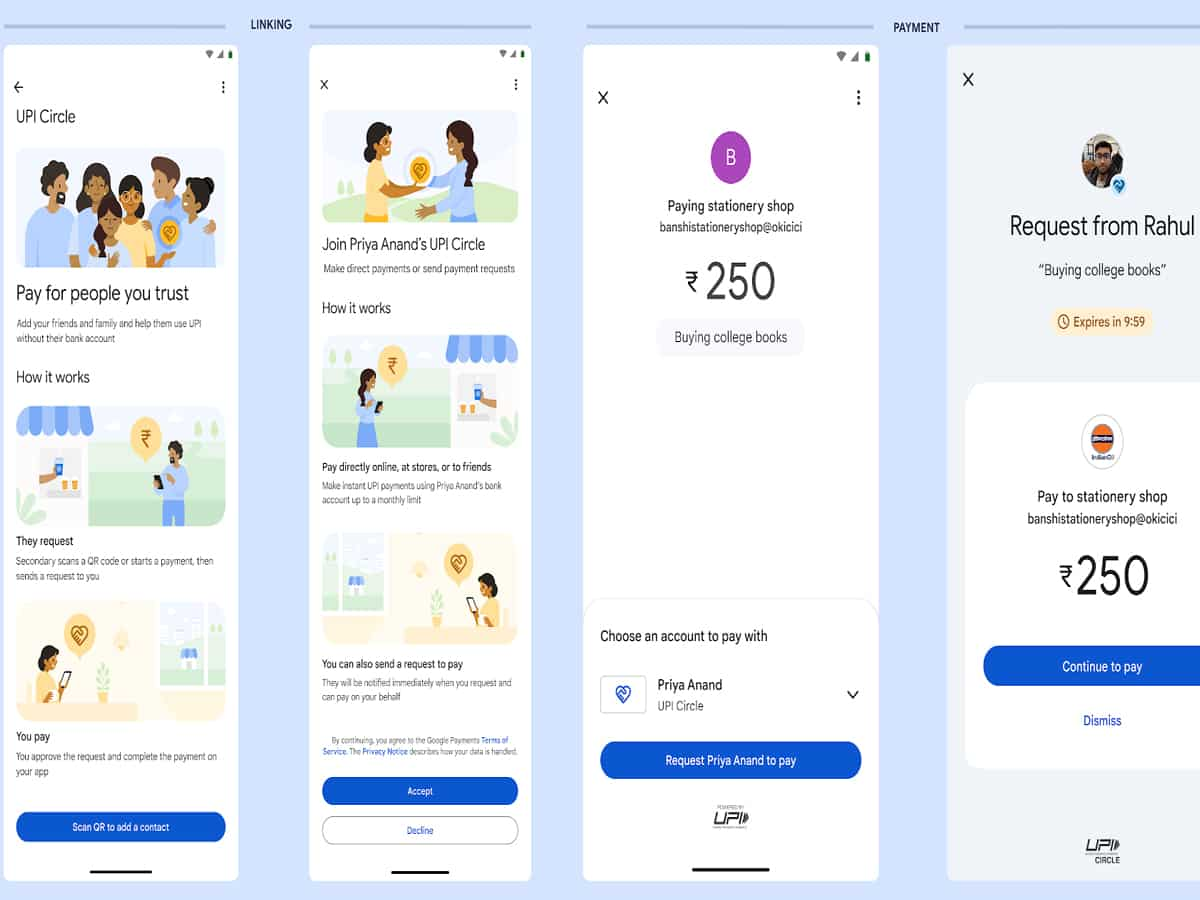

Google UPI Circle: Google has launched a new UPI tool known as UPI Circle for its Google Pay app in association with the National Payments Corporation of India (NPCI). It has been designed to streamline financial transactions for people who do not have a bank account or who have difficulty making digital payments on their own. UPI Circle helps these people make digital payments through the primary user’s account without linking a bank account. Google reports that the UPI Circle feature will be accessible in the Google Pay app. Its goal is to include people who still rely on cash in the digital payments system by allowing trusted friends or family to help them make payments digitally.

UPI Circle on Google Pay will help the primary user delegate digital payment tasks to trusted contacts like close friends or family. This feature has two types of delegations: full delegation and partial delegation. In full delegation, primary users have set a monthly transaction limit of up to Rs 15,000, which will allow secondary users to freely make payments below that limit without any additional approval. In partial delegation, the primary user has full control over each digital payment made by the secondary user. The primary user receives a request to authorize each transaction initiated by the secondary user, ensuring that the primary user is informed and participates in each transaction. Additionally, there is a 30-minute cooldown time after linking a secondary user, during which no payments can be initiated, ensuring an additional level of security.

This feature will be implemented for iOS and Android platforms. Users will need to update their Google Pay apps to see if UPI Circle is available.

How to use Google UPI circle

1. Users need an active bank account linked to the Google Pay app to add secondary users to UPI Circle.

2. Secondary users must have a UPI ID and their contact number must be stored in the primary user’s contact book.

3. To initiate payments from the primary user’s account, the secondary user will need to launch their UPI app and click on the QR code icon.

4. Then the primary user will go to the UPI Circle section by clicking on their profile photo or initials in the Google Pay app. The main user chooses the type of delegation (full or partial).

5. The secondary user will then be asked to consent to the invitation to confirm the settings. Once set up, the secondary user can freely initiate transactions within the default monthly limit of Rs 15,000, with payouts of up to Rs 5,000 per transaction.

Surprisingly, both primary and secondary users can track the status of their transaction requests in real time through the UPI Circle section in their profiles. This feature will also offer the history of all successful transactions for greater transparency. A primary user can include up to five secondary users. However, each secondary user can be included in only one UPI circle at a time.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.