Among the series of Cabinet decisions announced last week, the one to extend the Ayushman Bharat health insurance scheme to all citizens aged 70 and above, irrespective of their income, was the one that grabbed the most headlines.

The Pradhan Mantri Jan Arogya Yojana currently provides a ₹500,000 health coverage for the poorest 40% of India’s population. The Centre estimates that the expansion will benefit about 60 million senior citizens, at an estimated outlay of $100 billion. ₹3,437 crores.

The move comes at a time when India’s population is set to age faster than ever before. An estimated 4.3% of the country’s population is over 70 years old and that proportion is projected to rise to 9.7% by 2050, according to the United Nations.

Health problems occur more quickly among older people. Because they are more likely to have pre-existing conditions, insurance companies charge them high premiums and cover them with more exclusions. All of this makes the government’s move timely.

Read also: Why the GST Council can’t ignore the health insurance controversy

Since its inception in 2018, the Ayushman Bharat health insurance scheme has taken care of 68.6 million hospital admissions worth ₹90,204 crore, according to the Ministry of Health, with an almost equal split between men and women, and 30,510 hospitals covered, according to official data.

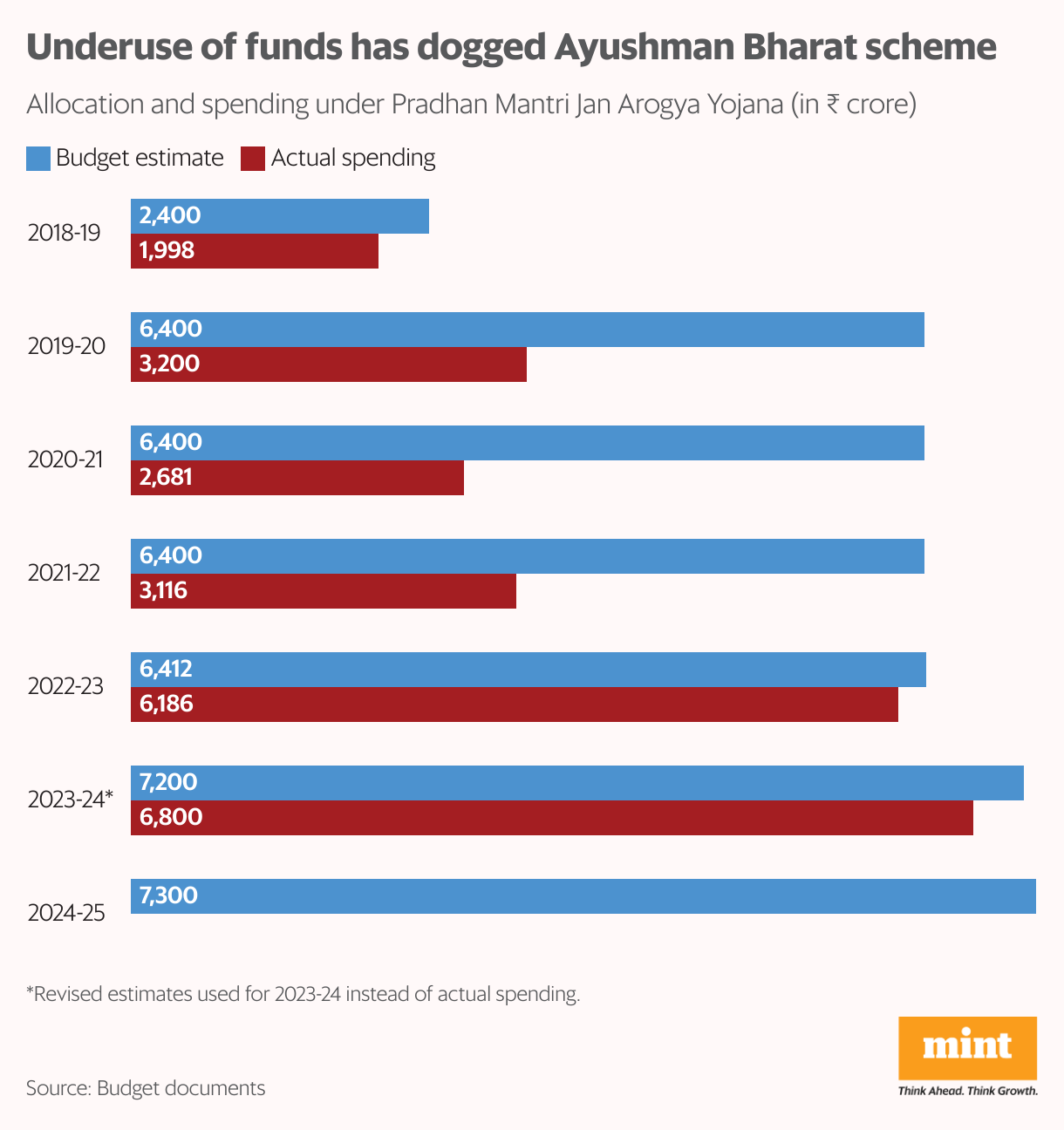

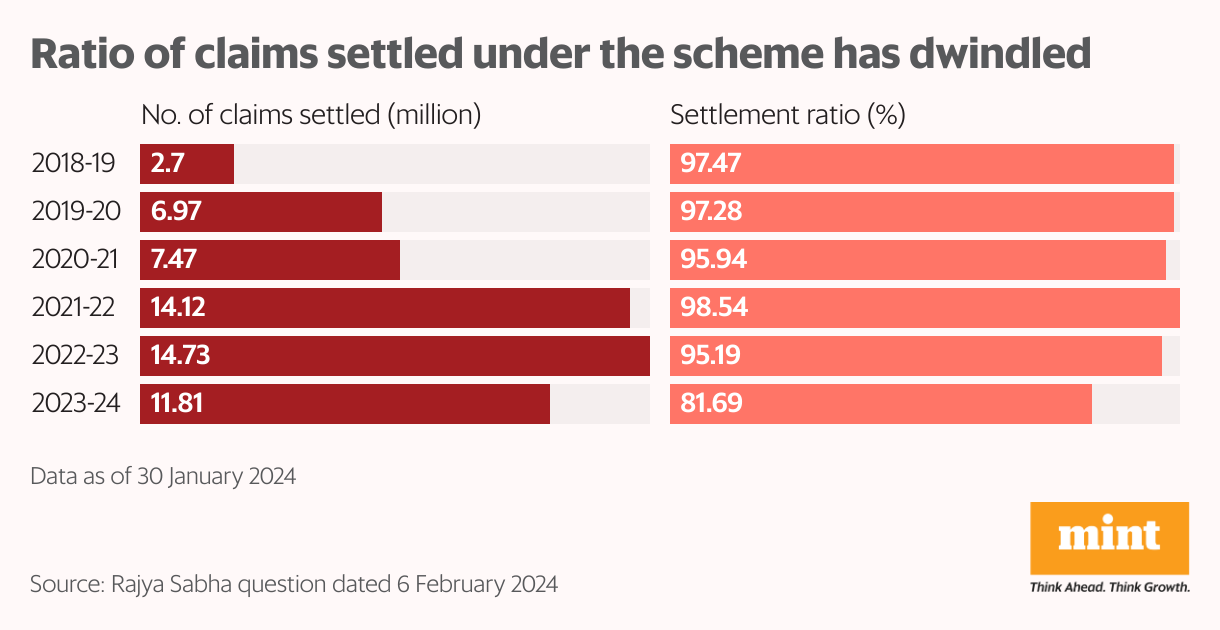

However, for all the successes credited to it, there are visible cracks. The scheme has suffered from consistent gross under-utilization of funds and the claim settlement rate has fallen from 97.5% after launch to 81.7% in 2023-24, government data shows. This raises questions about whether the scheme can effectively manage an additional volume of beneficiaries.

Puzzling Questions

The Ayushman Bharat scheme faced initial implementation problems, such as exclusion of eligible beneficiaries and delays in processing applications, as highlighted by the Comptroller and Auditor General and a parliamentary panel on health. In some cases, beneficiaries were forced to pay for treatment despite the scheme providing cashless services, the CAG observed.

Experts say the success of the plan depends on its timely implementation. payments to hospitals and competitive rates to attract private providers. Delayed payments have disincentivized private providers, leading them to reduce services to beneficiaries. Mint had previously reported.

One drawback of the Ayushman Bharat scheme is that it only provides free inpatient care; outpatient hospital services are not covered, although these are in much greater demand and need.

