A month after Ola Electric went public, its older but smaller rival Ather Energies also filed its draft red herring prospectus (DRHP) for an initial public offering (IPO). Founded in 2013, Ather Energies has seen four-years-younger Ola Electric outsell it in recent years. Prior to its IPO, Ola Electric had raised $1 billion in 14 rounds, while Ather raised $502 million in 19 rounds, according to Tracxn. This reflects their contrasting trajectories. But Ather’s decision to opt for an IPO and its preparation are strong indicators that it is changing course.

Ola Electric’s aggressive quest for scale is reflected in the revenues of the two companies. While Ather was ahead in operating revenue in 2021-22, Ola’s revenue grew by up to three times in 2023-24, according to DRHP figures. While Ather’s revenue declined, Ola Electric’s grew by over 90%.

The latest vehicle registration data from the Centre’s Vahan database also reflects this gap. While Ola sold 297,789 vehicles between April and August, Ather sold 73,497. Between Ola and Ather, there are TVS Motor and Bajaj, two traditional players betting on electric vehicles, in an increasingly competitive market.

Ather’s relationship with traditional players is more complicated, thanks to investments from two-wheeler major Hero MotoCorp. With 30%, Hero MotoCorp is the company’s largest shareholder. Even on an operational level, the two companies partnered last year to share an interoperable fast-charging network across the country.

Read also: Why China’s EV sector is no ‘footnote’

Scale vs engineering

The gap between Ola Electric and Ather Energies is partly due to the strategic direction the two rivals took. Ola positioned itself as a scale player, using the acquisition of Amsterdam-based Etergo BV as a springboard to launch its first product. Scale and speed had negative consequences, as customers complained of faulty products and inadequate service. An incident last week in Karnataka involved a disgruntled customer setting fire to an Ola showroom (he was arrested).

