The conglomerate returned to the dollar bond market in March for the first time since a report by short-seller Hindenburg Research in early 2023 | Photo: Bloomberg

By Saikat Das and Ishika Mookerjee

Billionaire Gautam Adani’s conglomerate is in talks with global banks to raise at least $1.5 billion through dollar bond sales, another sign of the group’s recovery after an onslaught by short sellers.

The funds would be used to refinance the project’s debt, according to people familiar with the plans, who asked not to be identified to discuss private details. Adani Group aims to complete the sales in several tranches by the end of February, two of the people said.

According to the sources, the bonds would be issued primarily through Adani Green Energy Ltd. and Adani Energy Solutions Ltd. units and through special purpose vehicles. Plans include selling green or sustainability-linked instruments, and talks are underway with more than 10 banks, including those in Japan, Europe and the Middle East, they said.

Adani Group did not immediately respond to a request for comment.

The conglomerate returned to the dollar bond market in March for the first time since a report by short-seller Hindenburg Research in early 2023 contained allegations of fraud and stock manipulation. Adani has repeatedly denied the allegations.

Since then, executives have sought to rebuild investor confidence by cutting debt, moving ahead with major projects and offering new details about the conglomerate’s future, including tycoon Adani’s retirement plans.

Prices of the 18-year bonds Adani sold earlier this year have declined steadily in the secondary market since their issuance, trading at around 96 cents on the dollar on Thursday.

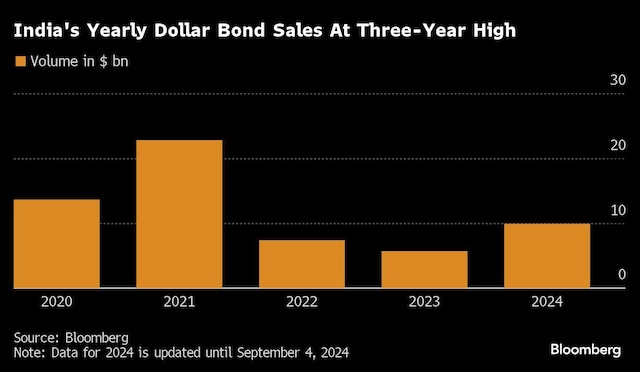

Indian companies have set up the most dollar-denominated debt in three years in 2024, raising nearly $10 billion, according to data compiled by Bloomberg. Companies are likely to raise at least $4 billion more over the rest of this year, according to JPMorgan Chase & Co.

Indian companies have set up the most dollar-denominated debt in three years in 2024, raising nearly $10 billion, according to data compiled by Bloomberg. Companies are likely to raise at least $4 billion more over the rest of this year, according to JPMorgan Chase & Co.First published: September 5, 2024 | 14:44 IS

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.