Avalanche (AVAX) is trading around $25 after a 10% surge since last Thursday as the broader cryptocurrency market shows signs of recovery. Bitcoin and most altcoins are trending higher from their yearly lows, with AVAX at a critical price level that could shape its price action in the coming weeks.

Related reading

Analysts and investors are closely monitoring the situation and predicting significant volatility for Avalanche. Many foresee a possible trend reversal and some anticipate a sharp and aggressive rally if AVAX manages to break out of its weekly bearish structure.

However, this volatility could also lead to downside risks if key support levels are lost. The next few days will be crucial in determining whether AVAX You can either ride the market momentum or face further turbulence.

The avalanche trend change will lead to higher prices

The market is at an inflection point as previously fearful investors are starting to feel encouraged by recent price action. Avalanche (AVAX) is up 25% from its local lows since September 6 and is now trading at a key level that could determine its price direction for the coming months.

This crucial level has caught the attention of both analysts and investors, particularly one prominent analyst, Daan, who shared his Technical information about X.

In his analysis, Daan points out a well-defined bearish channel that has kept AVAX in a downtrend for several months. However, AVAX is now attempting to break out of this descending channel, a move that could signal the end of its bearish phase.

Daan predicts that if AVAX manages to break above the $25 resistance level, the price could quickly advance towards $28. Such a breakout would represent a significant change in the short- to medium-term trend, which could change market sentiment and pave the way for further upside.

Related reading

A successful breakout would likely ignite a fresh wave of buying pressure, and analysts project an aggressive rally towards $30 or higher in the coming weeks. The next few days will be crucial and if the resistance fails to clear, AVAX could fall back into the bearish channel and retest lower support levels.

AVAX Price Action: Key Levels to Watch

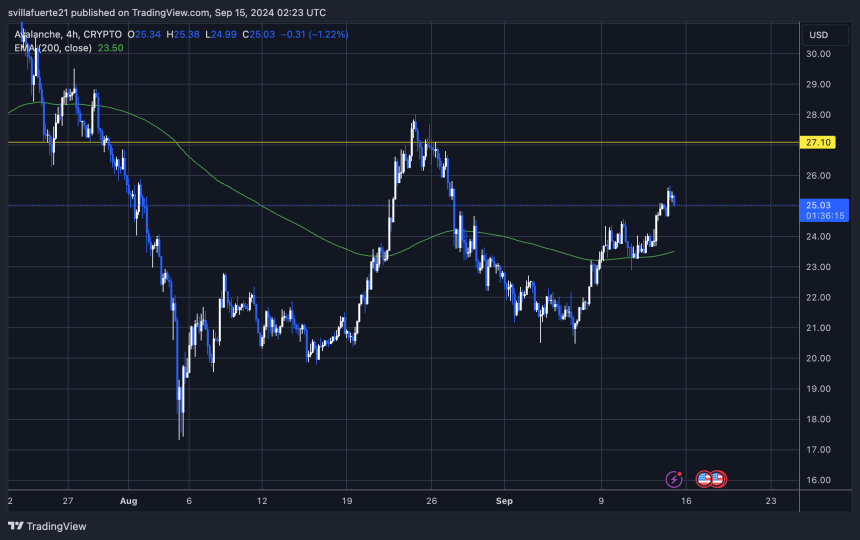

AVAX is trading at $25.04 after a 4-hour uptrend, marked by higher highs and higher lows. This positive move followed a breakout of the 4-hour 200-day exponential moving average (EMA), which AVAX successfully tested as support last Thursday, indicating near-term strength. This move has fostered bullish sentiment among traders.

The next key challenge for AVAX is to break above the $28 resistance level. Doing so would confirm a more significant uptrend and signal a shift in structure on higher time frames, which could set the stage for even higher prices in the coming weeks.

Related reading

However, if AVAX fails to sustain its position above the 4-hour 200 EMA, currently at $23.5, the price could experience volatility or a deeper correction, with lower demand levels likely to be tested.

Featured image of Dall-E, chart from TradingView

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.