Ethereum’s Layer 2 ecosystem hit an all-time high of 12.42 million daily transactions on Aug. 12, fueled by the rapid growth of platforms like Coinbase’s Foundation and the broader adoption of Layer 2 solutions. At the same time, Grayscale’s Ethereum Trust (ETHE) ETF reported new outflows, while other Ethereum ETFs saw positive inflows. Grayscale predicts that the cryptocurrency ETF market will soon begin to expand and recently launched a new MakerDAO Trust.

Ethereum Layer 2 Ecosystem Sets New Record

He Ethereum Layer 2 Scaling The ecosystem has reached a new milestone after its daily transactions hit an all-time high of 12.42 million on August 12, according to data from Foot growthLeon Waidmann, Head of Research at the Onchain Foundation, commented on the achievement, noting that scalability is rapidly improving and user activity has peaked.

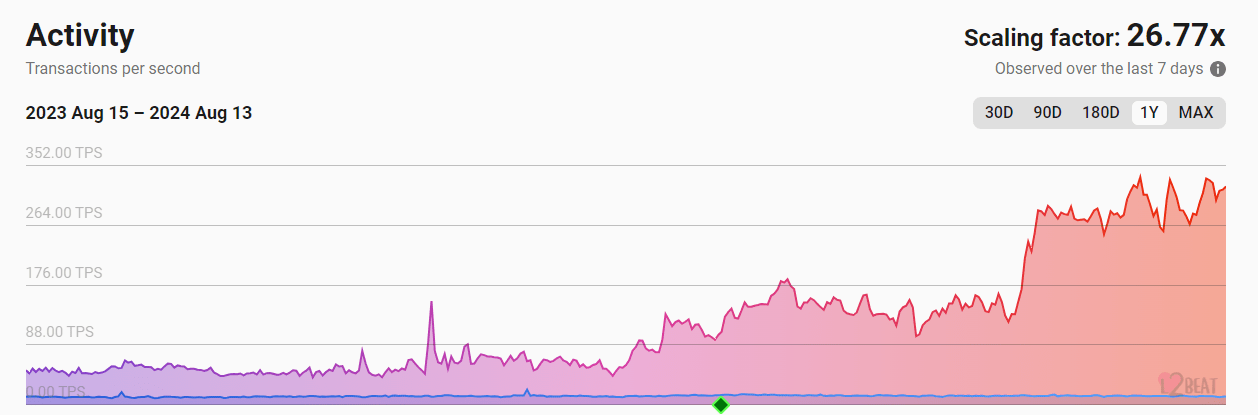

Since the beginning of 2024, the layer 2 ecosystem has seen a 140% increase in daily transactions. Growthepie data only counts transactions executed by users or smart contracts, excluding system transactions.

This growth has been largely driven by Coinbase’s L2 blockchain Basewhich saw a huge surge in transactions, peaking at over 4 million in late July. Basescan, a blockchain metrics platform for Base, reported a 700% increase in daily transactions over the past six months.

Base’s explosive growth has been driven primarily by the The madness of meme coinsas token creators flocked to lower-cost, higher-throughput chains to mint coins. The expanding industry metrics platform L2rhythm A recent increase in overall throughput was also noted. In fact, average transactions per second (TPS) doubled over the past two months as the number of scaling platforms increased.

L2 Activity (Source: L2rhythm)

Growthepie also reported that layer 2 networks now have More stablecoins that Solarium and Binance Chain as a whole, with 150% more stablecoins on Layer 2 networks than on Solana and 94% more than on BNB Smart Chain. In contrast, daily transactions on Ethereum’s Layer 1 have remained relatively stable, averaging around 1.1 million for most of the year, according to Etherscan.

In addition, average gas fees on Ethereum layer 1 have fallen to yearly lows. This allowed Tie minting 1 billion USDT for just 53 cents on August 13, according to Arkham.

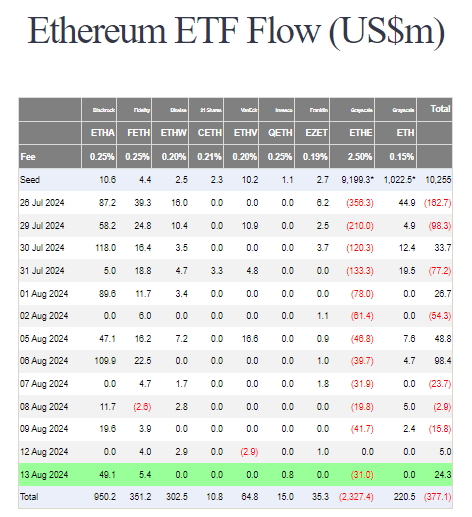

Grayscale’s ETHE is back to negative flows

On the other hand, Grayscale Ethereum Trust ETF (ETHE) reported a huge single-day net outflow of $31.01 million after its negative flows briefly paused. Data from Farside Investors reveals that ETHE’s all-time net outflow has now reached $2.327 billion.

These latest outflows came after a day of zero flows on August 12, which was a milestone for ETHE as it was the first day without any outflows. Despite this negative flow for Grayscale’s ETHE, the overall market for Ethereum Spot ETF showed some positive movement, with a total net inflow of $24.3412 billion on August 13.

