Bitcoin ETFs saw large outflows on August 29, with BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund among the hardest hit. US-based spot Ether ETFs also faced minor outflows on the same day. Despite this, analysts see potential for the Bitcoin price to rise, supported by declining Bitcoin reserves on exchanges. Meanwhile, El Salvador’s President Nayib Bukele acknowledged that Bitcoin adoption in the country has been much slower than expected, and Dell Technologies’ recent earnings report showed no Bitcoin holdings, despite previous hints from CEO Michael Dell on social media.

Bitcoin ETFs suffer heavy capital outflows

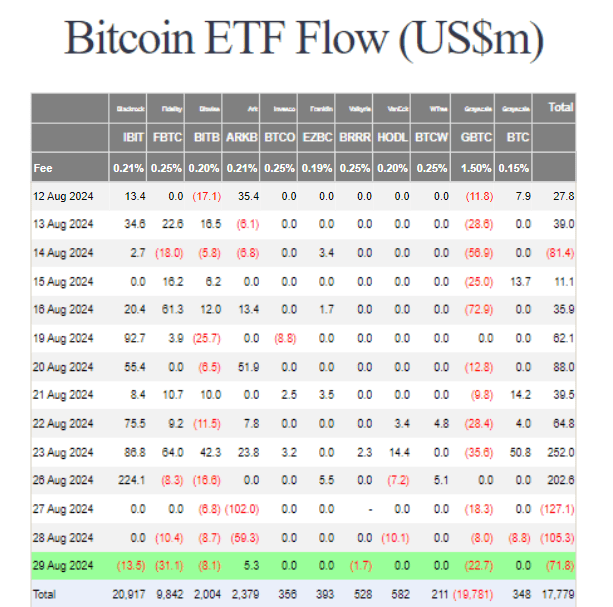

On August 29th, BlackRock iShares Bitcoin Trust (IBIT) recorded its second day of $13.5 million in outflows. Last time, IBIT suffered $36.9 million in outflows on May 1. This latest outflow contributed to a total of $71.8 million in combined net outflows across 11 U.S.-based spot exchanges. Bitcoin ETF on August 29, according to data from Farside Investors.

Bitcoin ETF Flow (Source: Farside Investors)

Among Bitcoin ETFs, Fidelity’s Wise Origin Bitcoin Fund (FBTC) saw the largest outflows at $31.1 million, followed by Grayscale Bitcoin Trust (GBTC) with $22.7 million. The ARK 21Shares Bitcoin ETF (ARKB) was the only fund to see a net inflow of $5.3 million. These outflows come during a broader decline in the Bitcoin Pricewhich fell by around 3% over the past week.

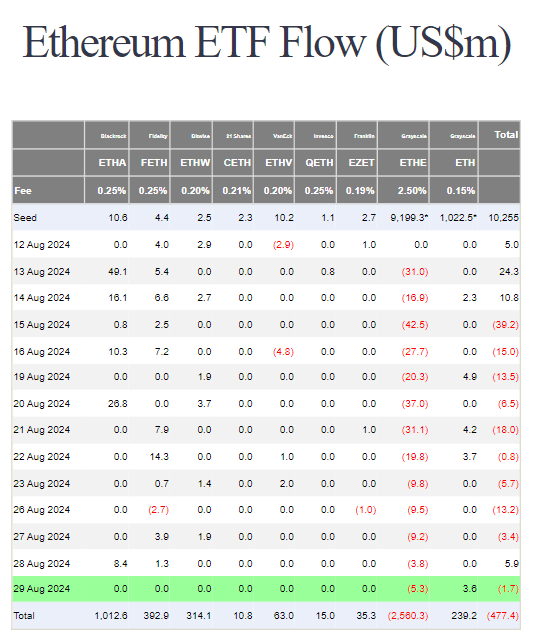

Meanwhile, the US-based spot Ether ETF Small outflows were also recorded on August 29, totaling $1.7 million. The Grayscale Ethereum Mini Trust (ETH) was the only fund to see a net inflow of $3.6 million, but it was not enough to offset the $5.3 million outflows from its higher-fee counterpart, the Grayscale Ethereum Trust (ETHE).

