Since last Friday, Bitcoin has seen a 4% pullback, following a strong 15% surge from its local lows. Despite this recent momentum, the market is facing uncertainty and volatility as BTC trades below the crucial $60,000 level, a psychological mark that indicates direction.

Investors are watching closely to see if Bitcoin can regain strength and break above this key resistance or continue to struggle in the near term.

There are signs of recovery, however, as Coinbase data shows that BTC is back to trading at a higher price, indicating strong demand. Additionally, key data from Coinglass highlights the critical liquidity levels that BTC may reach in the coming weeks.

These factors suggest Bitcoin Bitcoin is at a crucial moment, and its price action in the coming days is likely to determine the direction of the market in the coming months. Traders and investors are preparing for Bitcoin’s next big move.

Bitcoin Consolidation May Be Over: $70,000 Now?

The past few weeks have been encouraging for Bitcoin, sparking hope and optimism among investors who are bracing for a deeper correction. Recent data indicates a positive shift in market sentiment.

Analyst Daan highlighted in X BTC has been trading at a premium on Coinbase, a sign of renewed spot demand from US investors and potential interest from ETFs. This premium is generally bullish, reflecting increased buying activity and confidence in BTC’s future.

However, significant stock discounts, often seen at market lows, can signal bearish sentiment, although they also offer potential entry points for savvy investors.

As an add-on, Coinglass has provided key metrics on Bitcoin liquidity levels. Binance’s BTC/USDT liquidation heatmap shows that BTC recently absorbed a large pool of liquidity below $50,000 during the August 5 sell-off. This move broke through substantial support levels, leaving fewer significant pools nearby.

Major liquidity levels now sit around $47,000 and below, with substantial interest building up at the $70,000+ mark.

This data suggests that while Bitcoin is facing potential support and resistance challenges, current market dynamics indicate a more bullish outlook.

The absence of significant liquidity pools around the current price and the premium observed in Coinbase It could indicate a continued upward trajectory, provided BTC can maintain its recent gains and build momentum.

BTC Technical Analysis: Key Levels to Watch

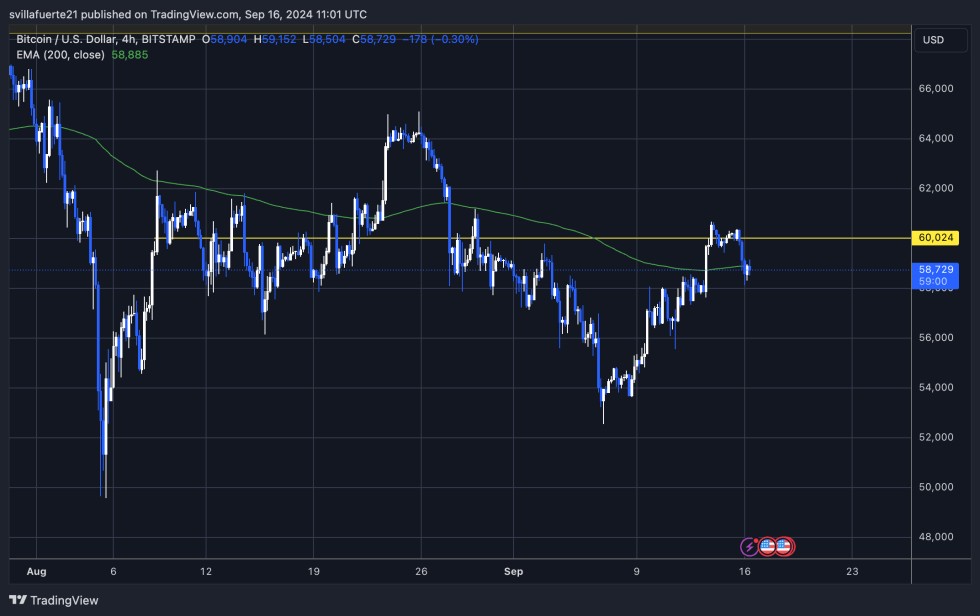

Bitcoin price is trading at $58,593, reflecting a 4% drop from last week’s peak of $60,670. The cryptocurrency is facing challenges to maintain its position above the 4-hour 200-day exponential moving average (EMA) at $58,883, a crucial level it reclaimed last Friday, indicating near-term strength.

This EMA has acted as significant resistance since early August and could serve as new support if BTC can sustain above it.

To reinforce the bullish outlook, Bitcoin must rebound and sustain above the 200-day 4-hour EMA and the $60,000 mark as these levels are crucial in shaping the overall market sentiment. If it fails to close above the 200-day 4-hour EMA, it could test the next level of demand around $57,500, which represents a healthier support zone.

If the correction extends further, BTC faces potential risks of dropping to $55,500. This deeper correction would test lower support levels and could signal more challenging market conditions ahead. Staying above these key levels will be critical in determining Bitcoin’s near-term direction and overall market stability.

Featured image of Dall-E, chart from TradingView

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.