Also in this letter:

■ Byju’s vs BCCI at NCLAT

■ China’s commitment to GenAI models

■ Swiggy modifies its service fee policy

Programming note: ETtech’s Morning Dispatch & Top 5 will be discontinued on Friday. Stay tuned. ETtech.com for all the news and updates.

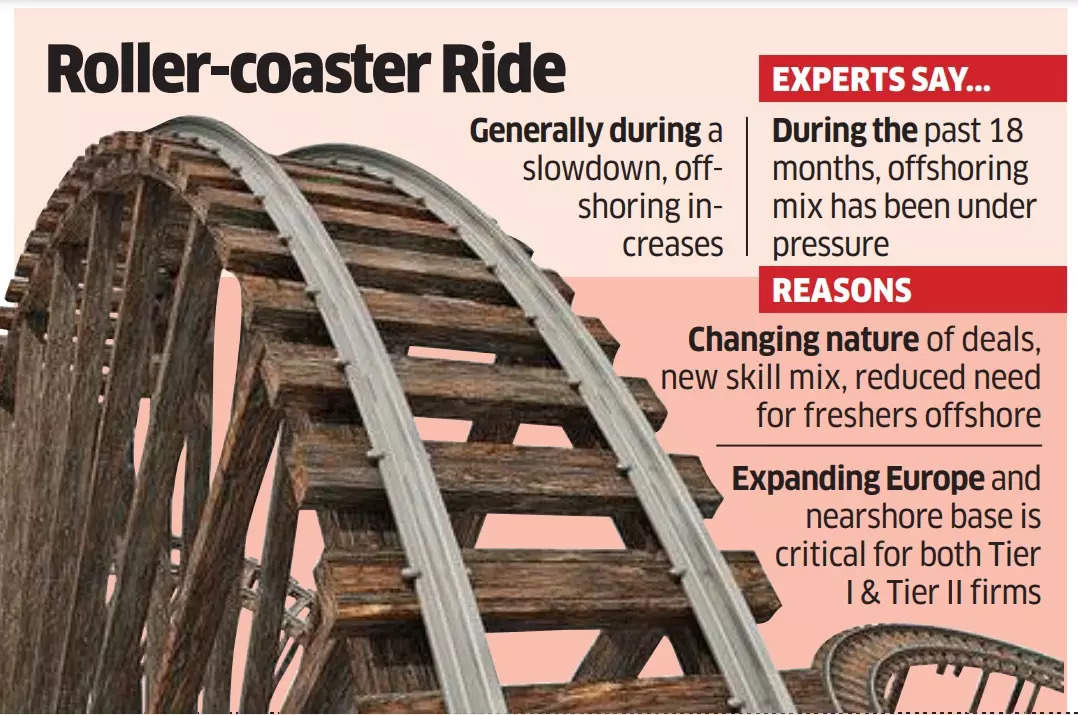

IT offshoring deals, driven by the crisis, are being reversed

Large-scale offshoring, which has begun in the last two years thanks to numerous cost optimization agreements, has either stopped or began to reverse, according to experts.

Driving change: “The reversal of the trend is largely due to the significant shift over the last year from onshore to offshore. This is now being balanced by a modest shift in the opposite direction. There is only so much you can do with offshore before clients demand more onshore,” said Peter Bendor-Samuel, chief executive of Everest Group, a research and consulting firm.

Wipro, LTIMindtree, Coforge, Mphasis and Happiest Minds saw their offshore contribution (efforts or revenue) decline in Q1FY25.

Read also: Digital transformation is once again taking centre stage in the IT sector, with a shift in costs

Jargon Destroyer: Offshoring is the practice of moving work to another country to reduce costs and increase efficiency and has seen an increase in the past five to six quarters.

Expert opinion: Typically, during a slowdown, offshoring increases, said Gaurav Vasu, founder of UnearthInsight, a technology market intelligence firm.

Vasu added, “However, over the last 18 months, the offshoring mix has been under pressure due to the changing nature of deals, new skill mix and reduced need for new employees from overseas. We saw a 0.5-1.5% growth in headcount in the on-premise and near-market, led primarily by M&A, digital transformation or BoT/BOOT deals for companies like HCLTech, TCS, etc.”

Read also: Deciphering the root of the IT problem: why clients are abandoning in-house outsourcing work

Ola Electric’s Q1 net loss widens to Rs 347 crore on year-on-year basis

Bhavish Aggarwal, founder of Ola Electric

Electric scooter maker Ola Electric on Wednesday reported a 32% increase in revenue for the first quarter from fiscal year 2025 to Rs 1,644 crore.

Key figures:

- Net loss widened to Rs 347 crore for the quarter ended June 30, from Rs 267 crore a year ago.

- Total expenses grew to Rs 1,849 crore, compared to Rs 1,461 crore in the same period last year.

- The automotive division saw total revenue rise 34% to Rs 1,722 crore

- The battery division reported a revenue of Rs 5 crore for the quarter, with a post-tax loss of Rs 37 crore.

New announcements: The company said it delivered more than 120,000 scooters during the quarter and added that it will launch a line of electric motorcycles on August 15. It said it has also started production of its own battery cells and expects to use its cells in its vehicles by the first quarter of fiscal year 26.