Ethereum ETF Flow (Source: Farside Investors)

Since its inception, ETHE has seen a 25% reduction from its initial holdings of $9 billion in ETH. On the plus side, it took Grayscale Bitcoin Trust (GBTC) almost four months to achieve its first day without withdrawals.

Grayscale’s Ethereum Mini Trust ETF maintained stability with a single-day net outflow of $0.00, preserving its all-time total net inflow of $221 million, highlighting the different performance and investor sentiment between Grayscale’s main and mini-trust ETFs.

Fortunately, there were still some impressive inflows into other Ethereum spot ETFs. BlackRock iShares ETF (ETHA) led the way with a single-day net inflow of $49.1244 million, bringing its all-time total net inflow to $950 million. Fidelity’s ETF (FETH) also fared well, with a single-day net inflow of $5.4132 million, bringing its all-time total net inflow to $351 million.

The total net asset value of Ethereum spot ETFs is around $7.649 billion. Despite recent positive inflows, the historical cumulative net outflow of Ethereum spot ETFs has reached $377 million.

DRW bets heavily on Ethereum

DRW Shares holds more than 195 million dollars in value Cryptocurrency ETFsaccording to its latest Form 13F filed with the SEC. Most of this exposure occurs through Grayscale Ethereum Trust, in which DRW invested more than 150 million dollars.

Grayscale DRW Ethereum Investment (Source: SECOND)

While the point Bitcoin ETF While Ethereum-based funds have attracted billions of dollars in net inflows from both institutions and retail traders, Ethereum-based funds have yet to achieve similar levels of interest. However, DRW’s large investment in ETH ETFs could signal a growing institutional appetite for Ethereum.

Interestingly, DRW’s holdings in ETH ETFs are more than three times larger than its Bitcoin ETF investments, with Grayscale Ethereum Trust being its third-largest holding, behind only a fund that tracks the S&P 500 and a gold trust. In contrast, DRW’s Bitcoin ETF investments are spread across several issuers, including Ark and 21Shares, Bitwise, Black RockFidelity and Proshares, with Proshares being its largest Bitcoin-focused holding company.

DRW has been increasingly involved in the cryptocurrency industry since at least 2018. Its crypto-focused market-making unit, Cumberland, has been active as a liquidity provider for several Bitcoin ETFs and recently Obtained a “BitLicense” from the New York State Department of Financial Services.

Grayscale predicts expansion of cryptocurrency ETFs

The market of Cryptocurrency ETFs It is expected to expand to include new types of digital assets and diversified crypto indexes, according to Dave LaValle, global head of ETFs at Grayscale Investments. During a August 12 WebinarLaValle said the market will see more single-asset products and diversified index-based offerings. Grayscale, one of the largest cryptocurrency ETF issuers, currently manages more than $25 billion in assets across its U.S.-listed cryptocurrency ETFs, which include single-asset Bitcoin and Ethereum funds.

The US Securities and Exchange Commission (SEC) has authorized the launch of a Bitcoin ETF Trade in Januaryfollowed by Ethereum ETFs in July. Currently, no other type of cryptocurrency ETFs are permitted to be traded in the US.

LaValle was surprised by the speed with which the SEC approved Ethereum ETFs, and stated that the regulatory path for the launch of Ethereum spot ETP It was quicker than expected. He acknowledged that many in the market had instead been expecting denials from the SEC.

Several proposed cryptocurrency ETFs, including new single-asset funds like Solana ETFs and diversified cryptocurrency indexes like the Hashdex Nasdaq Crypto Index ETF, are still awaiting regulatory approval. National stock exchanges like Nasdaq are also targeting list options Coming soon on Bitcoin and Ethereum ETFs.

The launch of cryptocurrency ETFs has been in high demand this year, with large-scale adoption by large financial institutions such as Morgan StanleyAccording to LaValle, inflows have exceeded $15 billion, more than triple the largest annual inflow of any ETF in history.

Grayscale launches MakerDAO trust

Grayscale Investments also recently launched a new investment fund focused on MakerDAO’s governance token, MKR, according to an Aug. 13 release. Press releaseThe Grayscale MakerDAO Trust offers qualified investors the opportunity to gain exposure to MKR, the utility and governance token of the Ethereum-based autonomous organization, MakerDAO.

This new unlisted fund adds to Grayscale’s portfolio of single-asset cryptocurrency investment products. Earlier in August, Grayscale launched two other trusts for Bittensor and Sui’s native protocol tokens.

Grayscale is well known for its Bitcoin and Ethereum ETFs, but it also operates single-asset private funds for other protocol tokens such as Basic Attention Token (BAT) and chain link (LINK).

MakerDAO is a decentralized finance platform (DeFi) protocol that issues the US dollar linked stablecoin Dai operates an ecosystem of on-chain lending products. In July, MakerDAO announced plans to invest $1 billion in tokenized U.S. Treasury bonds.

The Grayscale MakerDAO Trust allows investors to participate in the growth of the entire MakerDAO ecosystem, according to Rayhaneh Sharif-Askary, director of product and research at Grayscale.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.