Bank of Baroda (BoB) has launched a special 400-day term deposit scheme offering 7.9 per cent interest rate to senior citizens during the festival season.

Key features of ‘bob Utsav deposit scheme’

Click here to connect with us on WhatsApp

– Interest rate of 7.30 percent per year (pa) for citizens in general.

– 7.80 percent annually for seniors.

– 7.90 percent annually for elderly people (80 years or older).

– Up to 7.95 percent annually on non-callable deposits.

The scheme is applicable for fixed deposits below Rs 3 crore and is available for a limited period.

Additional Festival Offers

Bank of Baroda has also introduced other improvements to its deposit products:

Increase in interest rates: The state bank has increased interest rates by 30 basis points (bp) in the three- to five-year brackets, from 6.50 percent per year to 6.80 percent per year.

Benefits of SDP scheme: Bob’s Systematic Deposit Plan (SDP) customers can now lock in higher interest rates for each monthly contribution made over a period of 3 to 5 years.

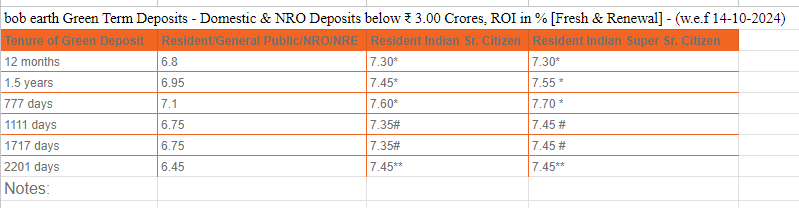

Verde Tierra Term Deposits: Interest rates on these environmentally focused deposits have increased by 30 basis points (bps) over selected tenors.

For seniors: The bank introduced a Super Senior Citizen category for customers aged 80 years and above, offering an additional interest of 10 basis points on top of the senior rate for term deposits from more than 1 year to up to 5 years.

“The bob Utsav deposit scheme is a great opportunity for depositors to get a higher interest rate at this point in the interest rate cycle. Additionally, with a substantial increase in rates in the three to five year category, we are serving two diverse groups of clients: those looking for competitive and assured returns in the medium term, as well as clients looking to increase their savings. through regular contributions every month through bob SDP and can guarantee a higher interest rate on every monthly deposit,” said Debadatta Chand, Managing Director and CEO, Bank of Baroda.

Customers can avail these new deposit schemes through any Bank of Baroda branch or through the bank’s digital channels, including the bob World app and the bank’s online banking platform.

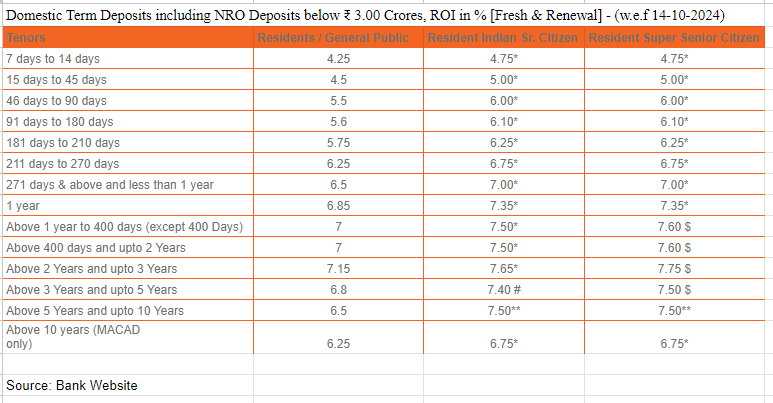

(* includes 0.50% additional ROI for RTD up to 3 years and 0.50% additional ROI for 10+ years, # includes 0.50+ additional ROI 0.10 (reduced from 0.15%) for RTD over 3 years and up to 5 years from 14.10 2024, **incl. additional ROI of 0.50%+0.50% for RTD over. 5 years and up to 10 years for resident seniors and $ includes 0.10% for seniors for deposits over 1 year and up to 5 years)

(* includes 0.50% additional ROI for RTD up to 3 years and 0.50% additional ROI for 10+ years, # includes 0.50+ additional ROI 0.10 (reduced from 0.15%) for RTD over 3 years and up to 5 years from 14.10 2024, **incl. additional ROI of 0.50%+0.50% for RTD over. 5 years and up to 10 years for resident seniors and $ includes 0.10% for seniors for deposits over 1 year and up to 5 years)

First published: October 15, 2024 | 13:12 IS

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.