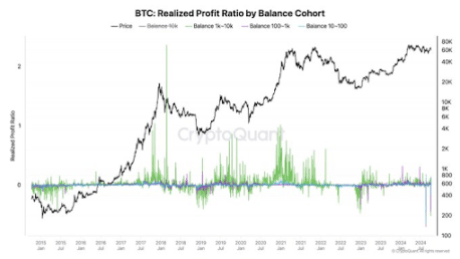

Ki-young-juthe founder of the on-chain analysis platform CryptoQuant, revealed that bitcoin whales are currently out of line in terms of profit making. These whales probably believe the bull is far from over, which is why they haven’t made as much profit as they did in previous bull runs.

Bitcoin whales have made lower profits in this market cycle than in previous years

Ki Young Ju mentioned in an Cryptographic analyst Ali Martínez He attempted to counter Ki Young Ju’s point by highlighting how these whales have been distributing their BTC in different addresses, which has caused a drop in the number of addresses containing between 1,000 and 10,000 BTC.

Related reading

However, the founder of CryptoQuant He claimed that this is still the lowest rate of return in all cycles, no matter how much these whales sold through those different wallets. He also revealed that the whales that are selling now are doing so at little profit, suggesting that they are likely new whales with weak hands.

Meanwhile, Ki-young-ju He noted that the type of transactions Martínez alluded to cannot always be considered sales. He commented that more macro-level aggregate data, such as historical realized profits, should be looked at rather than just transactions to get a broader view.

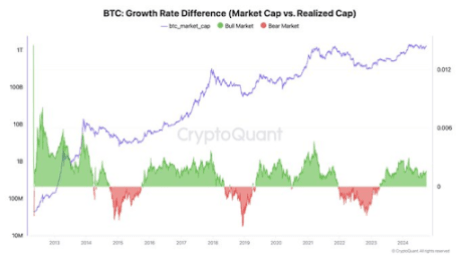

It is believed that these whales are still holding back from taking profits, considering that the bull run appears to be far from over. The CryptoQuant CEO also previously mentioned that Bitcoin was still in the middle of a bull run based on the market cap to realized cap metric.

Instead of making profits, these Bitcoin whales are still accumulating more BTC before the next leg of the bull run. CryptoQuantum recently revealed that there has been an increase in outflows from the stock exchanges, the largest since November 2022. Meanwhile, Ki Young Ju also noted that new whales are accumulating at a rate the market has never witnessed before.

When is this market cycle expected to peak?

Crypto analysts like Rekt Capital have predicted that the Bitcoin Market Top could occur sometime in mid-September or mid-October 2025. However, in a recent reportCoinMarketCap offered a different view, predicting that the top of the cycle could be reached between mid-May and mid-June 2025.

Related reading

The platform noted that bitcoin It is currently ahead of historical trends, especially considering that it reached a new all-time high (ATH) before the halving event. CoinMarketCap noted that this market cycle is accelerating by approximately 100 days, indicating that the next peak could come sooner than expected.

Featured image created with Dall.E, chart from Tradingview.com

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.