On Monday, US spot Bitcoin ETFs suffered a sharp drop in trading volume. Some analysts believe this is due to subdued market sentiment and the summer holidays. Despite these lower volumes, BlackRock and Fidelity are still seeing net inflows. Meanwhile, Bitwise has expanded into Europe with the acquisition of ETC Group, while Franklin Templeton plans to launch a new crypto index ETF.

Bitcoin Spot ETF Trading Volume Hits Seven-Month Low

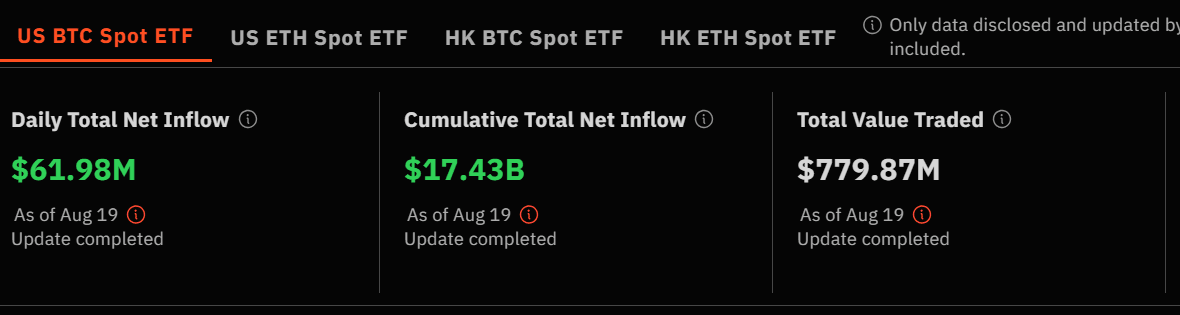

Bitcoin Spot in the US exchange-traded funds On Monday, exchange-traded funds (ETFs) saw net inflows of $61.98 million, but total daily trading volume was just $779.87 million, making it the lowest volume since Feb. 6 and the third-lowest overall.

Bitcoin Spot ETF Data (Source: SoSoValue)

This was also a big drop from the $5.24 billion traded on August 6. According to SOFA.org’s chief information officer, Augustine fanLower trading volume is in line with more moderate behavior market sentiment Fan believes the summer holiday period and easing recession concerns have led investors to adopt a wait-and-see attitude ahead of the Federal Reserve’s meeting in Jackson Hole later this week.

On Mondays, BlackRock IBIT The fund saw net inflows of $92.68 million, while Fidelity’s FBTC added $3.87 million. However, these gains were somewhat offset by net outflows of $25.72 million from Bitwise’s Bitcoin spot fund and $8.84 million from Invesco’s BTCO.

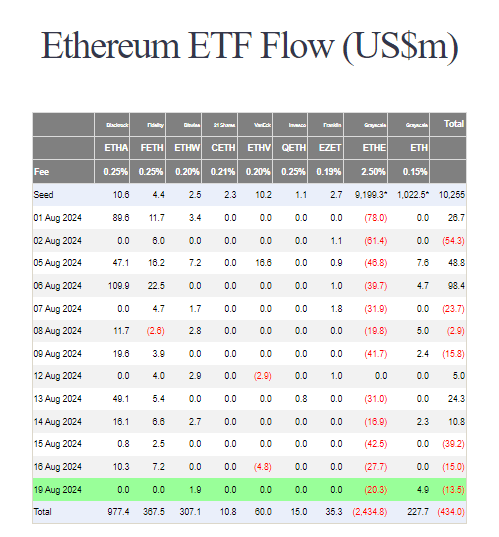

In the Ethereum ETF spot market, funds reported their lowest levels Daily trading volume Since their debut, they have recorded approximately $124 million. The nine Ether spot funds recorded $13.52 million in net outflows, led by a $20.30 million outflow from Grayscale ETHE. Meanwhile, Grayscale’s Ethereum mini trust recorded net inflows of $4.92 million, and Bitwise’s ETHW fund added $1.87 million.

