Indian public sector bank Bank of Baroda recently announced that it is adopting Generative AI (GenAI) technologies.

The bank has introduced three innovative GenAI-powered solutions – “Aditi”, a virtual relationship manager, “GyanSahay.AI”, a knowledge management platform, and “ADI”, a customer service chatbot – aimed at improving customer interactions and increasing employee efficiency.

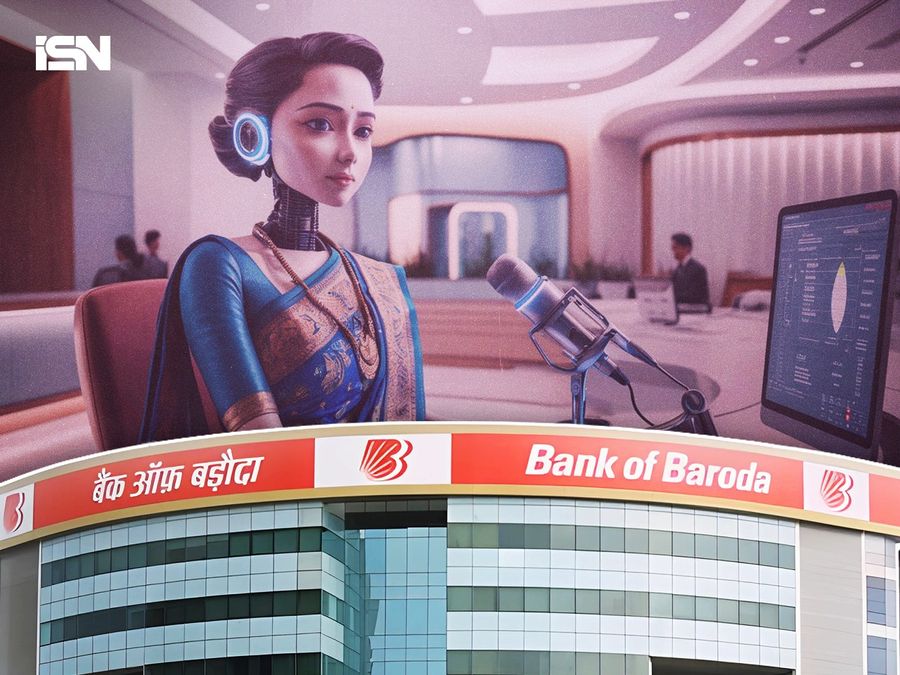

BoB introduces a new virtual relationship manager

‘Aditi’ is a GenAI-powered virtual relationship manager that offers customers human-like interaction through digital avatars.

The tool, which is available on Bank of Baroda’s web portal, provides 24×7 multilingual support in audio, video and chat formats.

Aimed at enhancing digital customer service, ‘Aditi’ helps users navigate a wide range of banking services and address queries without the need for human intervention.

The service is being rolled out gradually to existing customers through a registration process on the bank’s website.

Boosting Employee Efficiency with ‘GyanSahay.AI’

Along with enhancing customer experience, Bank of Baroda has launched ‘GyanSahay.AI’, a GenAI-enabled knowledge management platform designed specifically for its employees.

The platform is trained on the bank’s product policies and processes, allowing employees to respond quickly and accurately to customer queries.

By providing immediate access to essential operational information, ‘GyanSahay.AI’ helps employees work more efficiently, thereby improving overall service delivery.

Streamline customer queries with ‘ADI’

Bank of Baroda has also introduced a new GenAI-powered chatbot, ‘ADI’, which is designed to help customers resolve common queries quickly and efficiently.

It is similar to ‘Aditi’, which offers a seamless digital experience and provides instant solutions to banking queries.

Comments from the leaders

Debadatta Chand, Managing Director and CEO of Bank of Baroda, expressed optimism about the potential of GenAI technologies to reshape banking operations.

“At Bank of Baroda, we have been closely following the rapid advancement of GenAI and are convinced that it has the power to transform banking operations as we know it today,” he said.

He stressed that the bank plans to continue improving these platforms with new functionalities to promote customer self-service and improve the speed of fulfillment.

Sanjay Mudaliar, CEO of Bank of Baroda, also highlighted the bank’s investment in data-driven transformation.

He noted that GenAI will play a crucial role in giving customers greater control through “anytime, anywhere banking.”

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.