“Which mutual fund should I invest in?”

This must have been the twentieth time my sister had called me to ask this. As usual, I tried to explain the basics to her, but this time I was quickly interrupted.

“Don’t waste my time, just tell me where most people are investing.”

This was understandable. She had recently received a bonus and was in a race against time before the temptation to buy took over.

I analyzed the data and found that thematic and sector funds had the largest portfolio size, which indicates the number of investors. This category also became the largest in terms of asset size last month.

But before I give my sister a thumbs up or thumbs down, let’s look at some ways to think about this space. This list was compiled with the help of experts.

Read also: How to buy a 3-bedroom flat at a 2BHK price: Secrets of distressed properties

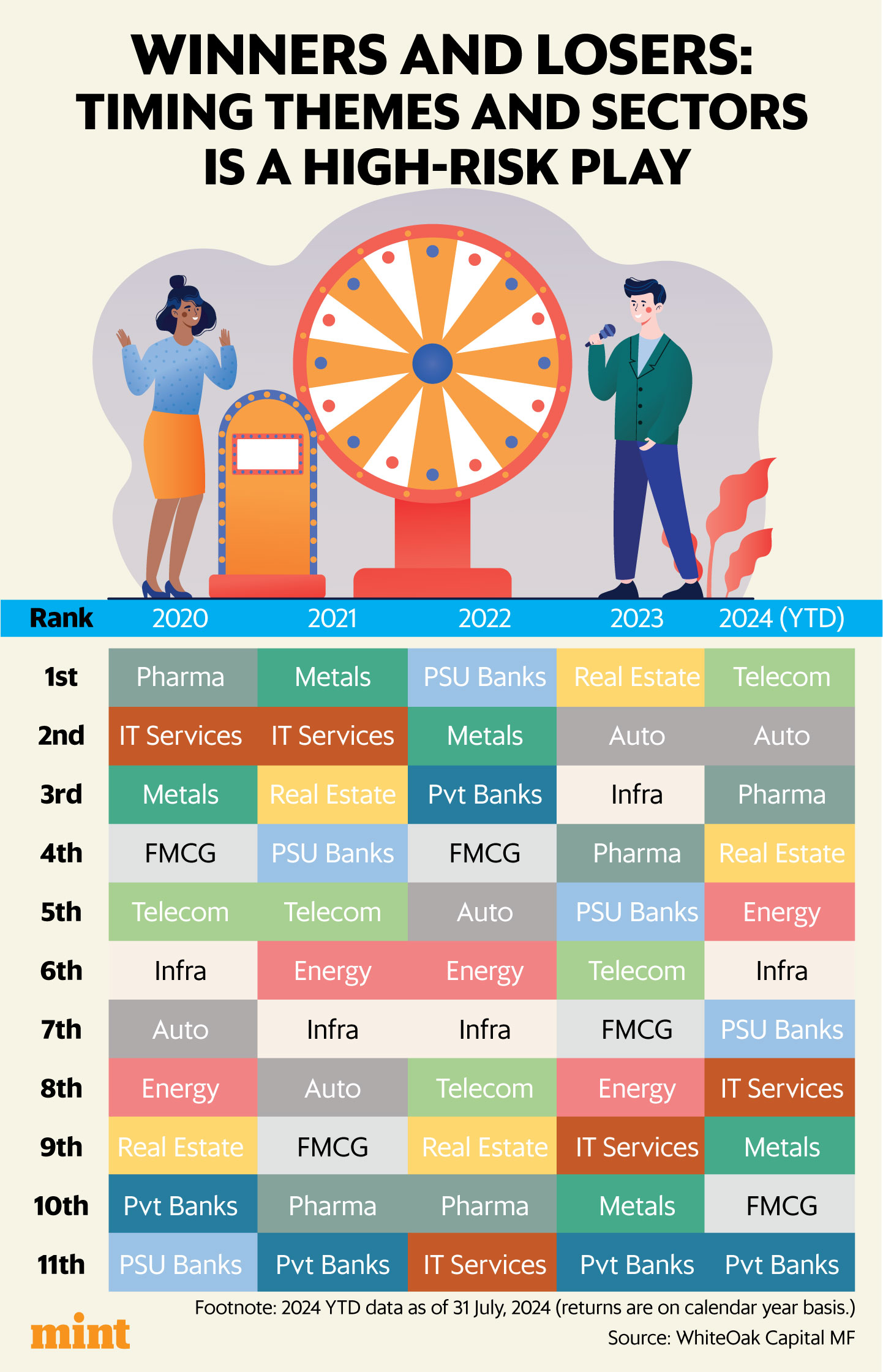

Chasing returns: Any classic investment book would advise you to buy low and sell high, but that is easier said than done. There is a sales pitch for a “defence plan” that says the Nifty Defence index returned 206% over the past 12 months. Staggering performance makes for good marketing material, but investing in a theme or sector that has performed well over the past three to five years is risky as it is probably time for the cycle to turn. A look at the data for the past 10 years (WhiteOak’s data from 2014 onwards, for example) shows that there have been different winners and losers almost every year when it comes to themes and sectors. That is not to say that the buy high and sell high strategy never works, but asset management firms will, more often than not, try to sell you something that has already performed well in the recent past.

View full image

View full image

Staff turnover generates taxes: In a sector or thematic fund, the investor has to decide for himself (or with his adviser) when to enter and exit a sector or theme. It is a difficult task. Fund managers are best placed to judge this as it is their full-time job. But even if you manage to do so, you still have to sell your holdings and move to another fund. “When you do this, you have to pay tax,” said Rukun Tarachandani, co-fund manager at PPFAS Mutual Fund. In this year’s Union Budget, the tax on long-term capital gains was increased from 10% to 12.5% and the tax on short-term capital gains from 15% to 20%, making mistakes and staff turnover more costly.

Read also: Why this Singaporean couple is sticking with their Indian health insurance plan

The cost of being wrong: FundsIndia data shows that 11 sector and thematic indices underperformed the benchmark Nifty 500 by at least 100% over the past five years. The simplest explanation is that these funds have concentrated portfolios, so if one bet goes wrong, they underperform significantly.

Allocation size: Let’s assume for a moment that you’ve done everything right. You’ve timed your entry perfectly, picked the right fund and got decent valuations. But even that isn’t enough if you’re under-allocated. “Even if you do everything right, you’re likely to be under-allocated,” said Jiral Mehta, senior research analyst at FundsIndia. And if you allocate more to such funds, the cost of getting it wrong is much higher.

Read also: Children abroad? Why do parents need a power of attorney?

When to leave: This may be the most important point. “I have seen fund managers tell investors to invest in a theme, but never when to exit it,” said Rukun Tarachandani, fund manager at PPFAS. Exiting an investment at the right time is arguably harder than investing at the right time.

Paralysis by choice: There are 179 sector and thematic funds available in India. ELSS funds, the second largest category within equity funds, have 42. Deciding which one to invest in is not an easy task.

In conclusion, that’s a thumbs down for me, sister.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.