ETHE has been struggling with outflows almost every day since its launch in July, and has accumulated a total of $2.56 billion in outflows. The price of Ethnicity It has also been affected and is down more than 5% in its weekly time frame.

Ethereum ETF Flow (Source: Farside Investors)

Bitcoin reserves on exchanges hit new lows

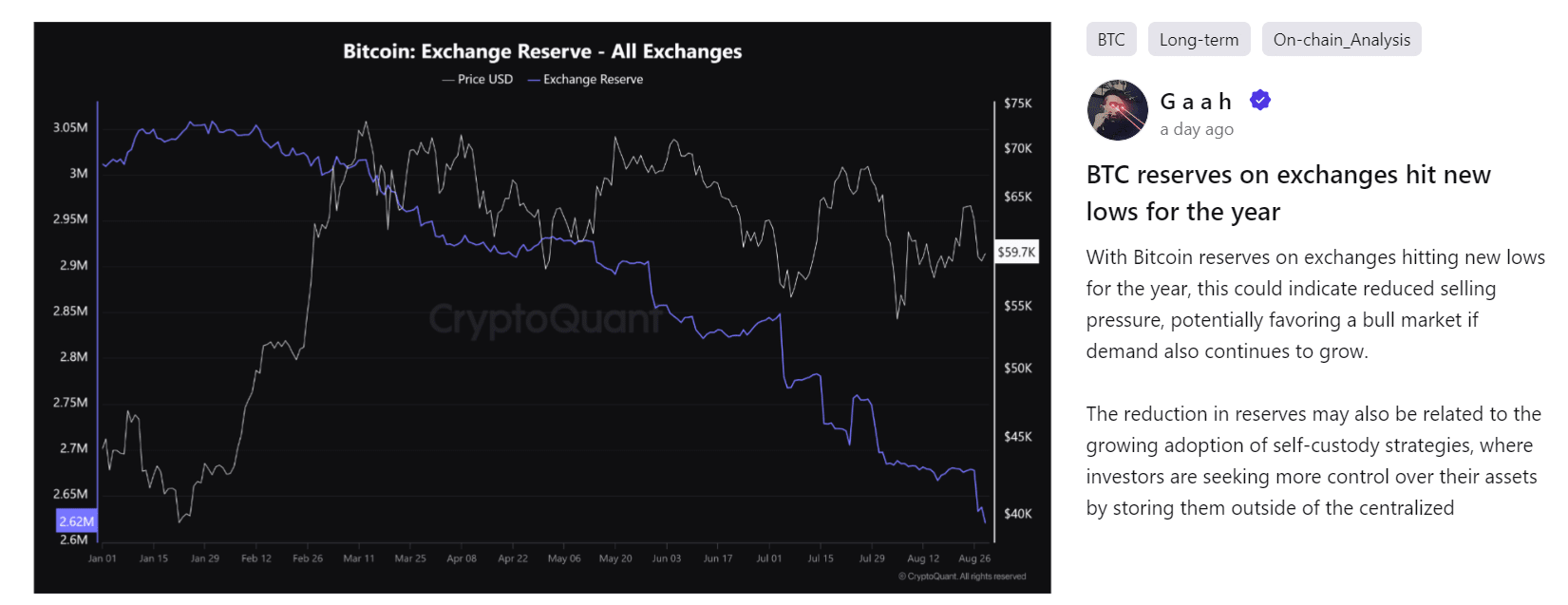

Even though Bitcoin ETFs face capital outflow challenges, there are some positive signs about the possible next BTC price move. The amount of Bitcoin held in cryptocurrencies exchanges has hit a new low, which may serve as a catalyst for Bitcoin to successfully retest and break above the $60,000 mark.

CryptoQuant Analyst gaah He pointed out that Bitcoin Exchange reserves are hitting new lows for the year, which could indicate less selling pressure and could favor a bull market if demand continues to grow. According to data from CryptoQuant, Bitcoin reserves on exchanges have decreased by almost 12.9% since January 1. This means that there are 2.62 million Bitcoin on all major exchanges.

Gaah Analysis (Source: Cryptoquantity)

Gaah believes that Bitcoin’s move to cold wallets generally indicates that investors are committed to holding the asset for the long term and are optimistic about its price potential.

