Also in this letter:

■ Standard regulations for electronic component manufacturers

■ What’s next for Byju’s after SC order?

■ Zomato shuts down intercity food delivery

With Paytm ticketing business under its belt, Zomato to challenge BookMyShow

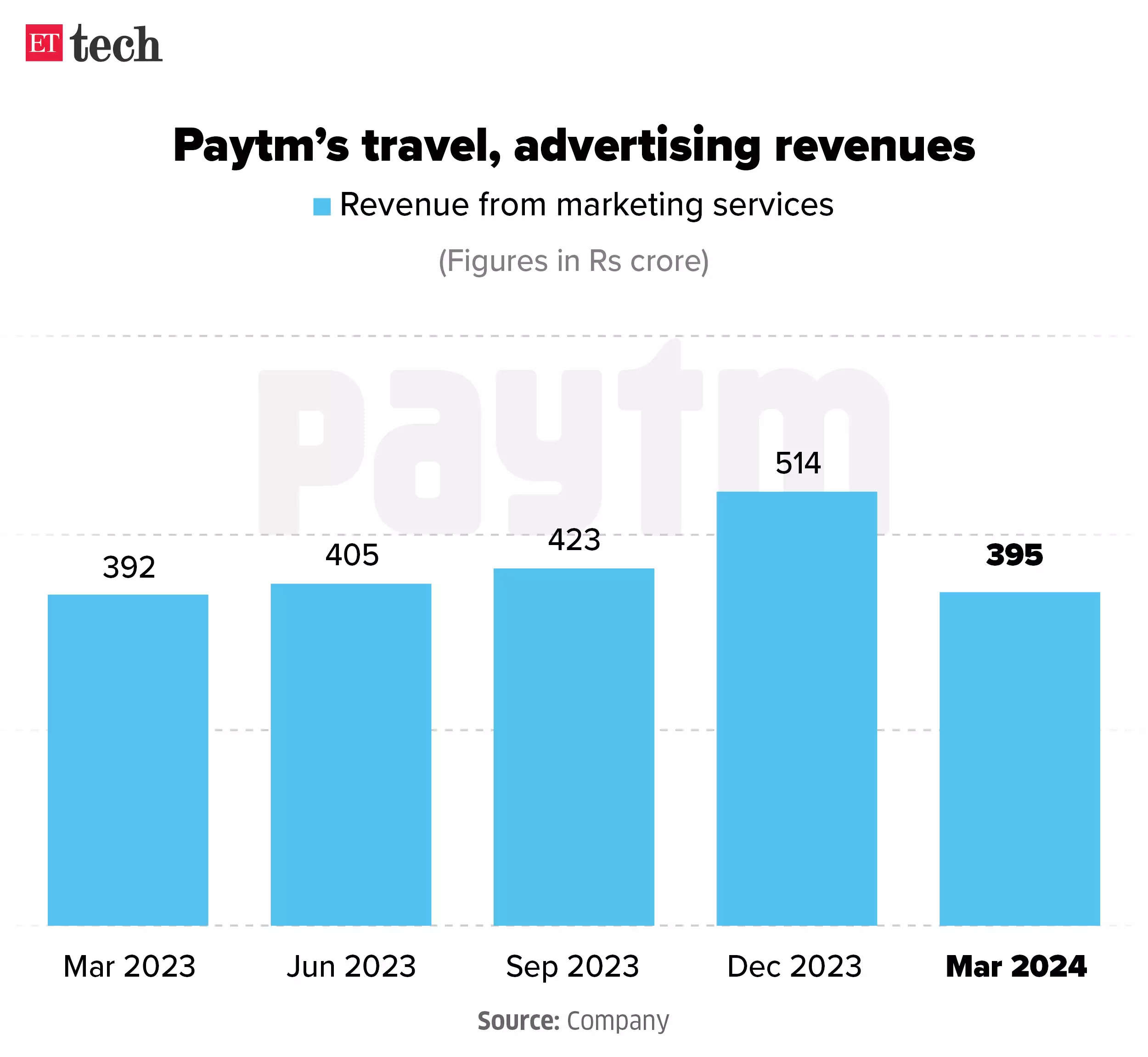

BookMyShow, the largest player in the online show ticketing segment, It could face tough competition from Zomato following his Acquiring Paytm’s ticketing business for Rs 2,048 crore.

