Deaton criticized Warren’s anti-crypto approach and accused her of neglecting more important issues such as inflation and banking access. Warren defended her stance and advocated for cryptocurrency regulation to be aligned with banking regulations. Meanwhile, Coinbase is working hard to educate lawmakers like Warren about the relatively low percentage of cryptocurrency that is actually used for illegal transactions. The Trump family’s crypto project World Liberty Financial faced a slow start after going live, as only 3.4% of its $300 million target was sold.

Deaton slams Warren’s anti-crypto approach

in your first debate for the United States Senate seat in Massachusetts, Senator Elizabeth Warren and crypto lawyer John Deaton They clashed over their positions and opinions on cryptocurrency regulation and other key issues. Deaton, a Republican candidate, criticized Warren for prioritizing the formation of an “anti-crypto army” instead of addressing serious concerns such as illegal immigration, inflation, and the struggles of the middle and lower classes. He also questioned why Warren decided to focus on cryptocurrency regulation and not these pressing challenges.

Warren and Deaton during their debate (Source: CBS Boston)

Warren defended herself, stating that while she’s not actually opposed to people buying and selling cryptocurrencies, she believes the industry should abide by the same rules as banks and stockbrokers, especially when it comes to protection. consumer protection and the application of anti-terrorism laws. . He also argued once again that cryptocurrencies are very frequently used to illicit activitiessuch as terrorist financing and drug trafficking, making regulation crucial.

While both candidates could agree that the traditional banking system has failed many Americans, Deaton still accused Warren of neglecting the issue of banking access. He specifically referred to a Senate Banking Committee hearing in December where Warren questioned JPMorgan CEO Jamie Dimon.

According to Deaton, there should have been more focus on bank failures rather than cryptocurrency-related crimes. Deaton also criticized Warren for not addressing JPMorgan’s connection to Jeffrey Epstein. child sex trafficking operation during the hearing.

Warren responded to this by pointing out that 90% of financial support Because Deaton’s campaign came from the crypto industry, suggesting those backers would likely expect favors in return if he were elected. Deaton dismissed Warren’s statement and shared that she often takes positions that anger the cryptocurrency industry and that she still has ongoing conflicts with several “crypto billionaires.”

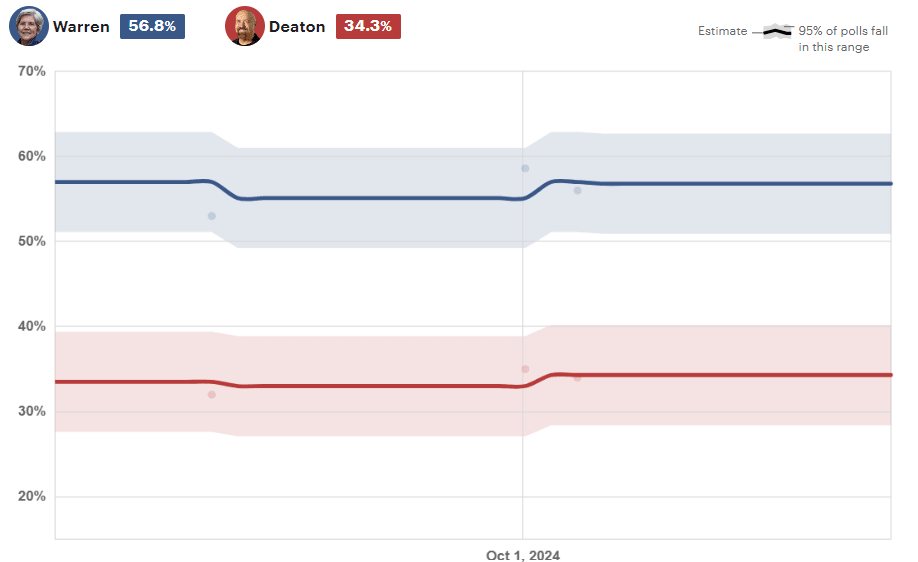

Massachusetts Senate Polls (Source: the hill)

The debate took place after Deaton won the Republican nomination in Massachusetts on September 4. Warren currently leads Deaton by 22.5% in the polls, according to The Hill’s 2024. Electoral dataas he plans to extend Democrats’ 11-year control over the state’s two U.S. Senate seats.

Education is key to improving crypto laws

Coinbase has made it a priority to educate the public and lawmakers to fight misleading narratives about cryptocurrencies’ links to illicit finance, according to the exchange’s chief security officer. Felipe Martin. At the Ripple Swell conference, Martin shared that better informed legislators can make more effective decisions, and that a lack of education very often leads to poor legislation and slows down innovation in the crypto space.

Coinbase has been helping US lawmakers understand the security and consumer protection measures that are in place to prevent illicit activity in the cryptocurrency industry. According to Martin, education is crucial when it comes to preventing misconceptions about cryptocurrencies, especially for people who form opinions based on media headlines that don’t always reflect the full picture.

