Bitcoin is holding steady at the close of the year, falling below $60,000 following the encouraging expansion of the second half of last week. The path of least resistance in the near term is to the north as, despite the weakness, prices are within the bullish engulfing bar of September 13.

Has Bitcoin bottomed?

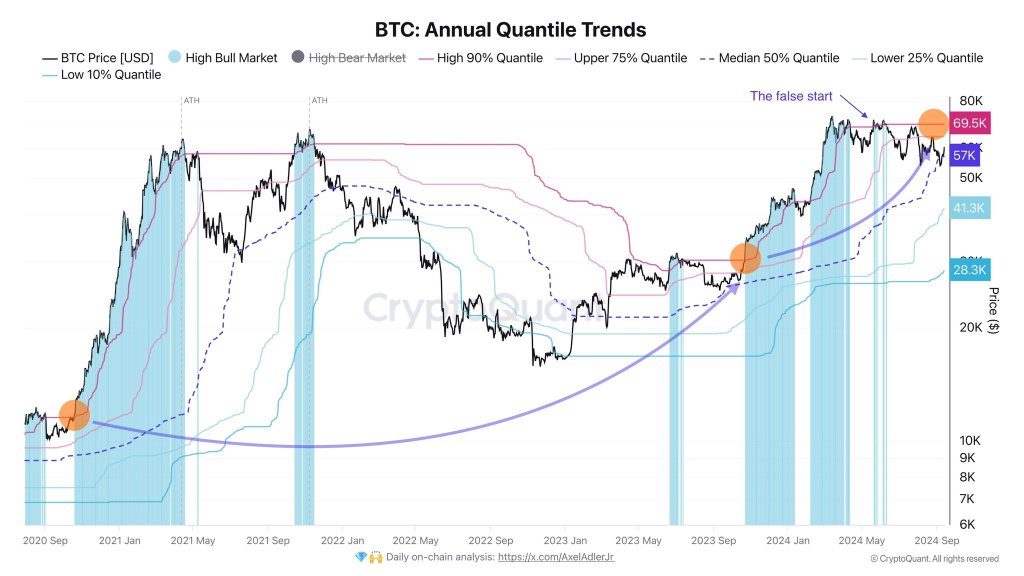

As prices retreat, on-chain data points to strength and the possibility of the world’s most valuable coin bottoming out. As for X, one analyst, citing on-chain data from CryptoQuant, grades that the Mayer Multiple, a tool used to measure market sentiment, is falling.

Specifically, the analyst notes that the Mayer Multiple reading has dropped from 1.82 to 0.9. Although it is low, it should fall a bit further. According to the trader, if sentiment falls and the reading drops to 0.7, it could indicate that the market has bottomed. Based on price action, this bottom ranges between $46,000 and $50,000.

It should be noted, however, that the Mayer Multiple, while useful, is a lagging indicator. It is calculated by dividing the spot price of BTC by the 200-day moving average. If the reading is below 1, it points to possible undervaluation, as is the case here.

Technically, Bitcoin’s uptrend remains as per the formation on the daily chart. Although the coin is trading below $60,000, prices are still within the bullish bar from September 13. From an effort versus outcome perspective, this is a net positive for buyers now that the drop is occurring even with lighter trading volume.

Buyers still have a chance if BTC holds above the $56,500 level. There will be better opportunities if Bitcoin rises and closes above last week’s highs of around $61,000.

Futures Market Tips

In addition to the Mayer Multiple and hopes for a floor price, the analyst is optimistic, expecting The coin finds support. There are signs of strength in the Bitcoin futures market.

The Bitcoin Futures Sentiment Index is now on the rise, according to data from CryptoQuant. Historically, prices tend to follow suit when the index starts to rise, moving up in tandem.

As bullish as this development is, Bitcoin bulls need to push prices higher, ideally breaking through immediate local resistance levels. According to the analyst, decent and high volume close up $69,500 could trigger a fear of missing out in the market (Missing Out (FOMO)), further elevating the currency to new horizons.

Featured image from Canva, chart from TradingView

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.