The decline in Bitcoin supply on exchanges comes as several analysts are… predicting that Bitcoin Price could recover in the fourth quarter of 2024, according to historical data. Gaah also shared that the increase in the long term Bitcoin Holders It will likely lead to a more resilient market that is less prone to large panic selling. When there is less Bitcoin available on exchanges, there is less liquidity available for immediate sale, which could potentially support price stability.

Cryptocurrency trader MartyParty also recently commented on Bitcoin’s ultra-low reserves and believes something big may be happening. Bitcoin for freedomAnother cryptocurrency commentator warned that a supply shock could be around the corner, as nearly 56,000 Bitcoin have been withdrawn from exchanges in the past week.

Long-Term Bitcoin Holders They have spent over $10 billion to acquire BTC and have refrained from selling as its price has declined from its peak of $69,000.

Bitcoin adoption in El Salvador is slower than expected

While analysts expect the price of BTC to rise soon, the Salvadoran president Nayib Bukele He recently acknowledged that the adoption of bitcoin as legal tender in the country has not progressed as much as he had hoped. Time Magazine Interview which was published on August 29, Bukele described Bitcoin Adoption in El Salvador as “clearly positive,” but admitted that it has not yet brought the widespread benefits he expected.

While many Salvadorans use Bitcoin and major companies in the country accept it, Bukele admitted that the adoption rate has not met expectations.

Bukele also addressed his somewhat controversial leadership style during the interview, which Time magazine referred to as “the world’s most popular authoritarian.” Since taking office in 2019, Bukele has overseen a major drop in El Salvador’s homicide rate. However, his government has faced accusations of human rights violations, especially in its crackdown on gang activity. dismissed He is concerned about being labelled authoritarian and said that does not bother him much.

Bukele attracted international attention in 2021 when he announced plans to make El Salvador The first country to adopt Bitcoin as legal tender. The announcement was made at the Bitcoin Conference in Miami.

Since then, he has continued to pursue ambitious projects. Projects such as a “Bitcoin city” powered by a volcano and a citizenship program for those who invest $1 million in Bitcoin or USDT. Bukele also frequently shares updates on the situation in the country. Bitcoin Purchases On social media, Bukele claims that El Salvador has approximately $400 million in its “public wallet” alone. After winning re-election in February, he is expected to remain president until 2029.

Dell’s profits soar without Bitcoin

Meanwhile, Dell Technologies did not include any bitcoin in its second quarter balance sheet, despite recent speculation that was fueled by CEO Michael Dell’s crypto-themed social media posts. In its Aug. 29 report, presentationThe company reported strong earnings driven by growing demand for AI, but did not mention Bitcoin at all in its earnings or results presentation.

The absence of Bitcoin caught the attention of many people, especially after Dell’s activity on social media led many to believe that the tech giant could be considering a Bitcoin purchase.

In a June 20 post on X, Dell hinted at his interest in Bitcoin by stating, “Scarcity creates value,” which is a phrase that is very often associated with Bitcoin due to its limited supply of 21 million. This was followed by his interaction with MicroStrategy CEO Michael Saylorwho is a well-known Bitcoin advocate. Other Dell posts included a survey where Bitcoin won as the most important topic and a comment on Black Rock CEO Larry Fink’s new interest in Bitcoin.

Despite these clues, Dell’s financial results showed no sign of Bitcoin or other cryptocurrencies on the company’s balance sheet. Typically, companies share their digital asset holdings in financial filings. Tesla, Microstrategyand some others have done this and have integrated Bitcoin into their treasury strategies. Microstrategy remains the largest corporate holder of Bitcoin, with 226,500 BTC valued at $13.5 billion.

Dell Technologies Second Quarter Results exceeded expectationsThis was mainly due to the growing demand for AI solutions. The company reported total revenue of $25 billion, up 9% from the previous year. It also revealed record server and network revenue of $7.7 billion, an increase of 80% year-over-year.

Vice President and COO Jeff Clarke believes the higher gains are due to accelerated AI momentum, noting that demand for AI-optimized servers reached $3.2 billion, up 23% sequentially, contributing to a year-to-date total of $5.8 billion.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.