Space heats up: Industry analysts and executives believe that BookMyShow, which posted revenues of nearly Rs 1,000 crore in FY23will attempt to protect its market share by using its influence with suppliers and other stakeholders, in addition to its exclusive contracts.

Reliance Industries and Accel-backed BookMyShow has a 75% market share, followed by Paytm Insider, according to Bernstein.

Zomato’s work: On the other hand, Gurugram-based Zomato is looking to build a third major consumer vertical by leveraging gains from its other mature businesses, such as food delivery, to scale its retail business.

In a letter to shareholders published on Wednesday, Zomato CEO Deepinder Goyal said the company anticipates the gross order value (GOV) of its outbound vertical to be will more than triple to over Rs 10,000 crore by fiscal year 2026.

Goyal said part of the success of this acquisition will depend on a Seamless transition of users from applications like Paytm, Insider, TicketNew and Zomato to District.

In quotation marks: “Movie and event ticketing is the largest business… about two-thirds of the revenue comes from convenience fees from movie and event ticketing. Live events would be the remaining 30% of the business,” said Karan Taurani, senior vice president at Elara Capital.

Swiggy valued at $11.5 billion by investor 360 One WAM

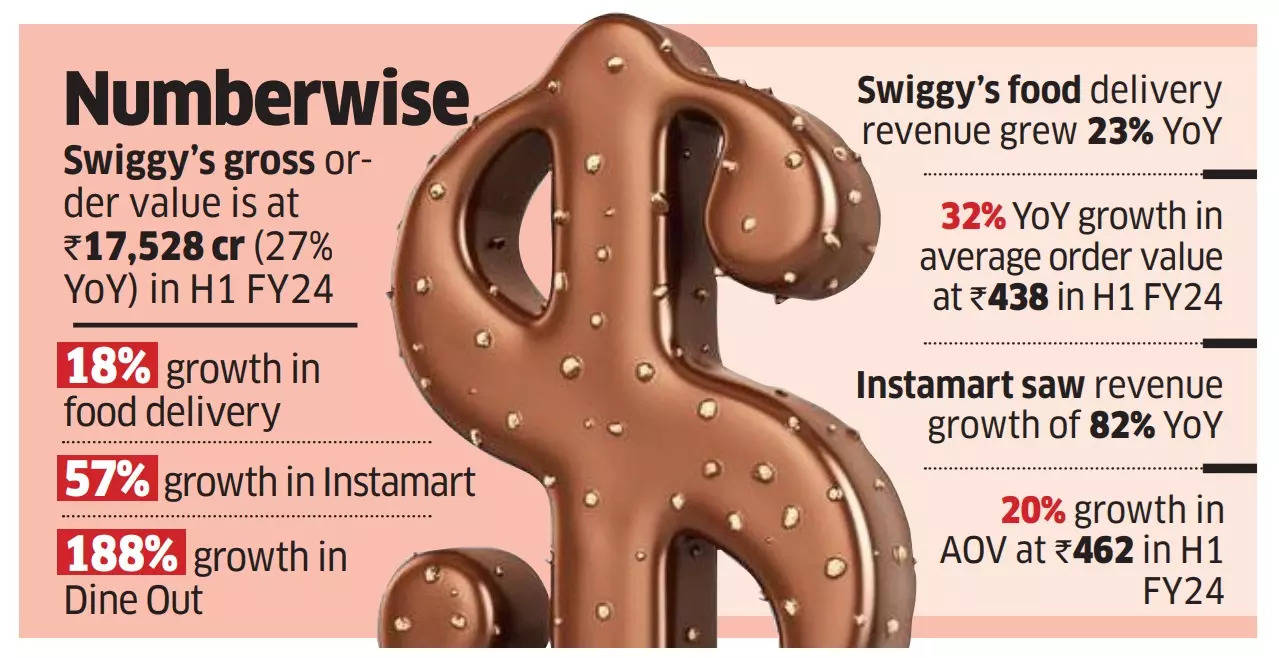

Swiggy 360 One WAM Investor, formerly IIFL Wealth Management, He valued the food and grocery delivery company that is going public at $11.5 billion starting in June 2024, according to an investor presentation seen by ET.