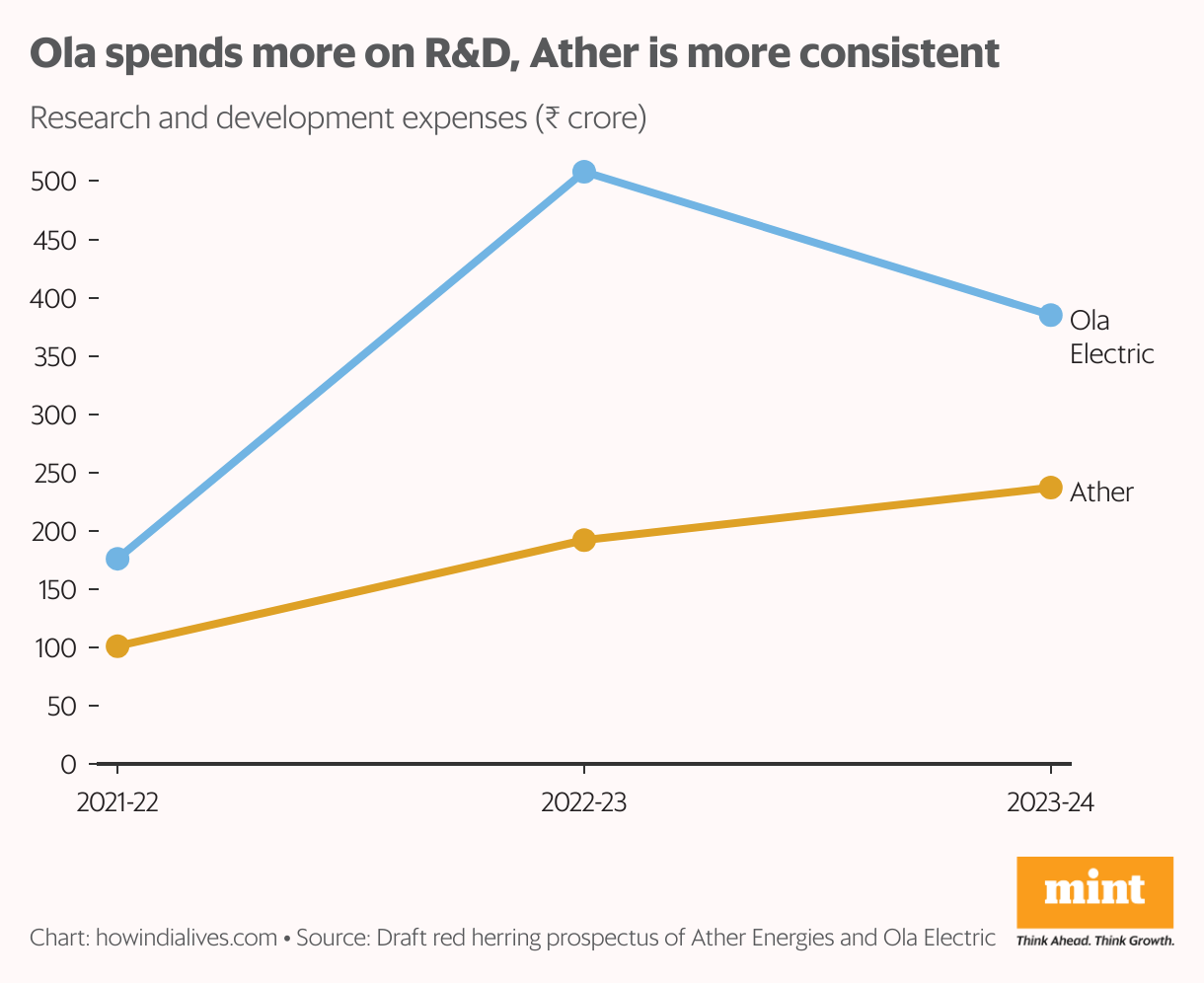

Ather’s slower pace of growth helped it establish a better reputation for quality. Its products were manufactured in-house. It has steadily increased its R&D spending, while Ola’s was down 24% in 2023-24 compared to the previous year. Still, Ola has a bigger R&D budget and has not been shy about paying big to attract talent. Ather plans to use some of the IPO funds on R&D.

