The official manufacturing purchasing managers’ index fell to 49.1 from 49.4 in July, the National Bureau of Statistics said Saturday. The median forecast of economists surveyed by Bloomberg News was 49.5. The reading has been below the 50 mark that separates growth from contraction for all but three months since April 2023.

China’s $17 trillion economy has been struggling as a prolonged housing slump weighs on consumers and businesses. Recent government measures — including interest rate cuts — to boost confidence have yet to turn things around, meaning the economy continues to rely on manufacturing and exports to keep its growth target in sight.

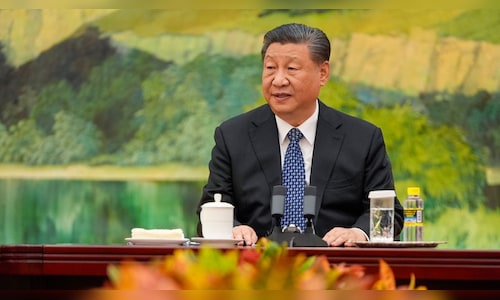

But as trade tensions with the United States and Europe escalate, so do the hurdles for the manufacturing sector. President Xi Jinping’s government is targeting gross domestic product growth of about 5% this year, a goal that economists say will require accelerated spending on infrastructure and other programs to achieve.

“Fiscal policy remains quite restrictive, which may have contributed to the weak economic momentum,” said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management. “To achieve economic stabilization, fiscal policy needs to be much more supportive. With the U.S. economy slowing, exports may not be as reliable a source of growth as they were in the first half of the year.”

In a statement accompanying the data, NBS analyst Zhao Qinghe attributed the latest contraction to high temperatures, heavy rains and a seasonal decline in output in some industries.

The gauge of non-manufacturing activity in construction and services rose to 50.3, boosted by consumption during the summer holiday season, according to the statistics office. This compares with a forecast of 50.1 and a July reading of 50.2.

Economists at banks including UBS Group AG and JPMorgan Chase & Co. expect China to miss their growth target of about 5% this year.

Recent data showed the first contraction in lending to the real economy in nearly two decades, a surprise slowdown in fixed-asset investment and weaker-than-expected exports. Demand for credit has remained weak as the housing crisis and poor labor market discourage businesses and consumers from spending.

External demand is also under pressure: indicators of manufacturing activity in the United States and the euro area point to a deeper decline in August.

Trade protectionism looms as another obstacle. The United States and the European Union have moved to impose new barriers to trade after accusing Beijing of creating overcapacity in their industries through state subsidies.

The impact of the new European tariffs was already evident in July, when Chinese carmakers registered fewer electric cars on the continent.

What Bloomberg Economics says…

“Looking ahead, the economy will need further policy support to emerge from its prolonged period of weakness. Two months of weak PMI readings so far this quarter, including the latest downside surprise in the manufacturing indicator, bode ill for the outlook.”

— Chang Shu, chief economist for Asia, and Eric Zhu, economist. For the full analysis, click here

The growth bottlenecks have yet to prompt a more forceful government response, with less than half of budgeted spending completed in the first seven months of 2024. On Friday, Finance Minister Lan Fo’an said the economy is still growing at a 5% pace and described its performance in the first half as “generally stable and steadily progressing.”

“Looking ahead, China’s economic development has multiple advantages and macroeconomic control policies will continue,” he said via video message at a meeting in Cape Town of the New Development Bank, a multilateral lender set up by the BRICS group of emerging market nations.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.