“Some of these affordable housing companies saw a good rise in their share prices as there was emphasis on rural housing schemes in the budget,” said Dhaval Gada, fund manager at DSP Mutual Fund. Mint“The hype surrounding Bajaj (Housing Finance) IPO has also led to a sharp move in its prices, particularly for the more comparable large players like PNB (Housing Finance).”

Strong demand visibility, significant government support and high return on assets (ROA) have provided significant boosts to these companies. Over the past six months, the stocks of the top affordable housing financiers – Aadhar Housing Finance, Aavas Financiers and Home First Finance Co. India – have posted an average return of 34%. Aptus Value Housing Finance alone lost around 6% in this period as it reported relatively lower disbursement velocity and worse asset quality in the quarter ended June.

However, market participants remain optimistic about affordable housing because they see it as a booming sector with enough room for a variety of players. The market has already rewarded those venturing into this segment handsomely. A good example is PNB Housing Finance.

PNB Housing shares have generated a 50% return in the last six months, the highest among all housing finance companies. During the first quarter of fiscal 2025, 32% of the company’s incremental disbursements were in the affordable housing and emerging markets segments. The company plans to increase this share to 40-45% by the end of this fiscal.

“There was a surplus of some private equity block deals that were due to be done in PNB (Housing). Now that they have closed, their share price is catching up with the rest of the players in the affordable housing sector,” Gada said.

As part of its broader push into the retail lending segment, the housing financier is targeting an affordable housing portfolio of ₹5,000 crore for fiscal year 25 and ₹15,000 crore for FY27.

In contrast, shares of Can Fin Homes and LIC Housing Finance, which are yet to make significant entries in the affordable housing segment, have delivered an average return of 10% in the past six months.

Profitable model

The affordable housing segment is lucrative for housing financiers because these loans typically have high interest rates, which generate higher ROAs for them.

“The lending rate (in the affordable housing segment) is around 12-13% on average, as opposed to the prime segment where rates are more competitive at around 8-11%,” said Anusha Raheja, research analyst at Dalal & Broacha Stock Broking. Mint“Since the ROA in this business is better than in the prime segment, the valuations of companies in the affordable housing sector are also better.”

Affordable housing loans are granted at a more basic level. They involve physical underwriting and collection processes, which increase operational costs. A riskier borrower profile and lower collateral quality relative to the prime segment also increase financing costs.

As a result, affordable housing financiers charge higher interest on their loans. However, several subsidized refinancing schemes of the National Housing Bank reduce their financing costs, resulting in wider interest margins and, therefore, higher ROA for them.

In addition, the government’s credit-linked subsidy program reduces borrowers’ liabilities by subsidizing the principal portions of their loans, thereby reducing credit risk for lenders and making the overall business model profitable for them.

“The main reason why PNB (Housing) has significantly increased the distribution of affordable housing loans is because it offers better profitability as the model comes with higher ROAs by design,” Gada said. “Also, it helps them diversify their customer cohort.”

Read also: Bajaj Housing will not need more capital in the coming years: Sanjiv Bajaj

Market participants said that with the government’s renewed push to provide affordable housing to the poor, the growth opportunities in this segment are greater than in the premium segment. The Union government announced the Pradhan Mantri Awas Yojna (PMAY) 2.0 scheme in its 2025 budget to provide an additional 20 million homes in the next five years.

“Anyone catering to the EWS (economically weaker section) and LIG (low-income group) segment has big tailwinds in the form of government support through PMAY 2.0,” said the CFO of a large housing finance company. Mint “The demand in the market is very strong, so there is enough room for this industry to grow. Also, with interest rate cuts on the way, these loans are performing better, as net interest margins are still very good. But that increase will be offset in a span of four to six months after the cuts.”

Strategic difference

While the affordable housing segment is a profitable business model, it is not the only one in the housing finance space. The non-housing corporate or construction loan segment is another high-performing space where Bajaj Housing Finance has a strong presence.