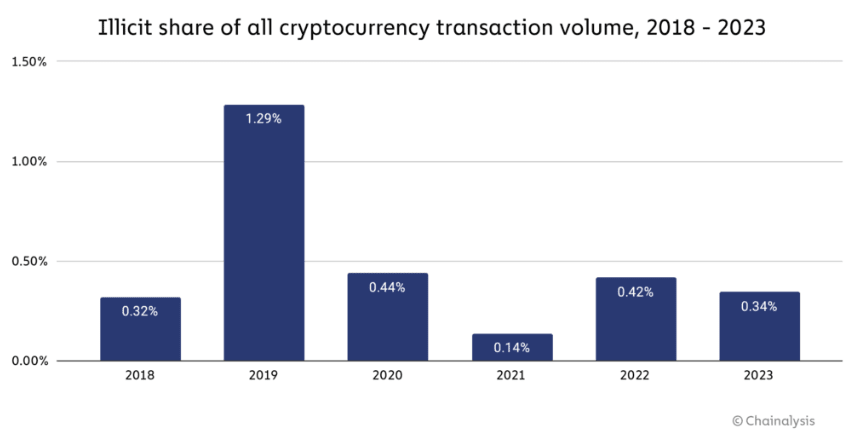

He argued that the belief that cryptocurrencies are widely used for illegal activities is a very misleading narrative that needs to be corrected. He referred to a Coinbase Report on October 1 which noted that only about 0.34% of cryptocurrency transactions involve illicit activities. This is very different from the estimated 33% of cash transactions in the US used to criminal purposes. He also shared that blockchain technology provides transparency and measurable data about transactions, something that is much more difficult to achieve in the traditional financial system.

Share of illicit crypto transaction volume (Source: Chain analysis)

with the united states elections Around the corner, Martin is optimistic about a more crypto-friendly stance from the next president. He also mentioned that the Democratic Party may be softening its approach to cryptocurrencies as it recognizes that a large portion of the population supports a fairer and freer financial system.

Crypto Companies Should Avoid Surprises

New York Department of Financial Services (NYDFS) Director Adrienne Harris and Ripple Chief Legal Officer Stuart Alderoty also recently spoke of the current state of crypto regulation and how companies can better navigate the regulatory landscape at the Ripple Swell event in Miami.

Harris believes crypto companies need to be proactive and transparent when dealing with regulators, and highlighted how important it is to communicate openly to avoid surprises. He advised the industry to approach regulators early when sharing their long-term business plans, even if New York has a more progressive stance on cryptocurrencies compared to federal regulations.

During the discussion, Alderoty asked Harris what advice she would give to the industry regarding interactions with regulators. Harris responded that regulators should never be surprised by news about the industry coming from the media. Instead, companies should ensure that regulators are fully informed in advance of any major issues. He also encouraged companies to present their five-year business plans when engaging with regulators to drive understanding and cooperation.

The conversation also touched on the broader state of US crypto regulation. Harris acknowledged that the country has lagged behind Europe and other regions in developing clear guidelines. Although the US of 2024 presidential election Initially appearing to be a possible referendum on crypto policy, both candidates have expressed positive opinions towards the sector.

This now leaves supporters of the crypto industry divided, with some backing Donald Trump out of frustration over the The Biden administration regulatory inaction, while others support Kamala Harris for its progressive economic platform.

Fights over Trump family crypto project

Meanwhile, the first token sale for the Trump family crypto project, Global financial freedom (WLFI), got off to a slow start after selling just 3.4% of its $300 million target, as its website crashed shortly after launch. the sale went live on October 15 and offered 20 billion tokens at a price of 1.5 cents each.

After 14 hours, only 687 million tokens were sold, or about $10.3 million. Despite claims of more than 100,000 registrations before launch, only 6,832 unique wallet addresses currently contain WLFI tokens, according to etherscan data.

The World Liberty Financial website experienced downtime shortly after the token sale began, which was reportedly due to high traffic. Many users reported encountering a “website under maintenance” notice.

the project white paper reveals a total supply of 100 billion WLFI tokens. A total of 35% will be allocated to token sales for eligible participants. The remaining tokens are intended for community growth, initial allocation of followers, and the team.

The Trump family played a central role in promoting WLFI. In fact, former President Donald Trump was named the platform’s “Chief Cryptocurrency Advocate,” and his sons Barron, Eric, and Donald Trump Jr. serve as “Web3 Ambassadors.” Trump took to social media on October 15 to promote the token sale and openly shared his belief in cryptocurrencies as the future of the digital economy.

In the US, WLFI tokens are only available to accredited investors due to their status as unregistered securities. The tokens are not tradable, but will act as governance tokens for the upcoming Ethereum-based decentralized finance. platform (DeFi). The platform will operate as an instance of the Aave DeFi protocol and will allow users to borrow and lend cryptocurrencies, interact with liquidity pools, and transact with stablecoins.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.