Bitcoin’s price recently dropped below $56,000, pushing market sentiment into “extreme fear” territory. BitMEX co-founder Arthur Hayes also predicts a further 12% price drop that could take Bitcoin below $50,000. Despite this, some traders remain optimistic about Bitcoin’s future performance, although Bitcoin ETFs are still dealing with continued outflows. On the other hand, Bitcoin DeFi is gaining some traction, with some developers predicting that it could even surpass Ethereum’s dominance in DeFi within the next two years.

Arthur Hayes warns of further BTC declines

Cryptocurrency market sentiment has fallen back into “extreme fear” territory after… Bitcoin (BTC) briefly fell below $56,000. BitMEX co-founder Arthur Hayes He also predicted a further 12% drop that could see Bitcoin fall below $50,000 over the weekend.

Cryptocurrency Fear and Greed Indexthat measures market sentiment The trend index, which measures the level of fear on a 100-point scale, fell to 22 on Sept. 6, indicating “extreme fear.” This is a seven-point drop from the “fear” rating the day before and is the lowest score since Aug. 8, when the index hit 20.

Cryptocurrency Fear and Greed Index (Source: Alternative)

Bitcoin price hit a low of $55,838 after a sharp drop from over $58,000. This wiped out $29.7 billion from its market cap. According to data from CoinMarketCap, Bitcoin is trading at $55,767.64 at the time of publication after its price fell more than 2% over the past 24 hours of trading. Arthur Hayes believes Bitcoin is under pressure and expects the price to fall further over the weekend.

This drop in Bitcoin price comes amid broader concerns about the US economy, particularly regarding a potential Federal Reserve interest rate cut later this month.

The fall in Bitcoin’s value has also affected other major cryptocurrencies. Ethereum (Ethnicity) The price also fell by over 2% since yesterday. As a result, the altcoin is worth around $2,346.67 at the time of writing. Both Solana (SOL) and XRP also saw their prices drop by over 2% over the same time period.

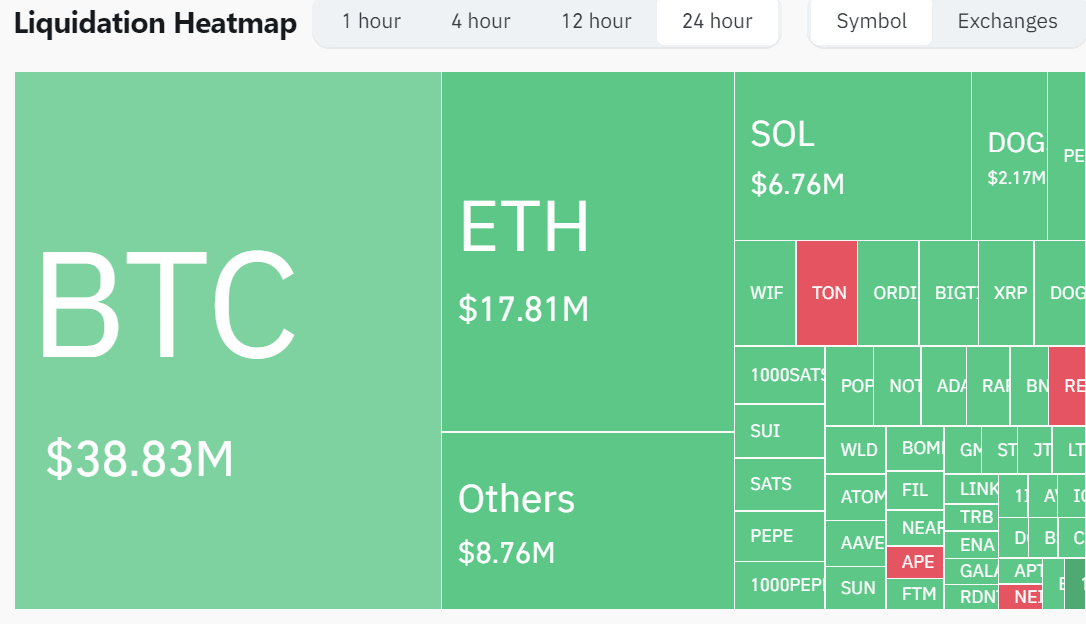

The extensive sale resulted in $94.26 million in liquidations In the past 24 hours, a large part of those betting that the price of Bitcoin will rise.