“Companies operating in the premium or premium segments operate on thin margins. To complement that, they venture into the corporate or affordable housing segment,” said the CFO quoted above. “Since both segments generate relatively higher returns, they help balance profitability.”

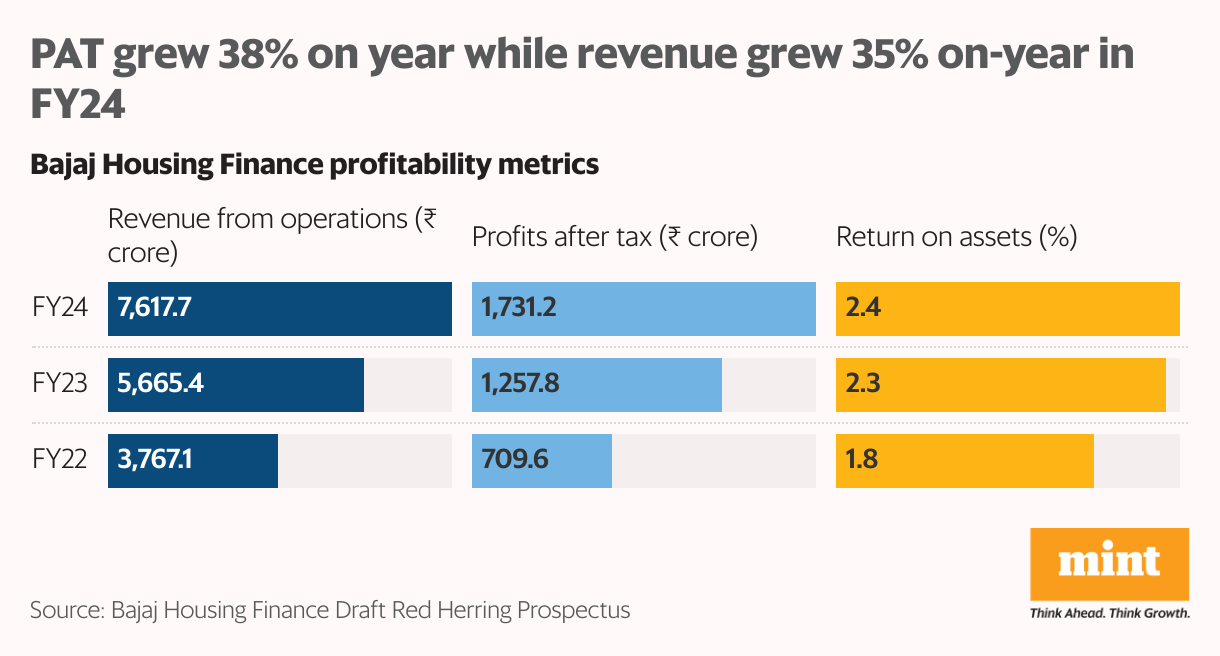

With a total assets under management of just over ₹Bajaj Housing Finance, which had Rs 97,000 crore in Q1 FY25, is one of the largest housing finance companies in the country. The company’s revenue grew 35% year-on-year to ₹7,617 crore, while net profit increased by 38% to ₹1,731 crore in FY24, according to the draft red herring prospectus filed by the company for its IPO.

Read also: Government to announce rules and expand income criteria for housing assistance this month

“Bajaj (Housing) is comfortable with its strategy. It is one of the largest players and its growth and asset quality have also been better than the rest,” Raheja said. “Hence, they are being valued at a higher multiple even though they are not in the affordable housing segment.”

The company’s shares are already trading at a premium of around 80% on the grey market ahead of its IPO, indicating strong demand for its initial public offering. The real estate financier has set a price band of ₹66-70 per share.

“Corporate and affordable strategies are very different. Whatever strategy they have adopted, they need to execute it well,” the CFO quoted above said. “Their (Bajaj Housing) multiple is not very different from affordable housing companies. They just need to be on top of their game.”

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.