Bitcoin ETFs in the US saw a resurgence on Thursday, with net inflows of $39.02 million after a period of outflows. ARKB, led by Ark and 21Shares, contributed the most to these inflows. Ethereum ETFs saw net outflows for the second day in a row, with Grayscale’s ETHE losing all of $20.14 million. Meanwhile, 21Shares added Anchorage Digital Bank and BitGo as custodians for its ETFs, while Grayscale launched its XRP Trust and plans a potential transition to XRP ETFs.

Bitcoin ETFs attract millions

Bitcoin Spot exchange-traded funds (ETFs) In the United States, a very positive change took place on Thursday. ETFs recorded net inflows of $39.02 million after experiencing money outflows the day before and consecutive days of departures a few weeks ago.

According to data from SoSoValue, 21Shares’ Ark and ARKB led the pack, attracting $18.34 million in inflows. Fidelity’s FBTC also had a good day with $11.47 million in inflows, followed by Grayscale’s Bitcoin Mini Trust, which gained $5.18 million. VanEck’s HODL fund and Franklin Templeton’s bitcoin fund saw smaller inflows of $4.95 million and $3.38 million, respectively. Bitwise’s BITB added $2.22 million to its assets.

Bitcoin ETF Flow (Source: Farside Investors)

On the other hand, Grayscale’s flagship GBTC fund was the only bitcoin ETF to see outflows, losing $6.51 million. Among the five bitcoin ETFs with zero flows on Thursday was BlackRock IBITthe largest bitcoin spot ETF by net assets. It has not seen any net inflows since Aug. 27.

The 12 Bitcoin ETFs combined had a lower daily performance Trading volume $896.92 million, up from $1.27 billion on Wednesday. So far, these ETFs have accumulated a total of $17.03 billion in net inflows since their launch in January.

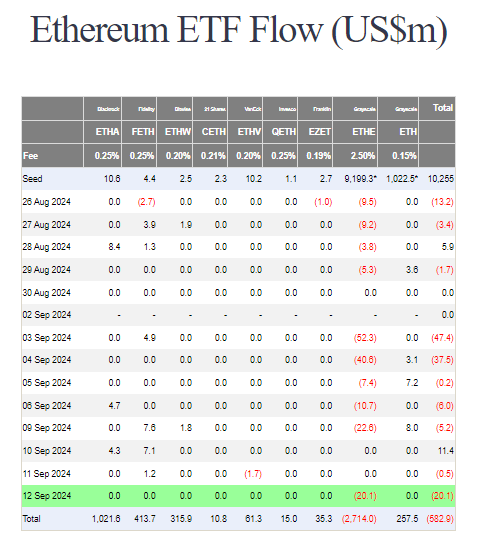

Meanwhile, Ethereum Spot ETF In the United States, net fund outflows continued on Thursday, making it the second consecutive day of losses. Grayscale’s ETHE fund accounted for all of the $20.14 million in outflows, while the remaining eight ether ETFs saw no movement.

Thursday’s total Trading volume Cumulative net outflows from Ethereum ETFs reached $106.14 million, down from $126.22 million the previous day. Cumulative net outflows from Ethereum ETFs now stand at $582.9 million.

Ethereum ETF Flow (Source: Farside Investors)

In the broader cryptocurrency market, Bitcoin Bitcoin is currently valued at around $58,032.69, after having experienced a drop to $53,000 following last Friday’s weak non-farm payrolls data. The king of cryptocurrencies was able to recover to its current level after the recent electoral debate between Kamala Harris and Donald Trump and the release of consumer price data.

Investors are now focused on next week’s Federal Open Market Committee (FOMC) meeting. CME Group FedWatch Tool indicates a 57% chance of a 25 basis point rate cut and a 43% chance of a 50 basis point reduction.