Clearance Heat Map (Source: Goinglass)

Traders dismiss fears of a Bitcoin price crash in September

Some Bitcoin Traders are still hopeful despite concerns about the usual September market crash, even though historical trends suggest otherwise. Ed NoHindi, chief investment officer at Tyr Capital, noted that while September has typically been a negative month for Bitcoin, a potential Federal Reserve rate cut and a strong U.S. economy could catch bears by surprise. Hindi claimed that the chances of Bitcoin breaking above $60,000 are much higher than those of it falling below that level.

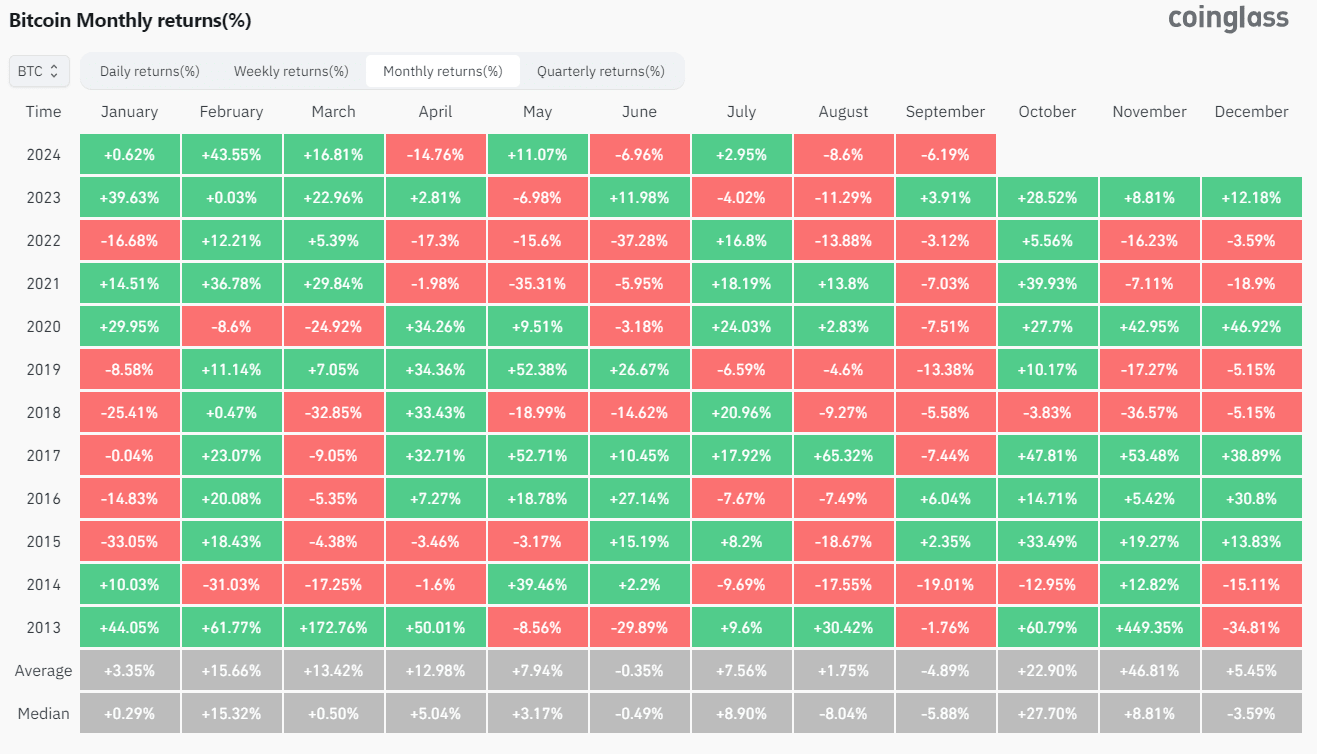

Well known trader Daan Cryptocurrency Trading He shared that despite its reputation, Bitcoin’s average return in September is around -4%, which he considers moderate considering the asset’s volatility. Data from CoinGlass backs this up and revealed that September has historically been Bitcoin’s worst month, with an average monthly loss of 4.89% over the past 11 years.

Bitcoin Monthly Returns (Source: Glass of coins)

Daan Crypto Trades added that it is very close listen The Bitcoin price chart shows “higher highs and higher lows,” which is a sign that buyers are gaining ground in the market. It also indicated that Bitcoin needs to break above $65,000 again to show real strength.

