Recent debates in the cryptocurrency space have cast doubt on Bitcoin’s dominance and its future trajectory. Analyst Benjamin Cowen is skeptical about Bitcoin’s dominance returning to its previous highs, while other analysts believe that Bitcoin’s dominance has already peaked. Despite concerns about a possible sharp drop in BTC price, experts like Samson Mow remain confident in Bitcoin’s resilience during market downturns. Furthermore, a report from VanEck suggests that Bitcoin miners could increase their revenue if they were to allocate some of their energy capacity to supporting the artificial intelligence and high-performance computing sectors.

Analysts cast doubt on Bitcoin’s dominance

Cryptocurrency analyst Benjamin Cowen recently shared his skepticism about Bitcoin (BTC) Dominance is back to levels it reached in December 2020, when the price of BTC increased by almost 220% in three months. Cowen explained in an article interview According to David Lin’s report, he does not expect Bitcoin dominance to return to 70%. Instead, he set a target of 60%.

Interview with Benjamin Cowen (Source: YouTube)

According to Cowen, while Bitcoin’s dominance tends to decline during altcoin seasons, such as the one in 2021, it usually slowly recovers after a market crash. However, in the current cycle, Cowen believes that Bitcoin is unlikely to reach its previous dominance highs due to the growing presence of Ethereum and other cryptocurrencies.

Cowen also predicted that Bitcoin could reach the 60% dominance level as early as September or as late as December. At the time of publication, Bitcoin dominance stands at 55.74%, after a 0.51% drop over the past 24 hours, according to data from CoinMarketCap.

Despite this, another well-known cryptocurrency trader, Kaleo, suggested that Bitcoin dominance may have already peaked. Kaleo is confident that the current cycle peak for Bitcoin dominance was reached around 57.50%, below the 60% predicted by Cowen. Kaleo also noted that the start of a true altcoin season could only occur when Bitcoin dominance falls below 50%, a signal that traders often look to as an indication to transfer capital from Bitcoin to altcoins.

Cowen also stated that the outlook for Bitcoin dominance is much more complex in 2024 compared to previous cycles, especially since stablecoin Market cap was much lower in 2019, when Bitcoin dominance peaked at just over 71%. To better measure the market’s “flight to safety,” Cowen recommended combining Bitcoin dominance with the dominance of the stablecoin Tether (USDT).

Bitcoin may fall but recover

Fear and greed often dictate market movements in the crypto space. This leads to the creation of many theories about The future of BitcoinOne such theory suggests that Bitcoin could experience a sharp drop in the near term due to a potential “black swan” event.

As a highly liquid asset, Bitcoin can sell off quickly as investors liquidate positions to cover losses on other leveraged bets. This scenario will be challenging for bulls and long leveraged position holders, but could ultimately result in a major V-shaped rally, propelling Bitcoin to new all-time highs.

Samson Mow, a well-known Bitcoin proponent, recently offered a positive viewpoint, specifically pointing out Bitcoin’s resilience during severe market crashes. Mow stated that historical trends show that large amounts of capital are ready to be deployed when the Bitcoin price falls below $50,000. He noted that during the last major market crash, Bitcoin quickly recovered as soon as the US markets reopened, suggesting that Bitcoin is unlikely to fall below $50,000 in another market crash.

Mow’s outlook is based on market performance over the past few years. Cryptocurrency market crash In early August, the price of Bitcoin fell by more than 15% in a single day, hitting $49,000. This was a price level not seen since the beginning of the year. The drop was due to recession fears that caused many investors to liquidate their cryptocurrency positions. Despite these concerns, Mow remains very confident in Bitcoin’s ability to quickly recover in similar situations.

Michael Saylor’s cryptic post sparks more BTC speculation

Michael SaylorCo-founder and President of Microstrategyhas also caught the attention of the crypto community after a very simple yet impactful tweet: “Behold Bitcoin.” Although the post is very short, the timing of the post caught the attention of many people, considering it was posted during a period of Bitcoin consolidation.

Bitcoin has been consolidating below $62,000 since August 8, after reaching a high of $62,755. This pause in price movement has sparked much speculation about Bitcoin’s short-term trajectory. At the time of writing, Bitcoin is trading at $58,745.01 after its price fell by 1.03% over the last day.

Saylor’s tweet appears to encourage the market to look beyond the current consolidation phase and consider the broader implications of Bitcoin adoption and its long-term potential.