Distribution model

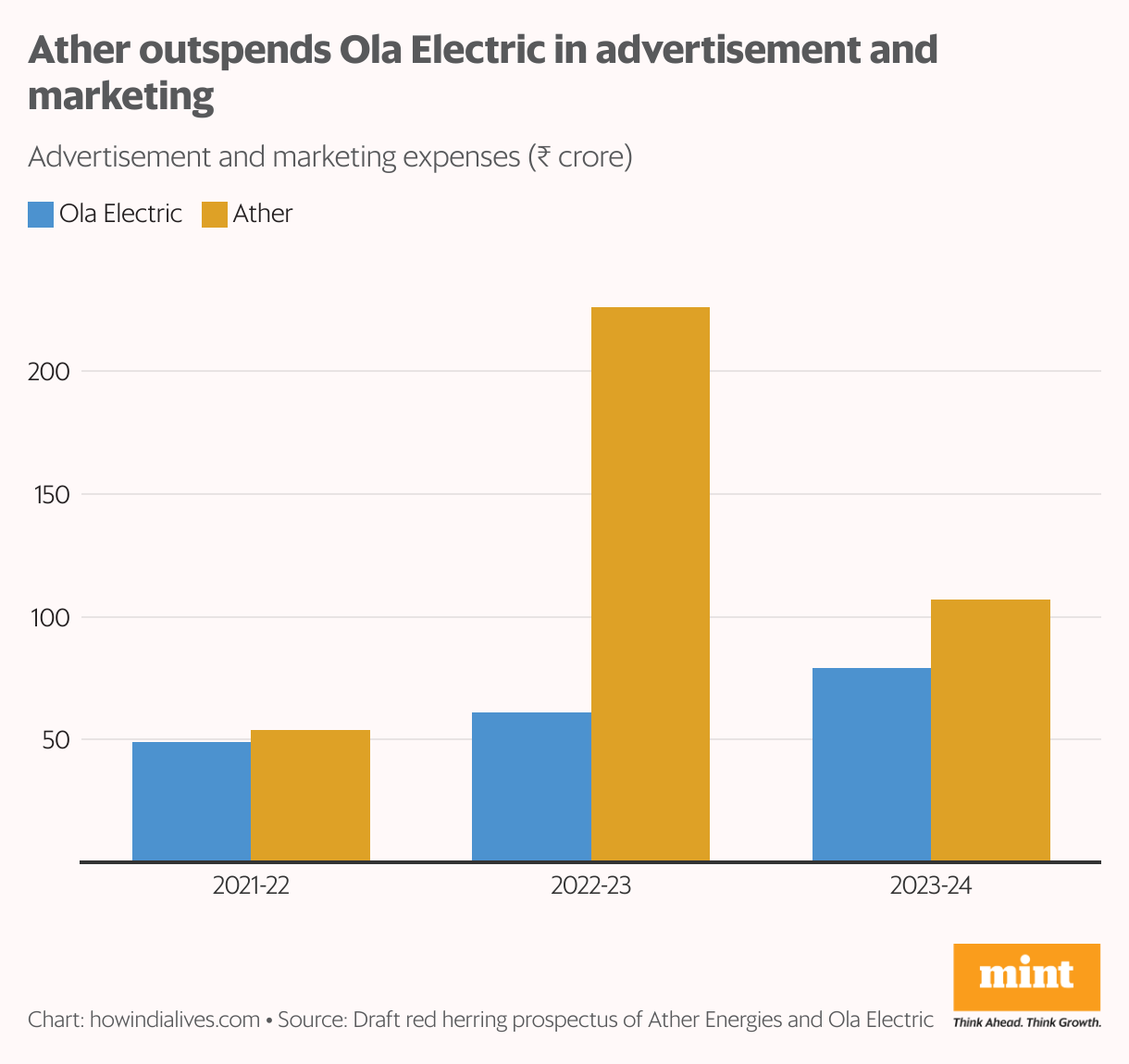

The common perception is that Ola Electric is stronger at marketing, bolstered by its dominant market position. However, in each of the last three fiscal years, Ather has outspent Ola Electric on this front by a wide margin in its bid to gain market share. Ola’s larger market share comes primarily from its manufacturing capabilities and distribution model. It launched its products across the country through an online-only and direct-to-home delivery model.

Read also: Are the wheels of growth coming off in the automotive segment?

Ather adopted a traditional showroom-based model, resulting in a relatively slower pace of growth and a concentration in South India. In 2023-24, the South accounted for 68% of all its sales, followed by the West at 16%. North, East and Central India accounted for 9%, 5% and 2% respectively. State-level regulations could impact the business either way. Karnataka has its own electric bike taxi policy. Delhi has pledged to shift ride-hailing and delivery companies to electric bikes by 2030.

Inevitable growth

Regulations will continue to play a major role in EV adoption. When the government withdrew subsidies for FAME-II, this impacted sales for all players. In China, EV adoption expanded even after the government withdrew subsidies, thanks to other factors such as the lower total cost of ownership of EVs compared to vehicles running on traditional fuels, better performance, and easier access to battery charging points.