This comes after the analyst Matthew Hyland Hyland has also been very vocal about the importance of Bitcoin recovering and making a higher high, especially after it fell below $58,000 on August 30. Hyland also believes that price action like this will confirm the bullish trend that Bitcoin has been following since August.

Bitcoin spot funds face seventh day of outflows

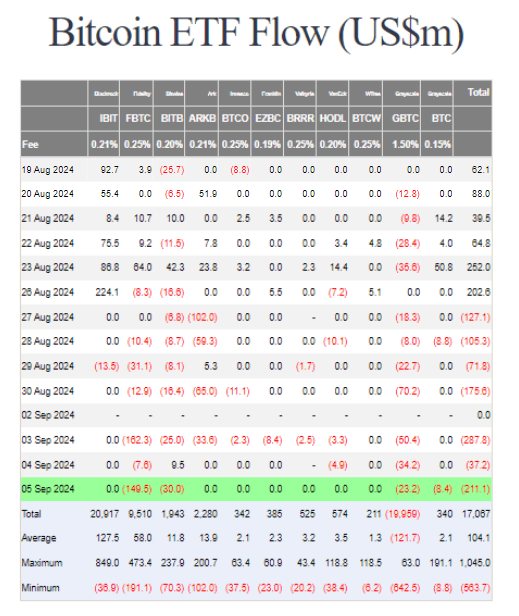

While some traders are optimistic about BTC’s potential performance for September, Bitcoin Exchange Traded Funds ETFs continue to bleed. U.S. spot bitcoin ETFs saw net outflows of $211.15 million on Thursday, making it the seventh consecutive day of negative flows.

Bitcoin ETF Flow (Source: Farside Investors)

Fidelity’s FBTC led the outflows with $149.49 million, followed by Bitwise’s BITB with $30 million. GBTC and Grayscale’s mini-trust also saw outflows, with $23.22 million and $8.45 million, respectively.

No Bitcoin spot ETFs saw net inflows, and eight other funds, including BlackRock IBITreported zero flows for the day. The newspaper Trading volume for the 12 ETFs fell to $1.35 billion, down from $1.41 billion the previous day.

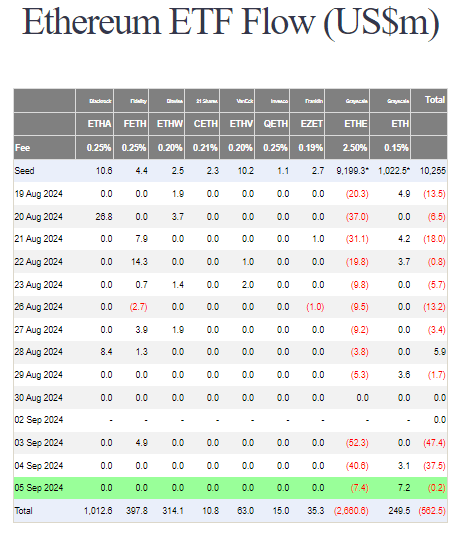

Meanwhile, U.S. Ethereum spot ETFs saw smaller moves, with $152,720 in net outflows on Thursday. Grayscale’s ETHE reported $7.39 million in outflows, while the Ethereum Mini Trust saw $7.24 million in inflows.