Ethereum ETF Flow (Source: Farside Investors)

Fan explained that traditional finance is still a bit cautious about ETH ETF purchases due to uncertainty around the legalities of staking and recent issues with Solana ETFThis caution is certainly justified, given the fact that the U.S. Securities and Exchange Commission (SEC) recently discussed with potential ETF issuers potential concerns about Solana’s status as a security. This led to Cboe BZX Deleting Solana ETF 19b-4 Filings.

Despite these concerns, Bitcoin Price Still, it managed to rise more than 3% in the last 24 hours to $60,943.55. ETH Price It also rose by approximately 1.74% over the past day, resulting in the altcoin trading at $2,663.97.

Bitcoin ETFs Attracted Big Buyers in Q2

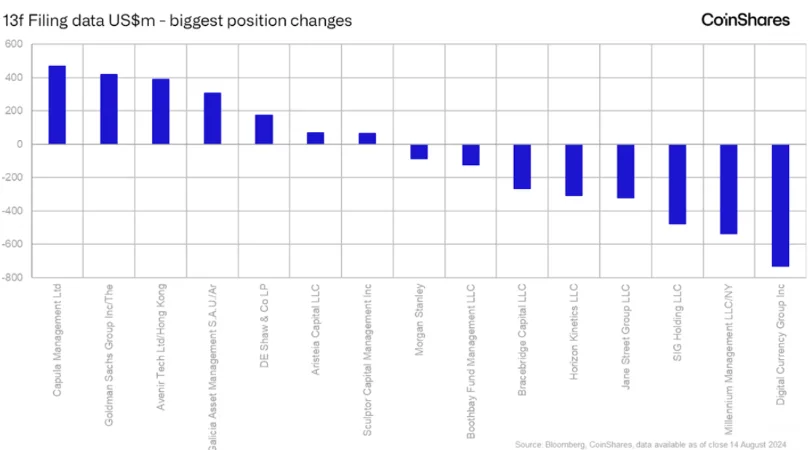

In the second quarter of 2024, asset managers Goldman Sachs, Capula Management and Avenir Tech were the largest buyers of Bitcoin ETFs, according to an analysis by CoinShares Research. The analysis is based on the large fund managers’ quarterly 13F disclosures, which revealed that the three firms collectively purchased nearly $1.3 billion worth of BTC ETF shares.

The biggest changes in Bitcoin ETF positions for the second quarter (Source: unknown)

Since their launch in January, Bitcoin ETFs have seen huge demand, driven in part by the adoption of these financial products by major institutions such as Morgan StanleyDave LaValle, Grayscale’s global head of ETFs, is very impressed by this demand, noting that Bitcoin ETFs have seen over $15 billion in inflows. That’s more than three times the largest annual inflow of any ETF in history.

According to CoinShares, Capula Management has purchased approximately $470 million worth of BTC shares since March. Goldman Sachs and Avenir Tech have purchased $419 million and $388 million, respectively. Additionally, fund managers Galacia Asset Management and DE Shaw have purchased shares worth $307 million and $174 million, respectively.

Almost half of Avenir’s properties now consist of Bitcoin funds. However, the largest outflows were recorded by native cryptocurrency hedge funds. Digital Currency Groupwhich has sold $732 million worth of shares since March.

Data from CoinShares indicated that hedge funds currently have the largest portfolio allocations to Bitcoin, averaging 2.2%. Private equity firms also have large allocations, averaging around 1.4%. Adoption among banks and pension funds remain minimal, with allocations of 0% and 0.1% respectively.

Bitcoin data by investor type (Source: unknown)

However, continued adoption by established wealth managers is expected to lead to increased allocations to cryptocurrency ETFs over time, even among more conservative institutions such as pension funds. Katalin TischhauserHead of investment research at cryptocurrency bank Sygnum, firmly believes that large investors, including sovereign wealth funds and pension funds, are preparing to invest in ETFs and that cryptocurrencies will eventually be integrated into model portfolios.

Bitwise acquires ETC Group

Other companies are also looking for ways to get their share of the ETF pie. Asset manager Bitwise has decided to expand into the European market by acquiring cryptocurrency investment firm ETC Group. Although the financial terms of the deal have not been made public, the acquisition was announced on August 19, bringing over $1 billion in assets under management (AUM) to Bitwise.