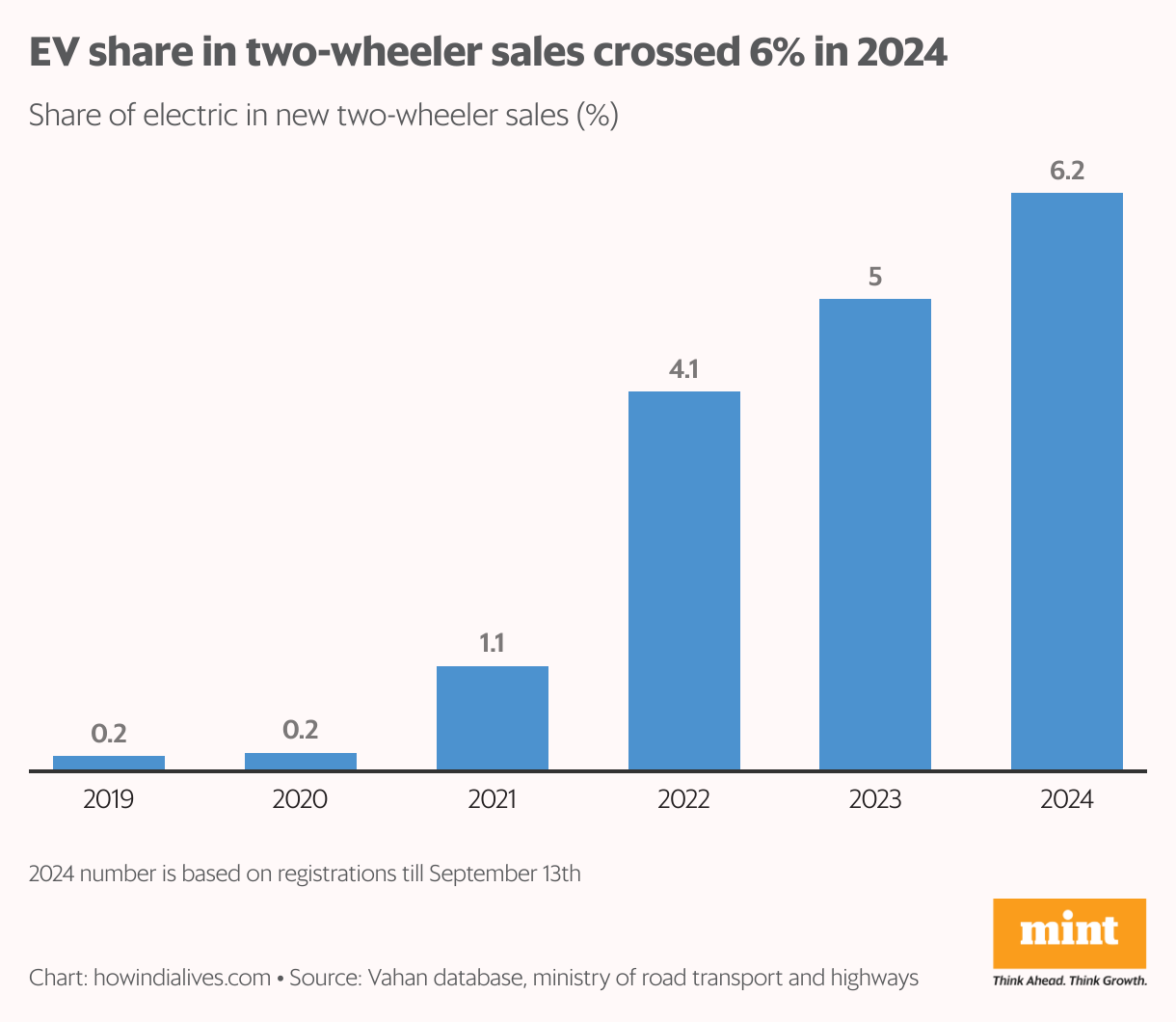

These factors are also expected to boost EV penetration in India, which has risen from 1.8% of new two-wheelers sold in 2021-22 to 5.1% in 2023-24. McKinsey expects it to reach 60-70% by 2030. Companies that invest in capabilities now have a better chance of capturing that market. That has been Ola’s bet. Ather’s current facility in Hosur is running at only 30%. However, it plans to build another one in Maharashtra with IPO FundsIt’s a sign that Ather is also betting on scale.

www.howindialives.com is a database and search engine for public data.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.