Other seven Ethereum ETF recorded zero flows during the day. Ethereum’s daily fund transaction volume also decreased to $108.59 million, compared to $145.86 million the previous day.

Ethereum ETF Flow (Source: Farside Investors)

Augustine Fan, director of analysis at SOFA.org, believes the ideal scenario for stocks and bitcoin would be a slightly weaker report that doesn’t raise recession concerns but allows the Federal Reserve to move ahead with its economic plans.

Bitcoin DeFi could surpass Ethereum

The total capital used in Bitcoin-based cryptocurrencies Decentralized Finance (DeFi) Protocols could surpass those of the Ethereum Network in the next two years, according to Bitcoin DeFi developer Brandon Sedo. In Korea Blockchain WeekSedo, an early contributor to the Bitcoin Core DAO sidechain, claimed that the $1 trillion currently in the Bitcoin ecosystem will gradually move on-chain, potentially reversing Ethereum’s dominance in DeFi.

Sedo noted that as the value of Bitcoin continually increases and more institutional capital is attracted through Exchange Traded Products (ETPs)Much of this capital is likely to flow into Bitcoin sidechains and DeFi applications. Solutions such as trustless bridges and roll-ups are expected to facilitate this transition, unlocking significant liquidity for on-chain opportunities in the Bitcoin ecosystem.

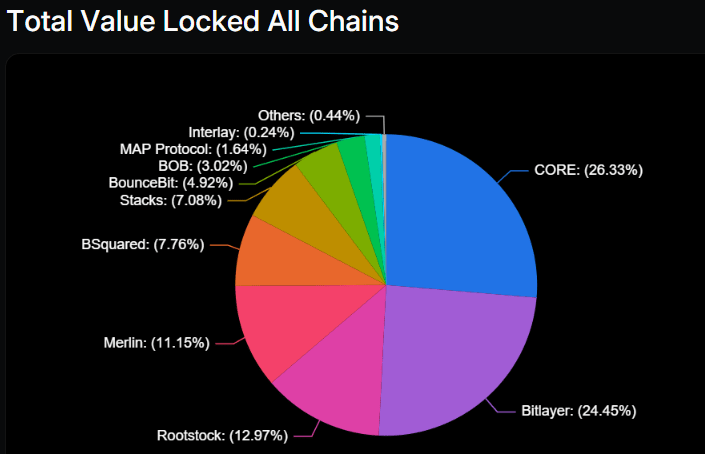

The recent approval of Bitcoin spot ETFs has boosted development activity around Bitcoin sidechains like Core, Bitlayer, and Stacks, driving interest in Bitcoin scalability. However, Sedo shared that for Bitcoin’s DeFi total value locked (TVL) to surpass that of Ethereum, more Bitcoin holders have to agree to put their assets to work in DeFi. This shift has been hampered by skepticism after the collapse of platforms like BlockFi and Celsius in 2022.

Despite past losses, Sedo believes that Bitcoiners’ attitudes are changing, particularly towards non-custodial DeFi applications. He also noted a shift in sentiment in recent years. Bitcoin Conference 2024where developers were excited about the growing potential of the Bitcoin DeFi ecosystem.

TVL of all Bitcoin sidechains (Source: DeFiLlama)

Sedo relies heavily on Core’s non-custodial staking system, which allows users to temporarily lock up their Bitcoin in exchange for a 3% yield paid in CORE tokens, which are used for gas and governance on the network. Core also recently surpassed Bitlayer to become the largest Bitcoin sidechain, with $314.4 million in TVL and over 5,500 BTC staked on its network. Core accounts for approximately 26.33% of the total TVL across all Bitcoin sidechains, according to DeFiLlama.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.