This is the latest valuation by a private investor as the Bengaluru-based company… The company is in the middle of a $1.25 billion IPO process.

Tell me more: The valuation is higher than the $10.7 billion Swiggy was worth when it… The last funding raised was in January 2022.

Finance: According to the filing, Swiggy posted revenue of Rs 7,474 crore in H1 FY24, which translates to Rs 14,947 crore for the full fiscal year ending March 2024, on an annualised basis.

“Overall, monthly cash burn was Rs 181 crore in H1FY24, up from Rs 336 crore in FY23. Cash balance stood at Rs 6,000 crore as of September 2023,” it added.

Read also | Exclusive | Amazon in talks with Swiggy for fast-commerce business Instamart: sources

IPO details: Swiggy is expected to go public at a discount to Zomato’s market cap, but the exact nature of the listing would depend on multiple factors. “It could be in the $13-15 billion range,” a person familiar with the talks told us.

Zomato’s market cap has surged to $28 billion, thanks to the rapid growth of its fast-growing commerce business, Blinkit. Swiggy’s Instamart competes with Blinkit and Zepto.

Read also | UBS assigns enterprise value of $15.4 billion to Zomato’s Blinkit business

Government may allocate up to Rs 40,000 crore for electronic component manufacturing scheme

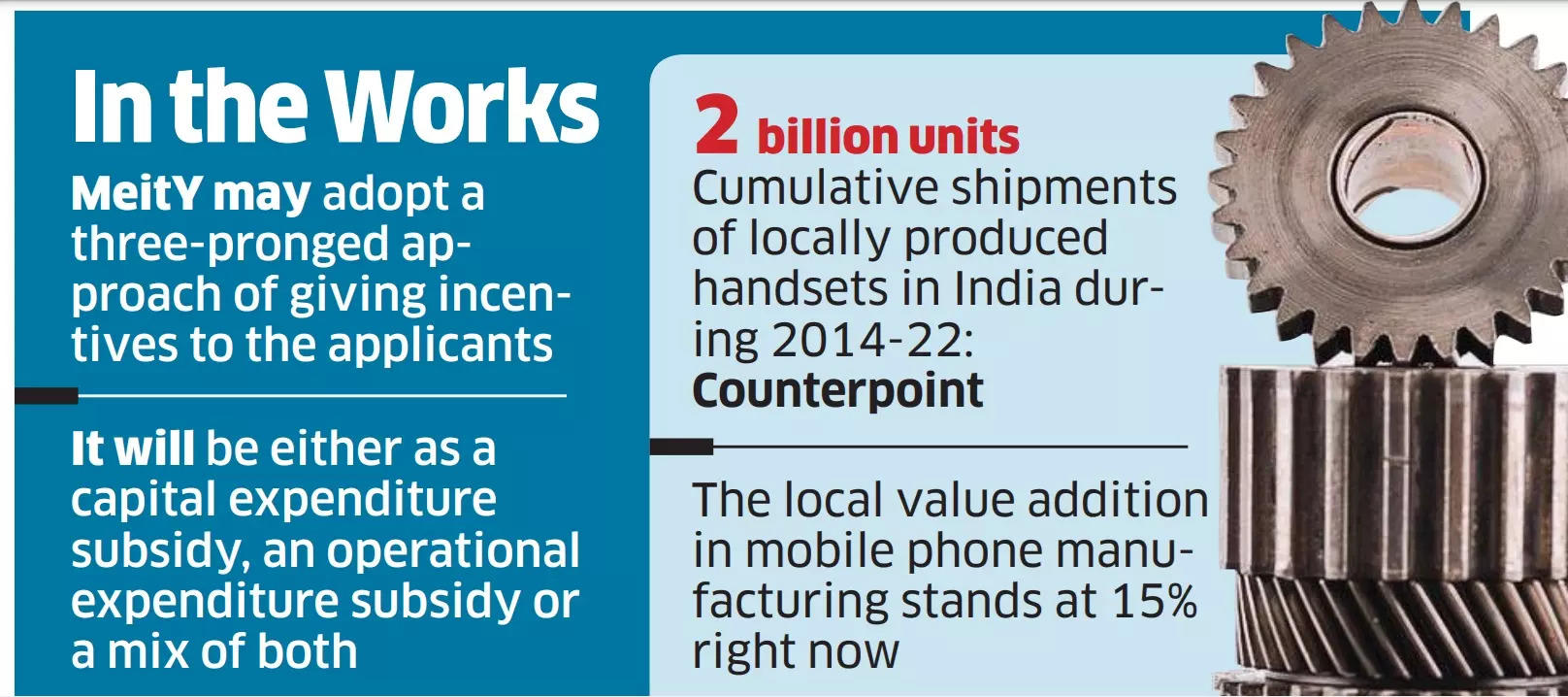

The government may allocate up to 40,000 crore for proposed electronic component manufacturing schemewhich will likely be implemented later this year, sources told us.

Driving the news: The government projects that the total investment made by successful applicants under the scheme could be around Rs 82,000 crore, while the output value of electronic components produced by the companies could be between Rs 1.95 lakh crore and Rs 2 lakh crore, a senior government official said.

“Of the Rs 40,000 crore, about Rs 19,800 crore will be allocated as grants for operating expenditure and about Rs 13,000 crore as grants for capital expenditure (could be allocated). The remaining amount could be allocated as a combination of grants for capital expenditure and operating expenditure,” the official said.

