Equity mutual funds continued their strong performance in August 2024, with assets under management (AUM) increasing by 2.04 per cent to Rs 25.64 trillion. A study by PL Wealth Management analysed 283 open-ended diversified equity funds and found that 67 per cent of them outperformed their respective benchmarks during the month. In the previous month, 39 per cent of the schemes managed to outperform their benchmarks.

The cumulative total of outperforming funds was 190 during the month ending August 2024 (one month).

The best performing category was large and mid-cap funds, where 79% of the schemes outperformed the benchmark. This was followed by focused fund schemes, which outperformed their respective benchmarks by 75%. During this period, multi-cap, mid-cap and flex-cap funds were the three categories that outperformed their respective benchmarks by 69% each.

Large-cap funds were the worst-performing fund category, with only 55% of funds outperforming the benchmark.

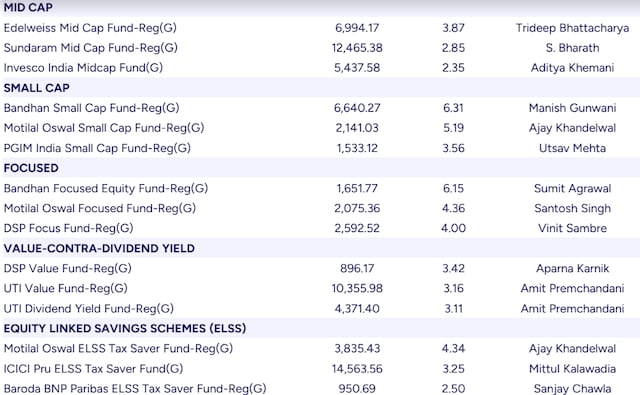

Best performing funds in the last month:

REFERENCE PERFORMANCES

NIFTY 50 – TRIPLE 1.74

NIFTY 500 – TRI 1.43

Nifty Midcap 150 Index: TRI 0.90

Nifty Smallcap 250 Index: TRI 1.17

“Investors are advised to stick to their SIP investments and maintain a long-term focus. SIPs over the last 3 years have delivered returns of over 15% per annum on average for top quartile equity funds,” PL Wealth Management said in a note.

Top Performing Funds: Motilal Oswal Large Cap Fund, Bandhan Large Cap Fund and HSBC Large Cap Fund led the way in the large-cap category.

Diverse Outperformance: Funds across a range of categories including large-cap, mid-cap, flexible-cap and multi-cap demonstrated strong returns.

First published: September 18, 2024 | 14:31 IS

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.