Bitcoin nearly hit $69,000 yesterday, setting a new local high and further solidifying the current bullish trend that began in September. This price development has fueled optimism among analysts and investors, who now anticipate significant gains in the coming weeks.

Investors believe Bitcoin is poised for a strong rally after seven months of sideways accumulation.

Critical data from Santiment reveals that the number of Bitcoin whales (large holders of BTC) grew substantially just as the price bottomed around $59,000 on October 10.

Related reading

This increase in whale activity is often seen as a sign that the “smart money” is positioning itself for a major move. Large investors accumulating BTC for a low suggests they are gearing up for something big in the coming weeks.

As excitement builds, market participants are closely watching other signs that Bitcoin could be headed for new all-time highs. With momentum on your side, Bitcoin looks ready to take the market to the next phase of this cycle.

Bitcoin Whale Activity Supports Bullish Outlook

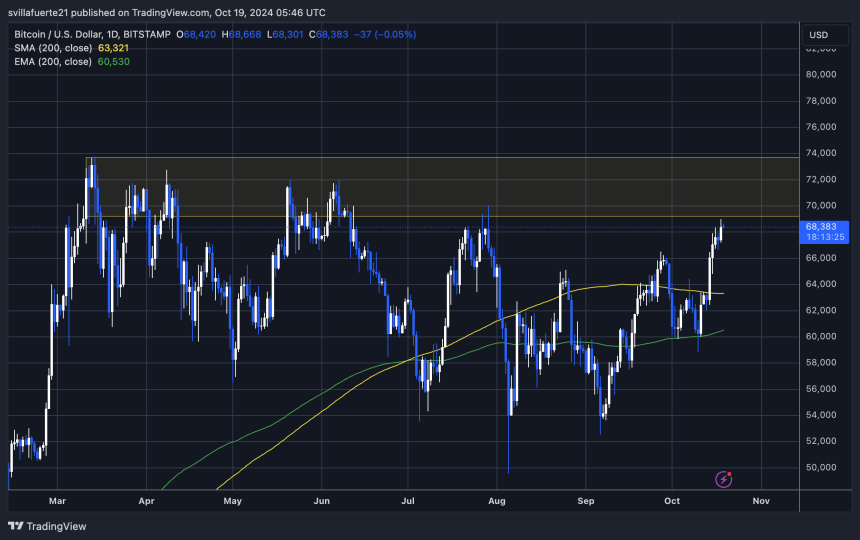

Bitcoin is trading near the historically reactive $70,000 price level. A critical zone that has consistently acted as resistance, pushing the price down five times in the last seven months. Every time Bitcoin approached this level, it caused sell-offs or corrections, causing caution among traders and investors.

However, recent Santiment data reveals that this resistance may be weakening due to increasing whale activity. Between October 10 and 13, a net increase of +268 wallets holding between 100 and 1000 BTC, indicating that big players are accumulating Bitcoin as the price rises.

Analysts typically view a rise in whale portfolios as a strong bullish indicator, suggesting influential investors are positioning themselves for potential gains in the coming months.

The timing of this accumulation is crucial as it coincides with Bitcoin’s upward momentum, indicating that these big players are expecting further gains. As more large holders continue to enter the market, the window to purchase Bitcoin at a favorable price narrows.

Related reading

This accumulation suggests that whales are betting on a sustained bull run, which could weaken the $70,000 resistance level and allow Bitcoin to rise further.

With Bitcoin trading near this critical price zone, the next few weeks could be decisive, either breaking above $70,000 or facing another correction.

BTC Testing Supply Levels

Bitcoin is trading at $68,383 after several days of steady highs, steadily moving towards new supply levels. The price recently stopped at $68,998 and now looks poised for a challenge to new all-time highs.

This rise has created a wave of optimism, but analysts warn that a healthy pullback may be on the horizon.

The 200-day moving average (MA), currently situated at $63,322, is a key level to watch. If Bitcoin returns to this support zone, it could indicate strength for fresh bullish momentum, as this level has historically acted as strong support during uptrends. Staying above the 200-day moving average is crucial to maintaining bullish momentum.

Related reading

If Bitcoin fails to overcome the $70,000 resistance in the next week, a pullback towards lower demand is expected. This setback would allow the market to regain liquidity and prepare for a possible new rally.

Investors are closely watching how price action in the coming days will determine Bitcoin’s long-term prospects.

Featured image of Dall-E, TradingView chart

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.