The new era direct to consumer Branded Selling (D2C) organic products plans to use the new funds to increase production capacity, invest in research and development, strengthen Offline sales infrastructure and increase brand awareness, according to co-founder Aditya Ruia.

“I think that, given the potential and size of the market that the industry has today and the scale we are at today, there is still a long way to go. That is why the positioning of this round is very much in line with our way of thinking and with what the future holds for us,” said Ruia.

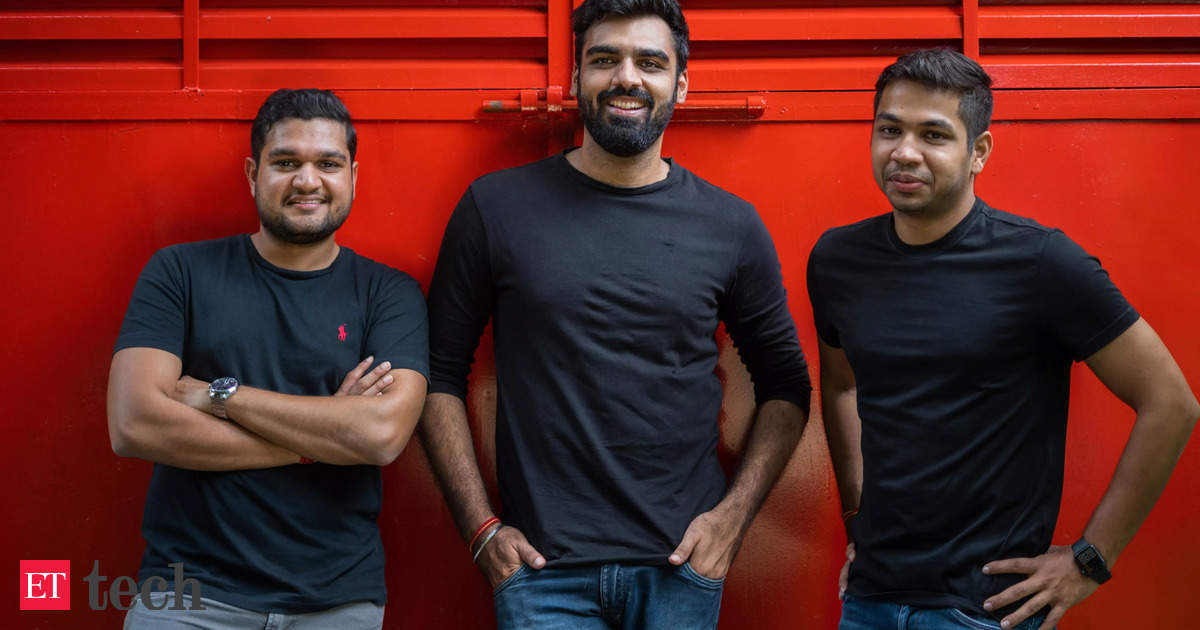

Founded in 2019 by Ruia, Akshay Varma and Anuj Ruia, Beco produces plant based and naturally derived personal care and household products, including laundry liquids, floor cleaners, dishwashing liquids and gels, tissues, toilet paper rolls, napkins, kitchen towels and compostable trash bags.

The Mumbai-based company is present in over 10,000 retail stores across 20+ cities in India and aims to scale this to 30,000-40,000 in the next 12 months, with over 50% of sales expected to be from offline channels. Beco also has a strong presence on e-commerce and fast-commerce platforms such as Amazon, Zepto, Blinkit, Swiggy Instamart and DMart Ready.

Beco aims to triple its revenue next year, Ruia said without disclosing current or past earnings.

Discover the stories that interest you

This funding comes at a time when there is a surge in consumer demand for new D2C brands, driven by the fast deliveries offered by fast commerce platforms such as Blinkit, Zepto and Instamart. This growth has led to increased interest from venture capital firms, fueling a wave of deals in the early- and mid-stage brands sector. On August 7, ET reported that children’s gift brand Tuco Intelligent was in talks to raise fresh funding with Fireside Ventures. Peak XV Partners is likely to invest in bakery The Health Factory, while Gourmet Garden, a brand specialising in fresh organic produce, is looking to raise around $10 million from a combination of investors. Tanglin Venture Partners has invested in Master Chow, a noodle brand.

Beco had raised $3 million in a 2022 Series A round led by Rukam Capital. The company currently has a post-money valuation of $11.1 million, according to Tracxn.

“In recent years, there has been a marked shift in consumer preferences towards healthier, toxin-free options. Beco’s focus on product innovation and the final supply chain has enabled it to offer superior products at prices comparable to traditional players,” said Sankalp Gupta, Partner at Tanglin Venture Partners.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.