In August 2024, following the Reserve Bank of India’s Monetary Policy Committee (MPC) meeting, some banks revised their fixed deposit (FD) interest rates to attract more customers. With the repo rate maintained at 6.5 per cent, banks are offering competitive rates, particularly for senior citizens.

This change represents a good opportunity for savers to maximise the profitability of their fixed-term deposits. Below is a summary of the latest interest rates on fixed-term deposits from various banks.

Small finance banks

Unity Small Finance Bank offers fixed deposit interest rates between 7.85 percent and 9 percent per annum, with terms ranging from 1 year to 5 years.

NorthEast Small Finance Bank offers fixed deposit interest rates between 6.25 percent and 9.00 percent per annum, with tenors ranging from 1 year to 5 years.

Suryoday Small Finance Bank offers fixed deposit interest rates between 6.85 percent and 8.65 percent per annum, with tenors ranging from 1 year to 5 years.

Utkarsh Small Finance Bank offers fixed deposit interest rates between 7.75 percent and 8.50 percent per annum, with tenors ranging from 1 year to 5 years.

Equitas Small Finance Bank offers fixed deposit interest rates between 7.25 percent and 8.50 percent per annum, with terms ranging from 1 year to 5 years.

AU Small Finance Bank offers fixed deposit interest rates between 7.25 percent and 8.00 percent per annum, with tenors ranging from 1 year to 5 years.

Below is a curated list of FD rates offered by small finance banks, as per Paisabazaar.com

Chart

YES Bank offers fixed deposit interest rates between 7.25 percent and 8.00 percent per annum, with terms of 18 months.

DCB Bank offers fixed deposit interest rates between 7.10 percent and 8.05 percent per annum, with terms ranging from 19 months to 20 months.

SBM Bank India offers fixed deposit interest rates between 7.05 percent and 8.25 percent per annum, with tenors of 3 years and 2 days.

IndusInd Bank offers fixed deposit interest rates between 7.25 percent and 7.75 percent per annum, with tenors varying from 1 year to 2 years.

Karur Vysya Bank offers fixed deposit interest rates of 7.00 percent and 7.60 percent per annum, with tenors of 760 days for special deposits.

Tamilnad Mercantile Bank offers fixed deposit interest rates between 6.50 percent and 7.50 percent per annum, with tenors of 400 days.

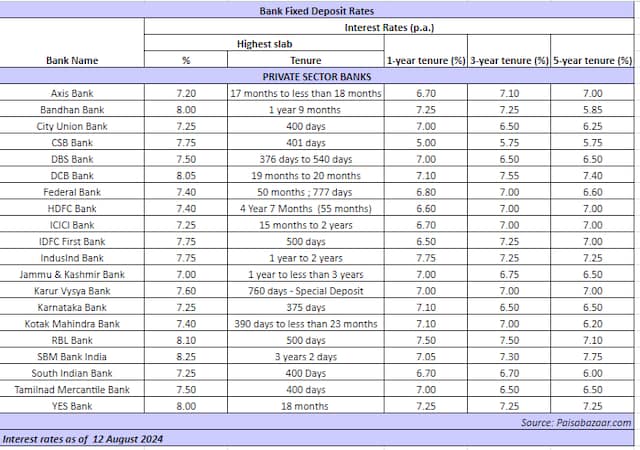

Below is a curated list of FD rates offered by private sector banks, as per Paisabazaar.com

Chart

Union Bank of India offers fixed deposit interest rates between 6.50 percent and 7.40 percent per annum, with tenors ranging from 1 year to 5 years.

State Bank of India offers fixed deposit interest rates between 6.50 percent and 7.25 percent per annum, with tenors ranging from 1 year to 5 years.

Punjab & Sind Bank offers fixed deposit interest rates between 6.00 percent and 7.30 percent per annum, with tenors ranging from 1 year to 5 years.

Punjab National Bank offers fixed deposit interest rates between 6.50 percent and 7.25 percent per annum, with tenors ranging from 1 year to 5 years.

Indian Overseas Bank offers fixed deposit interest rates between 6.50 percent and 7.30 percent per annum, with tenors ranging from 1 year to 5 years.

Bank of Baroda offers fixed deposit interest rates between 6.50 percent and 7.25 percent per annum, with tenors ranging from 1 year to 5 years.

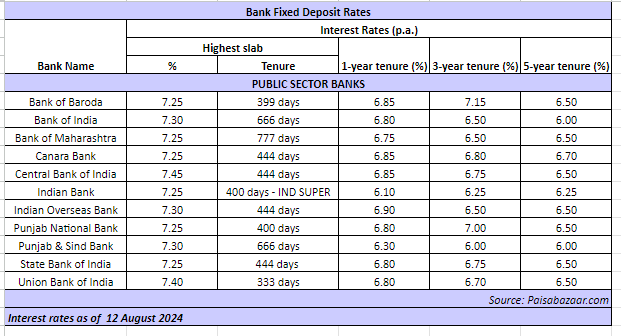

Below is a curated list of FD rates offered by Public Sector Bank, as per Paisabazaar.com

Chart

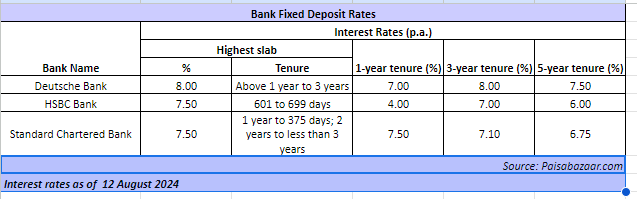

Deutsche Bank offers fixed deposit interest rates between 7.00 percent and 8.00 percent per annum, with terms ranging from more than 1 year to 3 years.

Standard Chartered Bank offers fixed deposit interest rates between 6.75 percent and 7.50 percent per annum, with terms ranging from 1 year to less than 3 years.

HSBC Bank offers fixed deposit interest rates between 4.00 percent and 7.50 percent per annum, with terms varying between 601 and 699 days.

Below is a curated list of FD rates offered by foreign banks, as per Paisabazaar.com

Chart

First published: August 12, 2024 | 17:42 IS

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.