Medicines accounted for about 29% of out-of-pocket spending for inpatients and 60% for outpatients in India, according to a 2022 study led by Mayanka Ambade of the International Institute for Population Sciences.

The experience of countries with ageing populations worldwide also shows that the need for outpatient care (and, consequently, expenditure) is higher for vulnerable populations, such as the elderly and the chronically ill. As non-communicable diseases soar in India, outpatient visits could account for a significant share of elderly health expenditures, rather than hospitalisation.

Two to dance the tango

Insurance coverage is only one of the two components of the Ayushman Bharat scheme; the other is the revamping of existing primary health care centres to encourage disease prevention. The scheme can only succeed if both components complement each other well. Public health experts point out that insurance payouts will rise without a concurrent reduction in morbidity unless the primary health care aspect is strengthened.

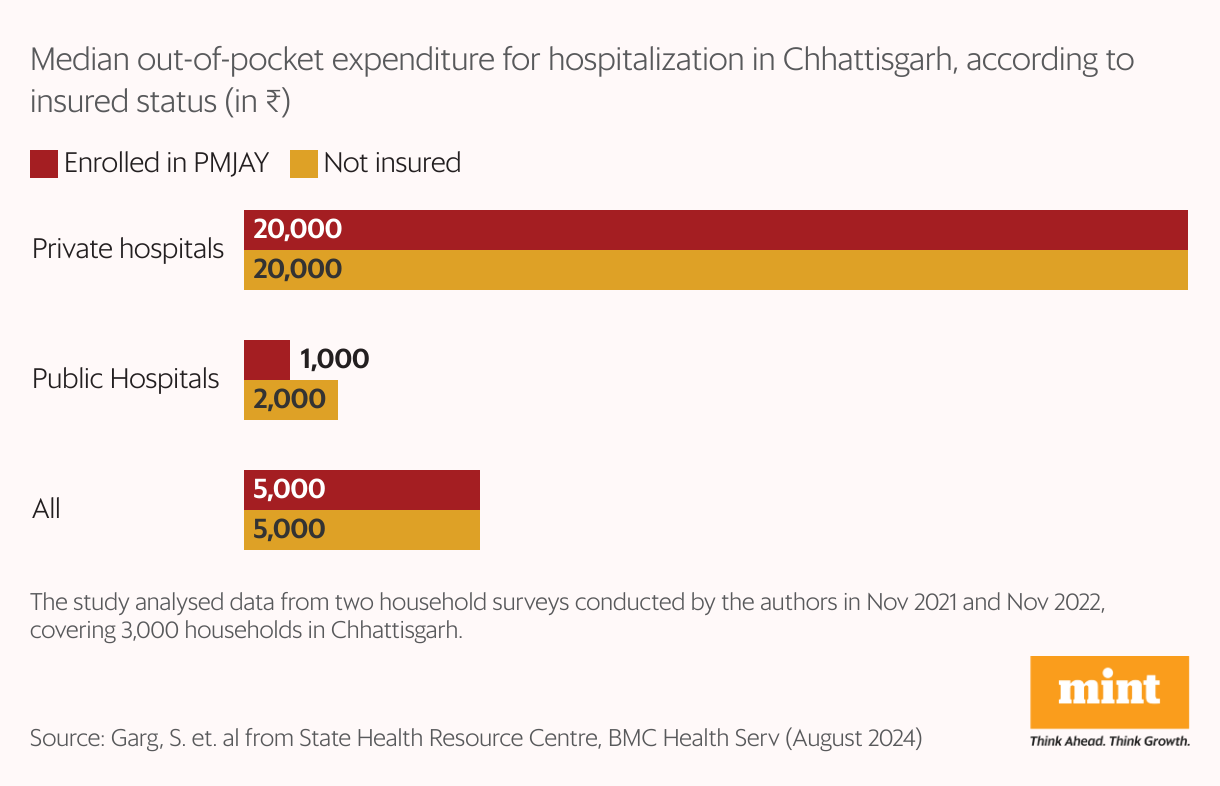

Studies have shown a mixed impact of Ayushman Bharat insurance coverage on out-of-pocket expenses.