ETC Group is headquartered in London and operates a range of physical cryptocurrency exchange-traded products (ETP), including Bitcoin ETP (BTCE), Staking Ethereum (ET32), Solana (ESOL), XRP (GXRP), and the MSCI Digital Assets Select 20 (DA20). In total, the acquisition adds nine European-listed cryptocurrency ETPs to Bitwise’s portfolio and brings its total AUM to over $4.5 billion.

Since its launch in 2020, ETC Group has introduced several cryptocurrency ETPs on the German exchange Xetra, with regulatory approval from Germany’s Federal Financial Supervisory Authority, BaFin. The firm also offers a Blockchain Stock ETF Providing exposure to blockchain-based companies in Europe.

In the United States, Bitwise is among the asset managers behind the recently approved Bitcoin spot ETFs. In January, Approved by the SEC 11 asset management apps, including Bitwise’s Bitcoin ETF (BITB), which holds around $2.27 billion in net assets. Additionally, Bitwise received approval in July to launch an Ether spot ETP, the Bitwise Ethereum ETF (ETHW), which has accumulated over $300 million in assets in its first few weeks.

Franklin Templeton eyes launching crypto index-based ETF

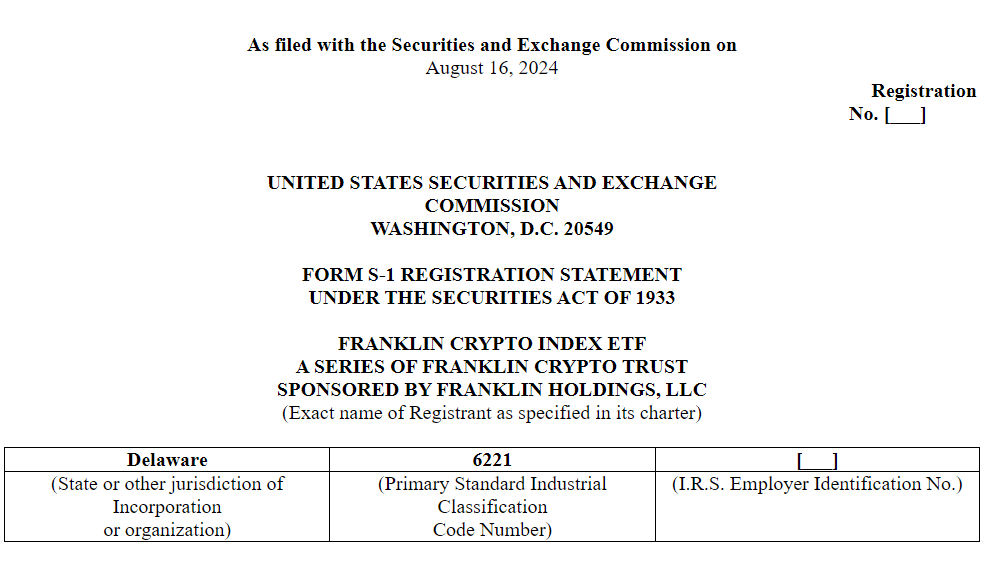

Meanwhile, Franklin Templeton is planning to launch a new ETF that is designed to offer a comprehensive cryptocurrency portfolio. The Franklin Crypto Index ETF will track the performance of the CF Institutional Digital Asset Index, which currently includes only Bitcoin and EthereumThe fund will invest in digital assets in proportions that reflect the underlying index and may incorporate additional cryptocurrencies in the future.

Screenshot of the SEC fine imposed on Franklin Templeton (Source: SECOND)

The Franklin Crypto Index ETF will compete with the Hashdex Nasdaq Crypto Index ETF, which was the first of its kind to seek regulatory approvalAccording to Katalin Tischhauser, index ETFs are the next logical step, similar to how investors use ETFs to buy the S&P 500, but she noted that current crypto index ETFs are limited to Bitcoin and Ethereum.

Grayscalethe largest issuer of crypto funds with $25 billion in assets under management, has also expressed interest in Entering the Crypto Index ETF SpaceDave LaValle hinted at future developments in index-based and single-asset products.

Before the Franklin Crypto Index ETF can be traded on exchanges, the SEC has to approve its registration application, known as an S-1, and allow at least one public stock exchange, such as Nasdaqto list the product.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.