Bitcoin (BTC) is currently trading below $60,000 after going through a volatile period and a notable 11% correction from last Sunday’s peak of $65,103. This sharp drop reflects the heightened uncertainty and fear that permeates the market.

Recent key data from Glassnode reveals a worrying slowdown in net capital inflows for BTC, indicating a potential shift in investor sentiment. The decline in inflows underscores the current market fragility and growing caution among traders. Coupled with recent price swings and market turbulence, this data suggests that Bitcoin’s journey through this volatile phase is far from over.

As BTC continues to navigate these… challenging conditionsThe risk of further fluctuations remains significant, forcing investors to prepare for further potential disruptions in the near term.

Bitcoin market equilibrium has been reached

Crucial Glassnode data indicates a slowdown in net capital inflows into Bitcoin, suggesting that a degree of equilibrium has been reached between investors making profits and those facing losses.

Historically, capital inflows into the Bitcoin market are rarely as moderate as they are now; 89% of days typically see higher inflows than seen today, except during periods dominated by significant losses in bear markets. This current phase of inactivity is notable as it often precedes substantial increases in market volatility.

Realized capitalization, a key metric for understanding Bitcoin’s market value, remains at an all-time high (ATH) of $619 billion, driven by a substantial net inflow of $217 billion since Bitcoin’s low of $15,000 in December 2022.

Despite the prevailing negative sentiment and recent market turbulence, these indicators reveal that there is still potential for growth. The impressive realized capitalization and strong net inflows suggest that while the market is going through a lull, this may set the stage for an upcoming uptrend.

As Bitcoin continues to navigate through this period of reduced inflows and investor doubt, the foundation appears to be forming for a potential resurgence and increased volatility, offering hope for a positive change in the market’s trajectory as the year progresses.

BTC trading at a crucial level

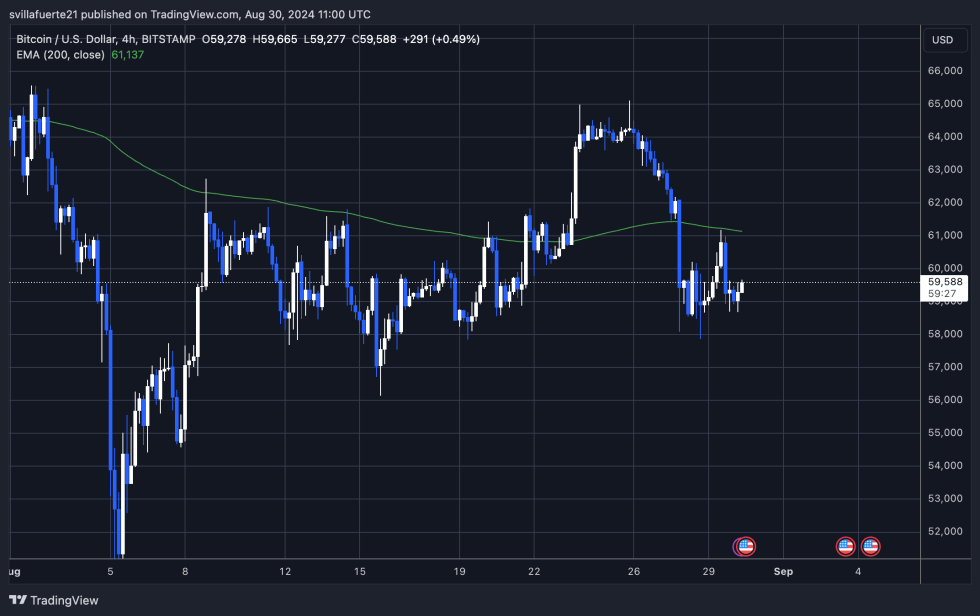

Bitcoin (BTC) is trading at $59,541 at the time of writing, following three days of intense price volatility. On the 4-hour chart, BTC has faced a clear rejection from the 4-hour 200-day exponential moving average (EMA), a crucial resistance level that has consistently hampered price advances over the past few weeks. Decline was observed on TuesdayThe price of Bitcoin has been oscillating between $57,866 and $61,182, creating a range that could generate liquidity for a significant move.

If BTC successfully breaks above the 200 hourly EMA, it could pave the way for a rally towards $65,000. Such a breakout would signal a bullish reversal, which could lead to substantial bullish momentum.

However, if Bitcoin fails to break above this resistance, it could test the next support level at $56,138. This level could become critical in determining whether the current range-bound phase will continue or if a deeper correction is imminent.

Monitoring BTC’s ability to navigate these key technical levels will be essential to forecasting its short-term price direction and future movement potential.

Cover image by Dall-E, charts by Tradingview

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.