Sentiment on Ether needs a little boost for a bullish rally

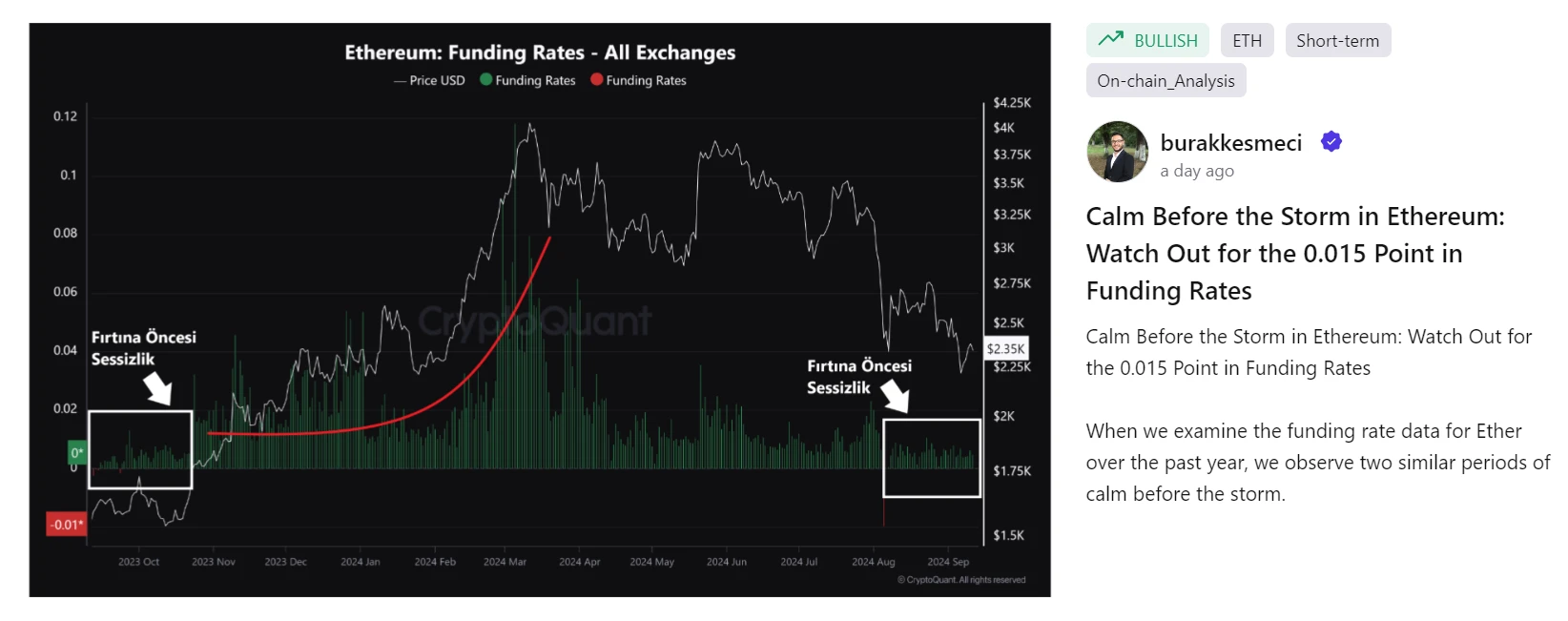

Although Ethereum ETFs are struggling to attract inflows, ETH trader sentiment only needs a slight uptick to trigger a potential price surge, according to CryptoQuant contributor. Burak KesmeciIn a note on Sept. 12, Kesmeci shared that an increase in the ETH funding rate above 0.015 could signal the start of a bullish rally.

The ETH funding rate currently stands at around 0.0056%. This is comparable to its level in September 2023, before it spiked, leading to a massive price increase.

Note by Burak Kesmeci (Source: Cryptoquantity)

The funding rate serves as a small market fee that helps align futures with place Prices and perpetual contracts are stabilising. A higher funding rate indicates increased market optimism as traders are more willing to hold long positions. According to Kesmeci, support from the futures market is critical for ETH price to experience another parabolic rise.

In September 2023, the increase in the Ethereum funding rate triggered a 166% price increase over the next six months, driving ETH Price to $4,006 by March 13. However, Ethnicity has struggled to close above $2,500 since Sept. 2, a crucial level for traders.

Critics have pointed out that the performance of the leading altcoin has lagged behind BitcoinDespite hopes that the launch of spot Ether ETFs Provide a boost at its price.

Futures Traders are still skeptical about ETH’s ability to break through this key level in the near term. If it does, $576.28 million in short positions could be at risk of liquidation, according to CoinGlass Data.

21Shares adds new custodians for cryptocurrency ETFs

In other ETF news, asset manager 21Shares announced the addition of Anchorage Digital Bank and BitGo as custodians of its spot cryptocurrency ETFs. They will join forces Coinbasewhich already acts as custodian for 21Shares’ US spot cryptocurrency ETFs.

These ETFs include the ARK 21Shares Bitcoin ETF (ARKB) and the 21Shares Core Ethereum ETF (CETH). Andrés Valencia, head of investment management at 21Shares, noted that it is important to diversify custodians to increase the security of its products.

This move makes 21Shares one of the first US companies to go public. Cryptocurrency ETFs Issuers will expand beyond Coinbase as a sole custodian. Nate Geraci, president of The ETF Store, commented that more issuers are now likely to diversify their custodians to reduce the risk of a single point of failure.

The number of regulated digital asset custodians in the US is growing. In August, Fireblocks received approval from the New York financial regulator to offer asset custody services. Other institutional players, including Coinbase Custody Trust, Fidelity Digital Asset Services, and PayPal Digital, have similar licenses. These qualified custodians follow very strict standards for secure storage, using Cold storage wallets and multi-party computation (MPC) to authorize transactions, with insurance for depositors against risks.

The United States Securities and Exchange Commission (SECOND) has been enforcing the custody rule to ensure adequate protection of investor funds. In September, the SEC even loaded Fund advisor Galois Capital Management has been sanctioned for failing to properly safeguard client assets, including holding funds at the now-defunct FTX.

Grayscale launches XRP Trust and aims to transition to ETF

Meanwhile, Grayscale Investments launched the Grayscale XRP Trustoffering investors exposure to the XRP cryptocurrency. The trust was announced on September 12 and is now open for daily subscriptions from eligible accredited individual and institutional investors.

Like Grayscale’s other single-asset investment trusts, the XRP Trust invests solely in XRP, the native token of the XRP Ledger (XRPL).

The launch of this trust could be a step towards the development of a XRP ETF. While ETFs require approval While SEC-regulated securities and securities are marketed to retail investors, trusts have lighter regulatory requirements and are geared toward accredited investors.

Grayscale outlined a four-phase lifecycle for the XRP Trust, potentially culminating in an ETF, offering greater access and transparency to investors as the product evolves.

Rayhaneh Sharif-Askary, Director of Product and Research at Grayscale, stated that XRP has impressive real-world utility, particularly in facilitating cross-border payments, which are completed in just a few seconds. The XRP Ledger is a decentralized public blockchain and supports various use cases such as tokenization, decentralized finance (DeFi) and cross-border payments.

Grayscale is best known for its Grayscale Bitcoin Trust (GBTC) ETF, and holds over 222,000 BTC worth nearly $12.8 billion. The firm has been one of the largest sellers of Bitcoin through GBTC and has also launched two spot Ether ETFs, which have seen billions of dollars in outflows since their debut.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.