The latest publication on X by American short seller Hindenburg Research has once again sparked a wide debate within the Indian stock market community.

In a recent post, Hindenburg wrote: “Something big soon in India,” possibly alluding to a new report involving an Indian company.

Something big coming soon India

— Hindenburg Research (@HindenburgRes) August 10, 2024

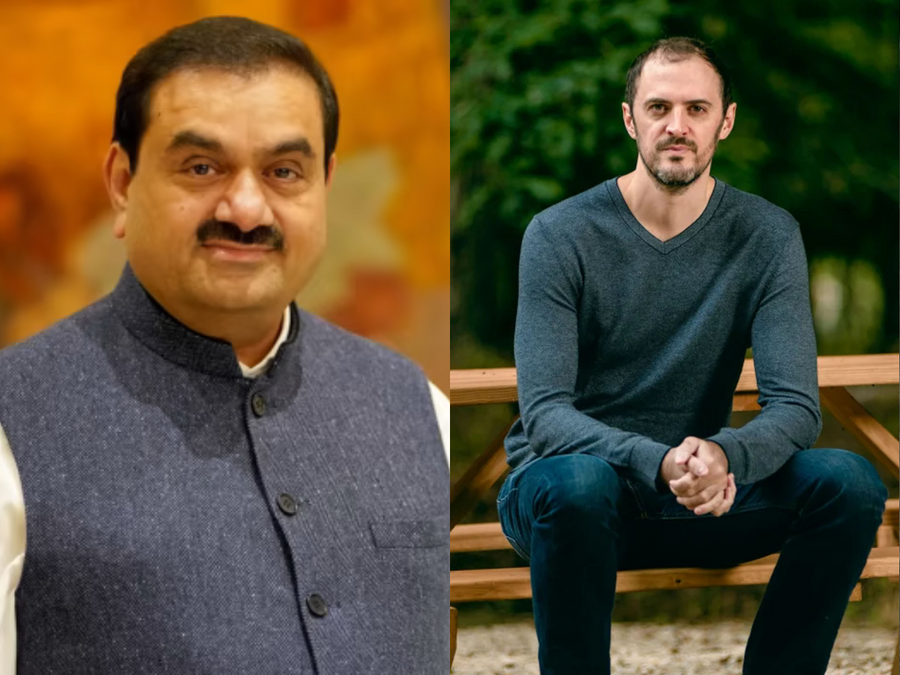

In January 2023, Hindenburg published a report accusing the Adani Group of orchestrating “the biggest scam in corporate history.” The report led to a loss of $86 billion in the market capitalization of the Adani Group.

In June this year, SEBI revealed links between Hindenburg Research and New York hedge fund manager Mark Kingdon.

SEBI said Hindenburg shared an advance copy of its Adani report with Kingdon about two months before its public release, allowing it to make substantial profits through strategic trading.

Hindenburg responded to SEBI’s notice, calling it “nonsense” and accusing the regulator of trying to silence those who expose corruption in India.

In his response, the short seller pointed out that the SEBI notice conspicuously avoided naming Kotak Bank, despite its alleged involvement in offshore fund structures related to Adani Group. Hindenburg also claimed that SEBI could be shielding powerful Indian businessmen from scrutiny.

Kotak Mahindra Bank denied any involvement or knowledge of Kingdon’s activities, while Kingdon Capital defended its right to enter into research arrangements that allow the use of reports before they are made public.

Reaction of Internet users

While the publication sparked significant debate, many believe that this time the report will not have much impact on the Indian stock market or any particular company it may target.

“Hindenburg has no credibility anymore. They have been exposed by SEBI,” wrote one user.

“Who cares now? Credibility has been lost!” said another.

“Hindenburg’s business strategy is simple: first it sells shares of a company, then it publishes a false report about that company and the company’s shares start falling. Then it books profits and repeats the same strategy with another company. But I don’t think that’s possible now. Adani has severely destroyed Hindenburg’s credibility,” commented a third.

Hindenburg is once again shorting the Indian market and economy but is failing to take into account the fact that since its last report in January 2023, not only have our markets recovered but the SENSEX has risen by around 20,000 points.

Tip: There is no need to panic. image.twitter.com/yztnqYA8ej— Dilip Mandal (@Profdilipmandal) August 10, 2024

Do you have any credibility? 🤣

Poor jealous western people 🔥🔥✌️— Manish Sharma 🇮🇳 (@manish_sharmaaa) August 10, 2024

When Hindenburg exposed Adani Group, the market reacted for a week and then saw a huge rally that gave attractive returns to investors.

Hindenburg also said that its clients did not earn much from Adani Exposure and the profit amount was just ₹35 crore.

Nothing important came out of…– Atul Modani (@atulmodani) August 10, 2024

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.