Key points

- US Bitcoin ETFs saw a total of $277 million in outflows last week.

- BlackRock’s iShares Bitcoin Trust reported rare net outflows at the end of the week.

Share this article

Outflows from Bitcoin exchange-traded funds (ETFs) in the US hit $277 million last week as the cryptocurrency market faced declines, with Bitcoin holding below the $60,000 mark and most altcoins continuing their slide.

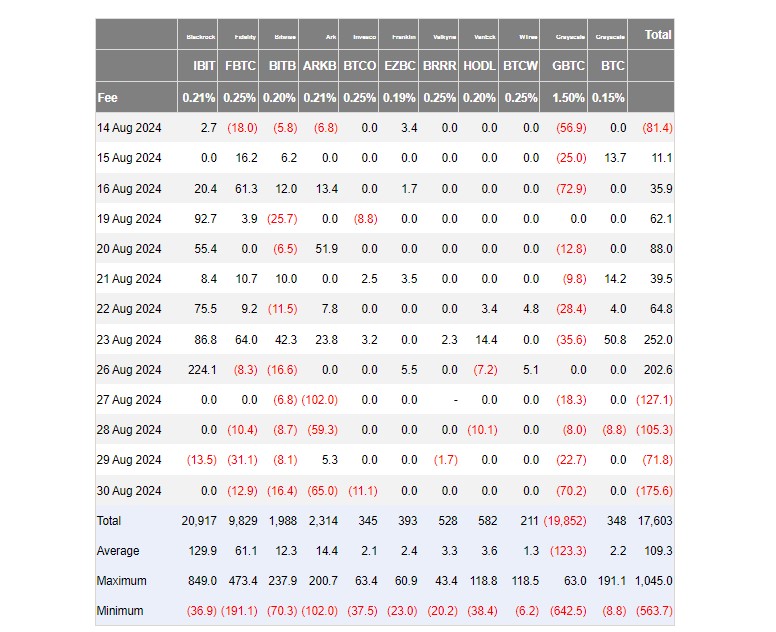

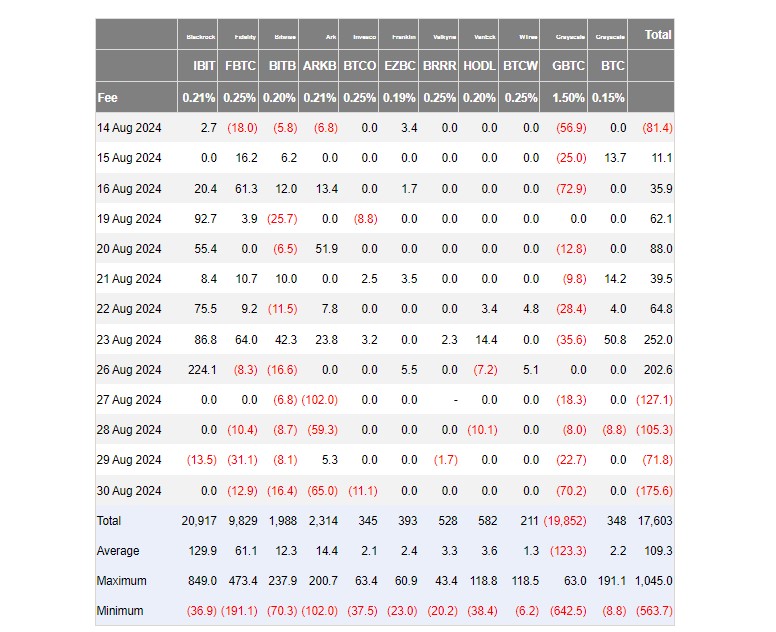

According data From Farside Investors, the group of American Bitcoin funds collectively attracted around $202 million in new investments on Monday, with BlackRock’s iShares Bitcoin Trust (IBIT) accounting for the majority of daily inflows. On that day alone, IBIT recorded more than 224 million dollars in net capital.

After a strong start to the week, Bitcoin spot ETF flows turned negative on Tuesday and extended their losing streak into Friday.

Data shows that investors withdrew roughly $480 million from funds during this period. On Friday alone, U.S. Bitcoin ETFs saw more than $175 million withdrawn, the largest outflow since August 2.

Amid a week of market decline, BlackRock’s IBIT, a fund known for its steady inflows, experienced its Second release since its launchHowever, strong Monday admissions allowed it to finish the week with a net take of around $210 million.

Last week, Ark Invest/21Shares’ Bitcoin Fund (ARKB) and Grayscale’s Bitcoin ETF (GBTC) saw the largest net outflows among Bitcoin spot ETFs, with ARKB losing $220 million and GBTC losing $119 million.

Over the same period, Bitcoin (BTC) fell by around 9%, from $64,500 on Aug. 26 to $58,000 on Aug. 30. The flagship cryptocurrency is currently trading at around $57,700, down 10% from last week, according to TradingView. data.

Bitcoin’s fall has dragged down the broader cryptocurrency market. Ethereum, Solana, Ripple and Dogecoin all experienced losses, with Dogecoin falling the most, down 5.6%.

The global cryptocurrency market capitalization has shrunk by 2.4% to $2.1 trillion, according to Gecko CoinMost altcoins have followed Bitcoin’s downtrend, with only four (Helium (HNT), Monero (XMR), Starknet (STRK), and Fetch.AI (FET)) showing gains over the past 24 hours.

Memecoins have led the altcoin decline, with DOGS, BEAM, BRETT, and Dogwifhat (WIF) seeing the most significant losses.

Share this article

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.