial system to the fiat system, it makes sense that there is a physical component” to accessing cash, said CEO Ben Weiss.

CoinFlip charges between 6% and 14% in fees in Australia, down from 6% to 18% in the United States, Weiss said. Earlier this year, the firm launched a trading desk in Australia for clients looking to transact large amounts of cryptocurrency.

At the analyst conference, Bitcoin Depot’s Mintz drew a comparison to the U.S. state of Texas, which has a population similar to Australia’s but has roughly 3,000 to 4,000 Bitcoin ATMs. “The market has the potential to grow by thousands of Bitcoin ATMs in the next few years in Australia,” he said.

(Only the headline and image of this report may have been reworked by Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First published: September 1, 2024 | 20:48 IS

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.