A study conducted in Chhattisgarh by the State Health Resource Centre, a technical agency that provides support to the state government, showed “little difference in OOPE for patients enrolled in the scheme and the uninsured,” with private hospitals being more expensive.

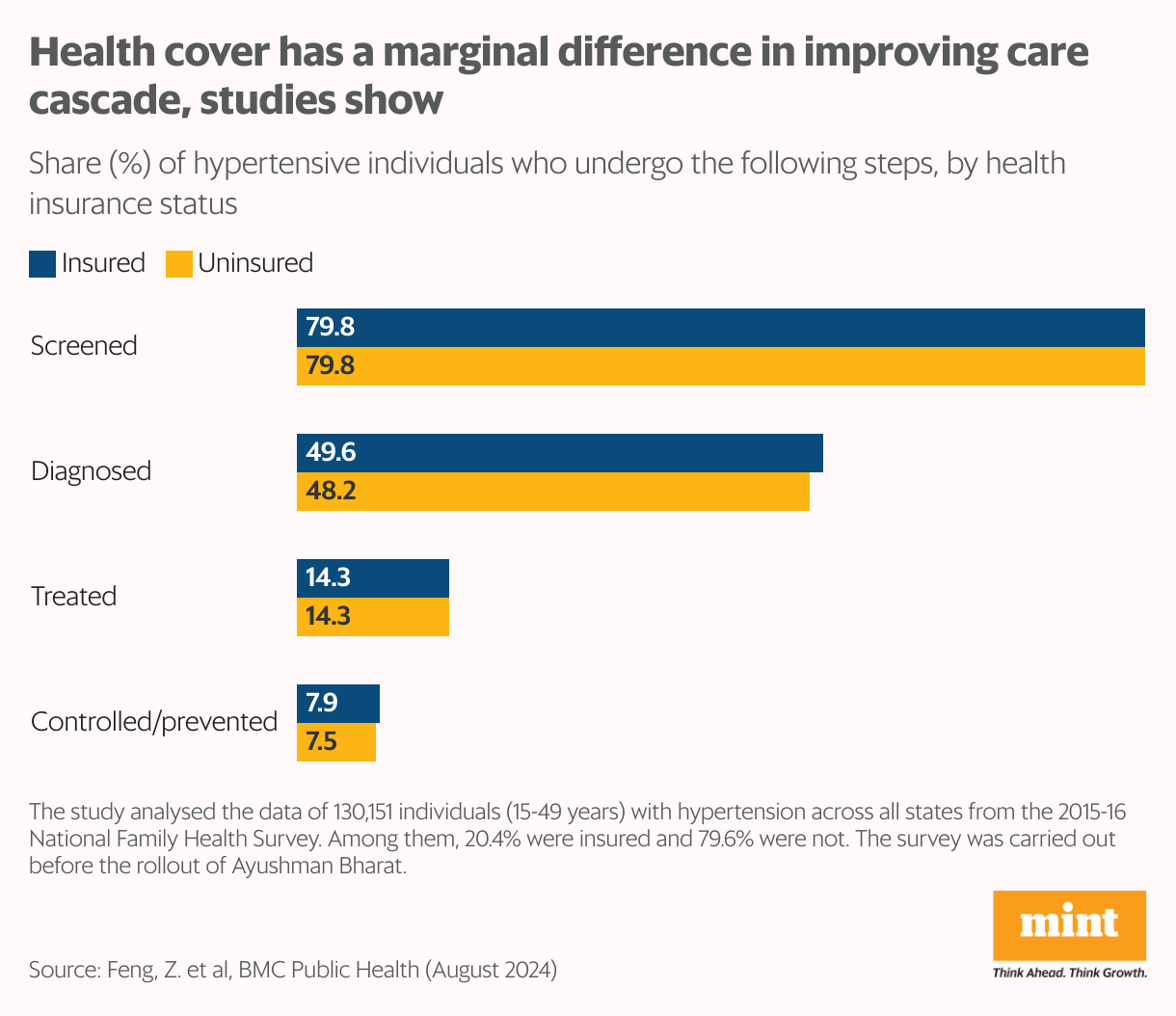

Another study based on data from the National Family Health Survey concluded that the impact of health insurance on health outcomes of hypertensive Indians is minimal, as health coverage alone cannot guarantee better care, a reality that any expansion of the scheme must recognise.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.