Get up to speed quickly: We had previously reported that the government plans to encourage the National production of at least 12 of the 30 subcomponents involved in the manufacture of a mobile phone.

The country has achieved significant scale in mobile phone manufacturing over the last decade and aims to increase the percentage of local value addition for mobile phones manufactured in India.

Other featured stories from our reporters

ETtech Explainer: What’s next for Byju’s after SC suspends settlement agreement with BCCI? Byju Raveendran, the founder of Byju’s, seemed close to resolving his company’s Rs 158 crore payment dispute with the Indian cricket board. However, on August 14, the The Supreme Court intervened by suspending the NCLAT order which had approved the settlement agreement between Byju’s parent company and the Board of Control for Cricket in India (BCCI), adding to the troubles of the beleaguered education technology company.

Zomato shuts down intercity food delivery service Captions: Food delivery platform Zomato has shut down its intercity food delivery service Zomato Legends, Its CEO Deepinder Goyal said in a post on X. “Update on Zomato Legends: After two years of trying, without finding a product-market fit, we have decided to shut down the service with immediate effect,” Goyal said on Thursday.

Auto and taxi services affected in Delhi due to two-day drivers’ strike: Taxi and autorickshaw services halted in New Delhi On Thursday, around 15 driver unions, representing over 400,000 taxi and autorickshaw drivers, launched a two-day strike in protest against falling earnings from Ola, Uber and other ride-hailing platforms.

InvestorAi secures Rs 80 crore in equity funding from Ashish Kacholia: AI-powered equity investment platform InvestorAi has raised Rs 80 crore from stock investor Ashish Kacholia, The founder of Lucky Investment Manager and his associates, the company said in a statement on Thursday. The newly raised funds will be used to expand business operations and add new products.

Global Picks We’re Reading

■ How Russian trolls are trying to go viral on X (WSJ newspaper)

■ This political startup wants to help progressives win… with AI-generated ads (Cabling)

■ OpenAI joins opposition to California AI safety bill (FOOT)

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.