Alternative Investment Funds (AIFs) are gaining traction among Indian family offices as a preferred tool to access private markets and startups, showed a report by Sundaram Alternatives, which caters to the investment needs of high net worth individuals (HNIs) with Portfolio Management Services (PMS) and Alternative Investment Funds (AIF) offerings.

Alternative investment funds are investment vehicles that pool investors’ capital to invest in assets that are not traditionally considered securities, such as real estate, private equity, venture capital, hedge funds, and commodities. They offer investors the opportunity to diversify their portfolios beyond traditional asset classes, such as stocks and bonds.

AIFs offer a diversified portfolio that mitigates risks compared to individual investments. “The expertise that AIF managers bring in selecting opportunities across the risk-return spectrum is driving this trend, with many family offices choosing to co-invest with existing funds to execute high-conviction strategies with minimal operational challenges,” the report notes.

The report also notes that Indian family offices are increasingly adopting alternative investments, with allocations projected to rise by 5% to 18% over the next three years. This is in line with a global trend, where family offices are allocating more than 50% of their assets to alternatives.

“The shift reflects a strategic move towards diversification, niche investment strategies and active participation in India’s growth story, particularly through startups and innovative ideas,” Sundaram Alternatives said.

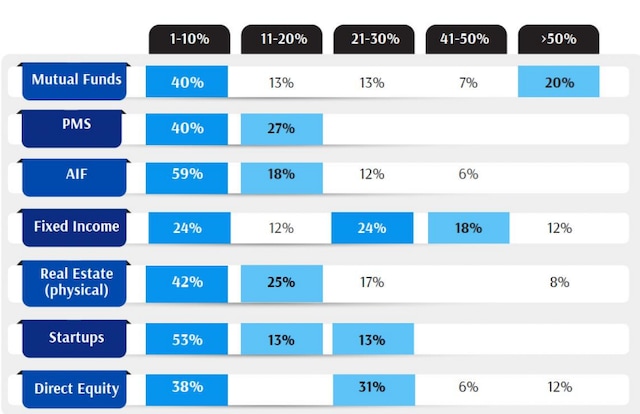

Indian family offices are looking to increase their investments primarily in alternative investment funds (AIFs) and reduce allocations to fixed income and real estate

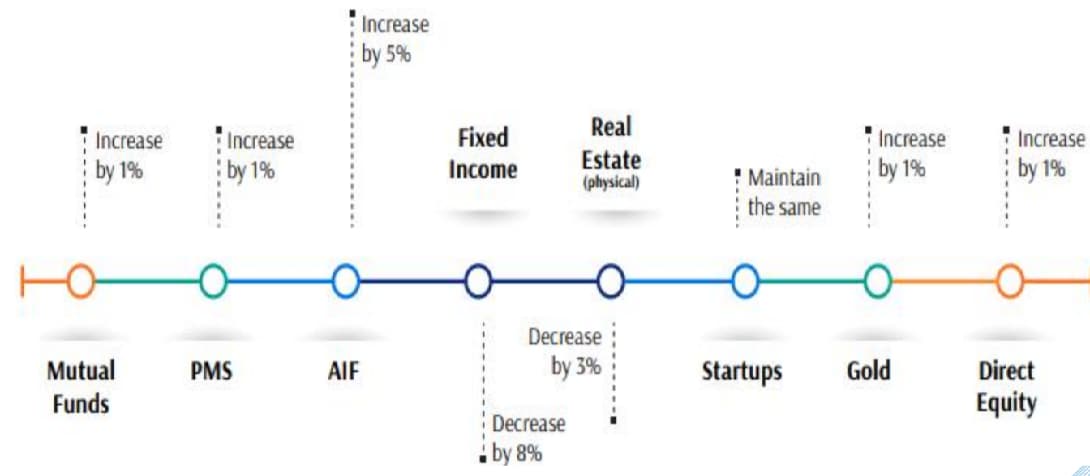

How Indian family offices will strategically increase their allocations in the next three years

The report titled “From Legacy to Leadership”, published by Sundaram Alternates, projects that assets under management (AUM) of mid- to large-sized family offices in India will grow at a compound annual growth rate (CAGR) of 14% over the next three years, potentially increasing by 1.5 times.

Evolving asset allocations: Fixed income declines while alternatives and gold rise

The report details the expected changes in asset allocation for family offices over the next three years. Allocations to mutual funds, PMS, AIF and gold are expected to see moderate increases, while fixed income and physical real estate are likely to see a decline. Allocation to emerging companies is expected to remain stable as family offices continue to explore and exploit opportunities in this sector.

First published: August 29, 2024 | 9:09 a.m. IS

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.