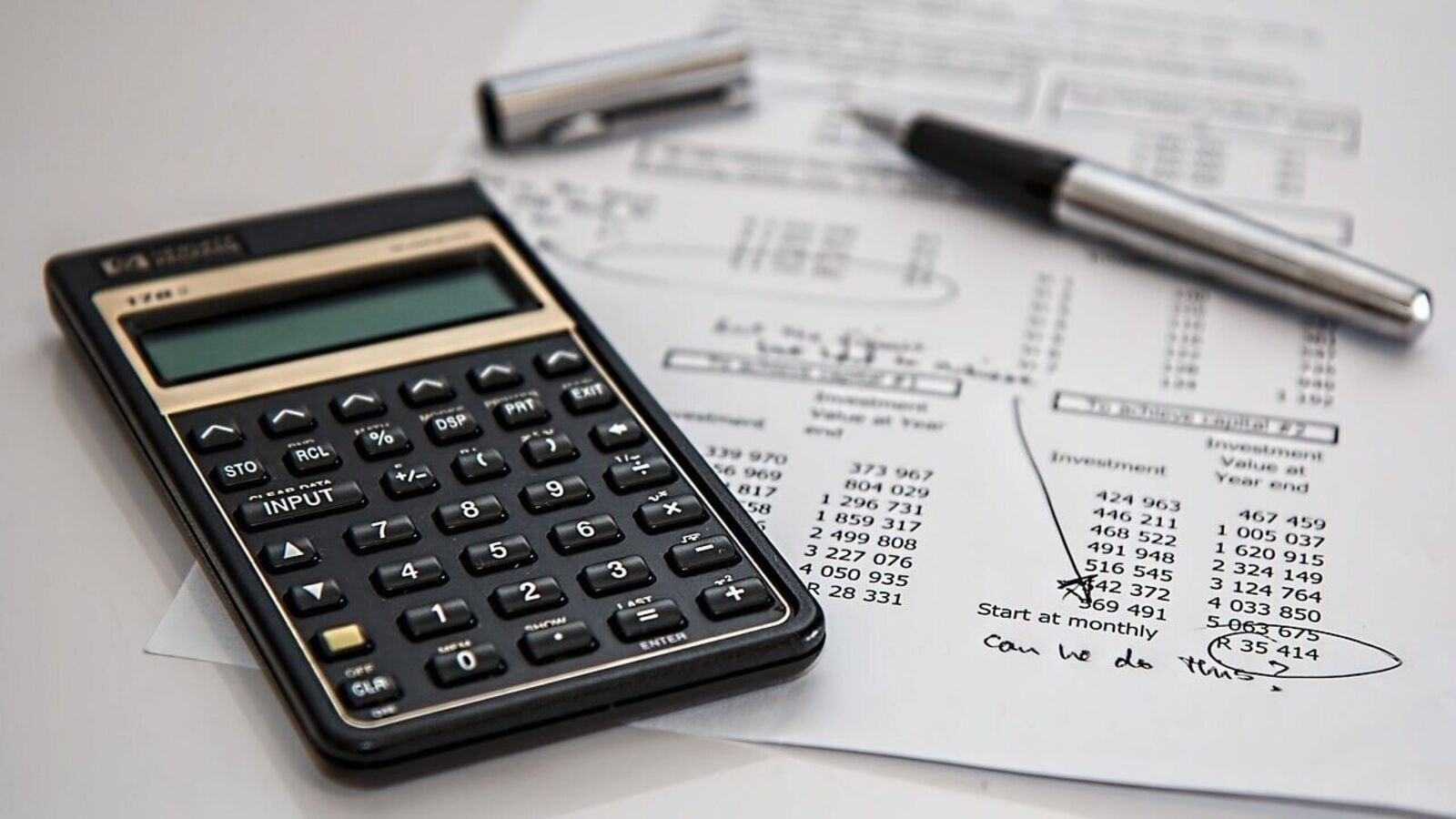

Long-Term Capital Gains Tax During Sabbatical

I took a two-year leave from my job to travel and pursue my interests. Last year, my mutual fund redemption income was ₹5.1 lakh; all these were long-term holdings. The approximate long-term capital gain was ₹2 lakh. Will any tax be payable this year and if so, how will it be calculated? —Name withheld on … Read more