Bitcoin (BTC) is at a crucial level after a sharp 15% pullback from recent local highs. While traders and enthusiasts speculate on the causes of this drop, the consensus is clear: demand is weakening.

CryptoQuant’s head of research, Julio Moreno, has provided an insight In-depth analysis of the situation, based on key market indicators and data to explain the ongoing change.

Their analysis suggests that falling demand is a factor driving BTC’s recent price action. As the cryptocurrency market goes through this turbulent period, uncertainty is increasing, making it difficult for investors to anticipate the next big move.

With indecision spreading among market participants, the next few days could prove crucial for Bitcoin’s price trajectory as bulls and bears struggle to reach critical levels. Will BTC recover or are more declines on the horizon? Investors are watching for signs of what’s to come.

Demand for Bitcoin is declining right now

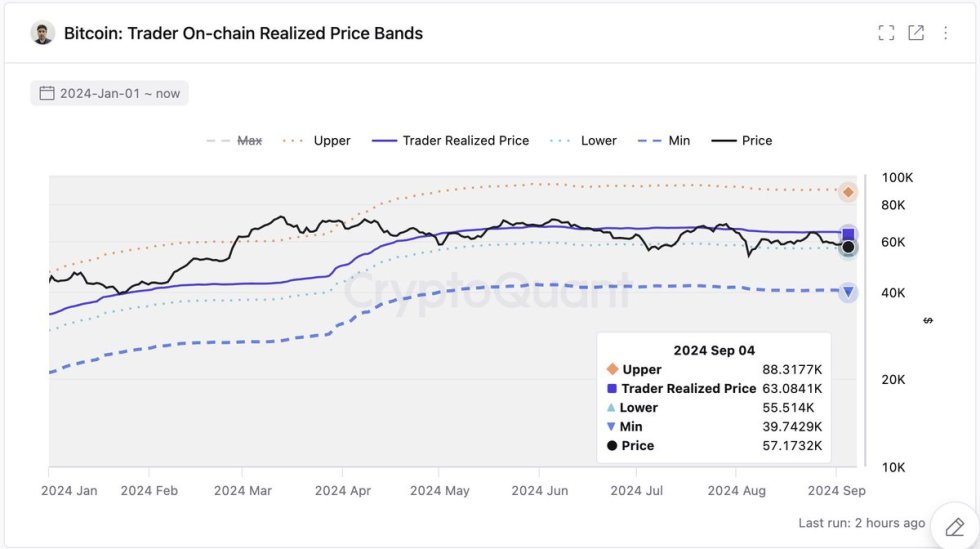

Bitcoin (BTC) is currently facing significant selling pressure, primarily due to a noticeable decline in demand growth. According to CryptoQuant’s head of research Julio Moreno, this demand issue is reflected in Various valuation metricswhich have remained stuck in bearish territory.

One of the most telling indicators is the apparent demand for BTC (30-day sum), which has entered a negative zone, highlighting weak buying interest. Moreno has shared his analysis on X, noting that the most severe signals have been appearing since July, when BTC demand began its steep decline.

This slow growth in demand is the main reason why the Bitcoin price has struggled to recover and start a new uptrend. While BTC managed to recover at the beginning of the year, the absence of new demand has prevented it from sustaining higher levels.

Moreno also noted that $55,500 is a key level to watch as it represents the lowest price traders have ever made on-chain. The market may remain weak without reclaiming this level as it indicates broader challenges in attracting new buyers. Investors are closely watching these metrics to determine whether the market can regain its footing or whether further declines are on the horizon.

BTC Price Action

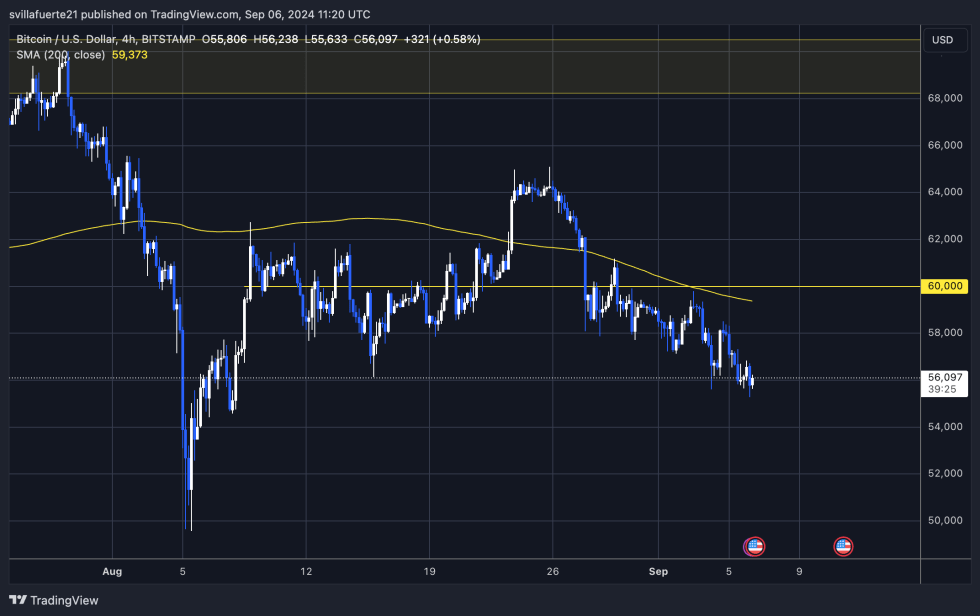

Bitcoin (BTC) is trading at $56,087, just above the critical $55,000 level after several days of slow decline and lackluster price action. The recent stagnation of BTC price suggests that it may test the lower demand zone at $54,500.

If Bitcoin manages to hold its position above $55,000, the bulls will have to reclaim the 4-hour 200-day moving average, currently at $59,373, and push the price above the important psychological barrier of $60,000. This level is crucial for establishing a new uptrend and gaining momentum.

Conversely, if BTC fails to hold the $54,500 support, there could be a more substantial drop on the horizon, which could see the price drop to $49,000 or even lower. This would signal a bearish changedefying current market sentiment and testing the resilience of Bitcoin’s recent gains.

Traders should keep a close eye on these key levels as a break below $54,500 could exacerbate the current decline, while a recovery above $60,000 could rekindle bullish enthusiasm.

Featured image of Dall-E, chart from TradingView

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.