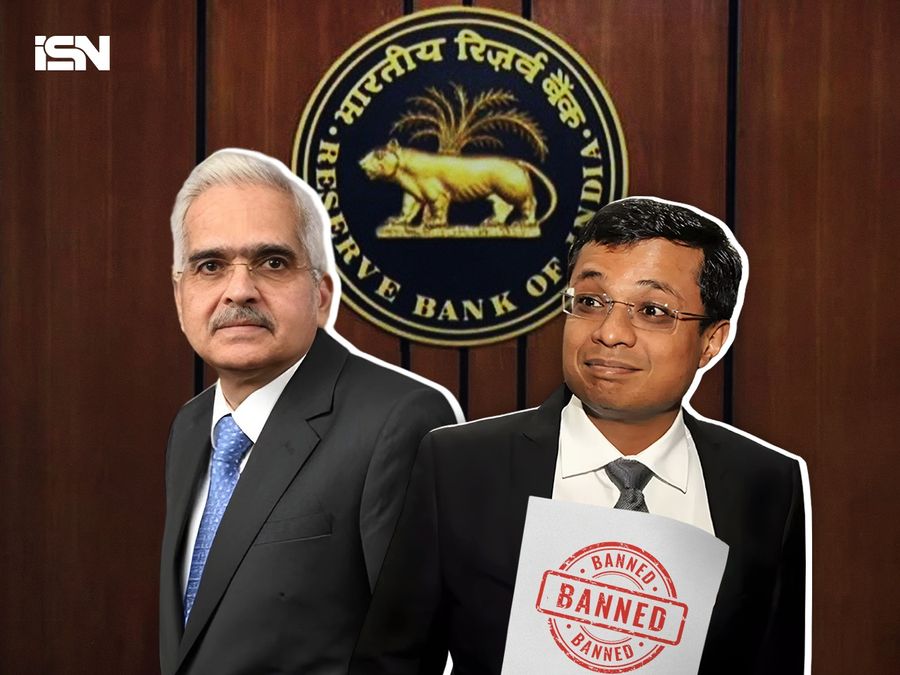

The Reserve Bank of India (RBI) has banned Flipkart co-founder Sachin Bansal, led by Navi Finserv of the loan sanctioning and disbursement processes, as of October 21, 2024.

Navi is not the only entity affected. The RBI has taken similar action against three other non-banking financial companies (NBFCs) – DMI Finance, Asirvad Micro Finance and Arohan Financial Services.

The RBI directive, issued under section 45L(1)(b) of the Reserve Bank of India Act, 1934, came into effect from the close of business on October 21, 2024.

Why did the RBI take this strict step?

The strict action came after the RBI thoroughly investigated NBFC loan pricing practices and other regulatory concerns. According to the RBI, the main reason for this action was the discovery of material supervisory concerns regarding the pricing policies of the companies.

Specifically, their weighted average credit rates (WALR) and interest spreads charged were deemed excessive and not in line with regulations.

The RBI also noted that these NBFCs did not comply with the Directorate General on Microfinance Lending (2022) and Scale Based Regulation (2023), which govern how microfinance loans should be priced and managed. These companies were also found to be non-compliant with the provisions set out in the Code of Fair Practices issued by the Reserve Bank.

In addition to usurious pricing, these NBFCs were found to be non-compliant with regulatory guidelines on assessing household income and considering existing or proposed monthly payment obligations in respect of their microfinance loans.

The RBI also observed deviations from income recognition and asset classification (IR&AC) norms, resulting in evergreening of loans, conduct of gold loan portfolio, mandatory disclosure requirements on interest rates. interest and fees, outsourcing of basic financial services, etc.

Impact on affected NBFCs

The directive comes at a critical time for the companies affected. For example, Asirvad Micro Finance is gearing up for an initial public offering (IPO) worth Rs 1,500 crore. Arohan Financial Services CEO Manoj Nambiar was recently appointed as Chairman of the Microfinance Industry Network.

Meanwhile, Navi Finserv is still reeling from the RBI’s rejection of its universal banking license application two years ago.

DMI Finance, which is backed by Japan’s MUFG Bank, had seen significant investment growth, with MUFG’s stake in the company reaching Rs 4,712 crore as of August 2024.

Responses from NBFCs

In response to the RBI’s actions, Navi Finserv issued a statement expressing its commitment to address the regulator’s concerns.

“Navi Finserv is currently reviewing the circular received from the RBI and is committed to addressing all concerns raised by the regulator quickly and effectively, prioritizing what is right for our clients. The company remains dedicated to maintaining the highest compliance standards , transparency and customer service.

Similarly, Asirvad Micro Finance acknowledged the RBI’s comments and stated that the company is preparing to take corrective actions to align with regulatory guidelines.

“The Board has reiterated its unwavering commitment to implement the direction of the RBI in letter and spirit,” Asirvad Micro Finance said in a statement. The firm also highlighted plans for a detailed review of governance and risk management.

RBI stance on compliance

The RBI has clarified that the restrictions are applicable only for sanctioning new loans. Notably, these NBFCs can continue to serve existing customers and manage loan collections as per prevailing regulatory guidelines.

These restrictions will remain in place until affected companies provide evidence of their compliance with RBI regulations, particularly around their pricing policies, risk management and customer service standards.

In recent months, the central bank has urged lenders to adopt fair and transparent pricing models, especially for small value loans, while warning against practices that could destabilize the financial integrity of the sector.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.