Meanwhile, cryptocurrency analyst Ali Martinez recently pointed out Bitcoin’s recent drop below the 200-day simple moving average (SMA) and described it as a double-edged sword. While a drop below the 200-day SMA in an uptrend can signal a buying opportunity, staying below it for too long could suggest the start of a bear market.

Despite the current uncertainty, on-chain analytics firm Glassnode has seen a shift in behavior among Bitcoin holders. After months of distribution pressures, there is a very noticeable change back to HODLing and accumulation. However, Glassnode also noted that recent activity in spot markets shows a net bias towards sell-side pressure, which has yet to fully subside. Overall, this is just another indication that BTC’s next move is still unclear and The market is stagnant in a state of indecision.

VanEck sees big profits for Bitcoin miners

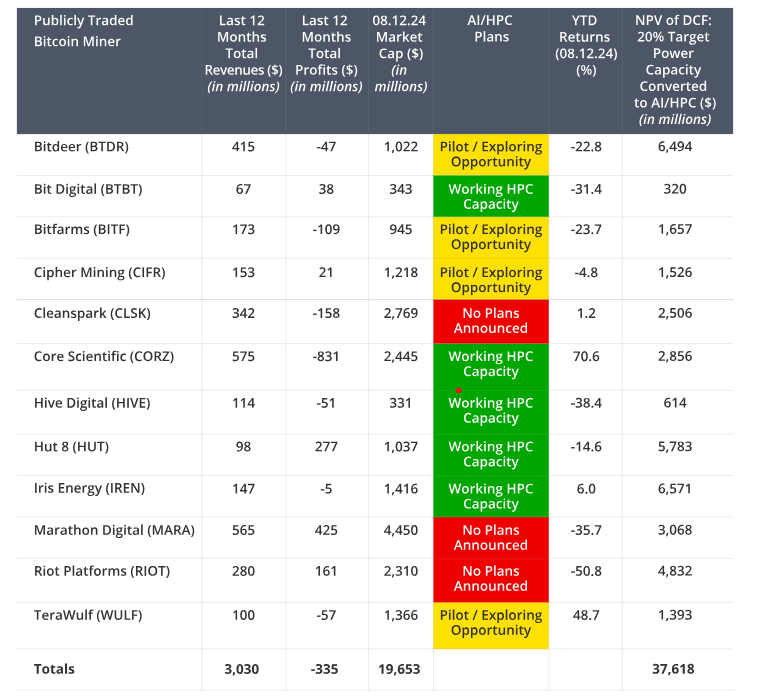

There is better news for Bitcoin Miners At the very least, Bitcoin miners could potentially generate an additional $13.9 billion in annual revenue by 2027 if they partially transition to powering the artificial intelligence (AI) and high-performance computing (HPC) sectors, according to a study. report by investment firm VanEck.

The report shed some light on the synergy between AI companies, which require a lot of energy, and Bitcoin miners, which have the capacity to supply it. VanEck noted that many Bitcoin Mining Companies They face serious financial challenges, including excessive debt, stock issuance, and executive compensation. By shifting 20% of their energy capacity to AI and HPC, these miners could reap impressive financial gains, with total additional annual profits potentially exceeding $13.9 billion on average over 13 years.

This much more positive outlook is in stark contrast to recent criticism from Kerrisdale Capital, which called the Bitcoin mining industry a “snake oil salesman industry.” Kerrisdale’s chief investment officer Sahm Adrangi believes that Bitcoin mining companies often dilute their shares without generating returns.

The VanEck report also noted that AI companies are generally willing to provide the financial resources needed for capital expenditure, which could benefit Bitcoin miners entering into these contracts.

Bitcoin miners are already exploring AI/HPC plans (Source: Van Eck)

Core Scientific, the fourth-largest Bitcoin miner by hash rate, recently secured a 12-year contract with AI hyperscaler CoreWeave, and is now expected to generate over $3.5 billion in revenue by supplying 200 megawatts of infrastructure. Similarly, Canadian miner Hive Digital Technologies has expanded its facilities to offer HPC services to a number of industries, including gaming and AI.

VanEck’s report came at the perfect time for Bitcoin miners after April 4. Bitcoin price halvingwhich reduced mining rewards from 6.25 BTC to 3.125 BTC per block. This further reduced profit margins for miners, which was made very clear in Digital Marathon second-quarter revenue of $145.1 million, below analysts’ expectations.

Furthermore, the cost of mining with Antminer S19 XP is expected to double from $40,000 to $80,000 after the halving, which will add even more pressure to the industry.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.