Read also: IPO price was reduced to attract a wider group of investors: Bhavish Aggarwal, CEO of Ola Electric

Nazara’s net profit rises 13% to Rs 24 crore in Q1: Media and gaming company Nazara Technologies Reported a 13% rise in net profit to Rs 23.6 crore for the first quarter of fiscal 2025 even as its quarterly revenue fell slightly. The company’s operating income fell 1.7% to Rs 250 crore on a year-on-year (YoY) basis for the quarter ended June 30, 2024.

Oyo posted a net profit of Rs 229 crore in FY24: Ritesh Agarwal: Oyo hotel startup posted a net profit of Rs 229 crore for fiscal year 24, founder and CEO Ritesh Agarwal said. In a post on XAgarwal said the audited results were published after their adoption by the company’s board, but the financial statements for FY24 were not available with the Registrar of Companies (RoC) till midday on Thursday.

Read also: Aris Infra files draft documents for IPO, plans to raise Rs 600 crore

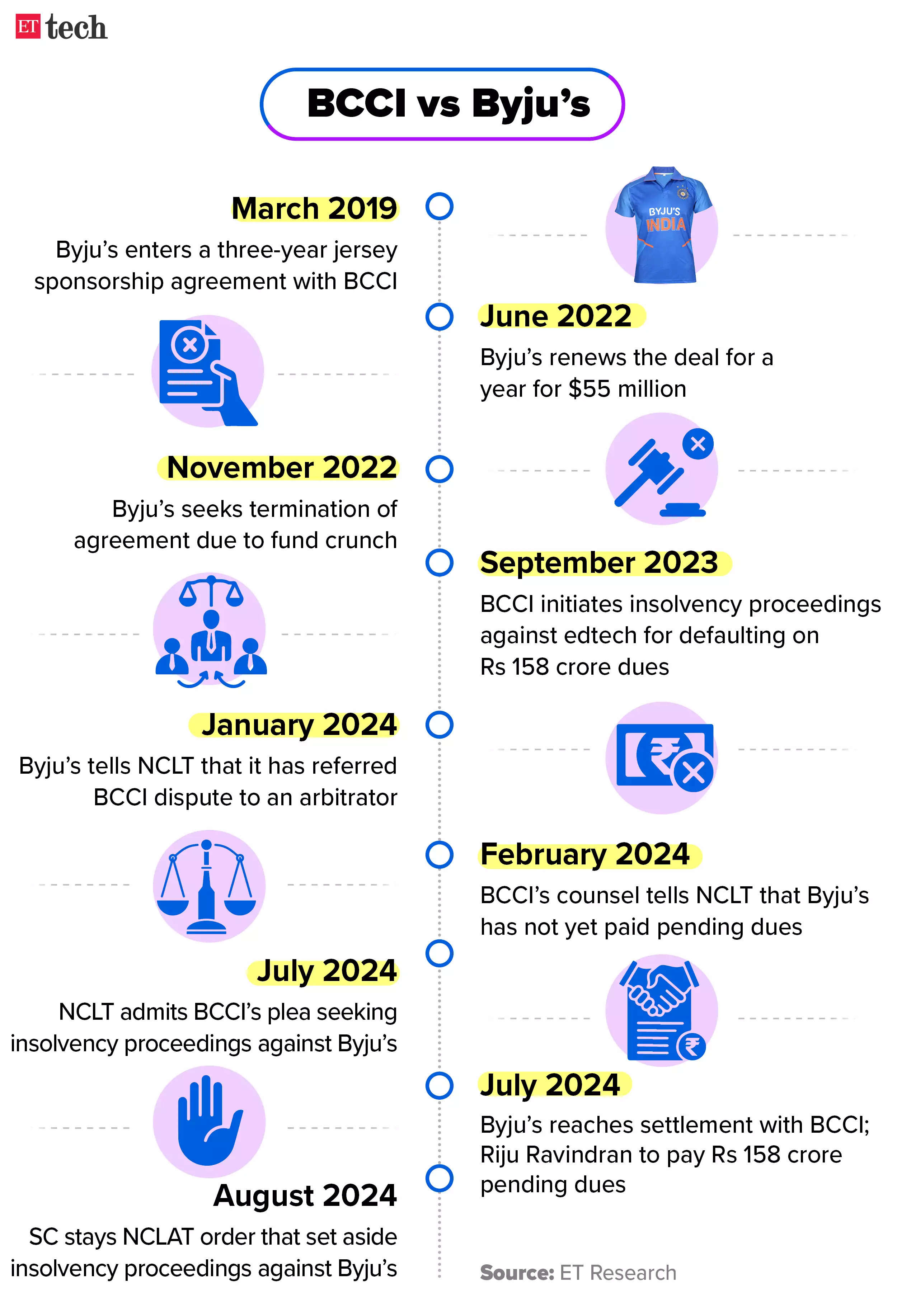

Byju’s vs BCCI: SC stays NCLAT order quashing insolvency case against edtech

The Supreme Court on Wednesday stayed the order of the National Company Law Appellate Tribunal (NCLAT) approving the settlement between education technology company Byju’s and the Board of Control for Cricket in India (BCCI) over unpaid dues of Rs 158 crore.

The court had previously annulled the bankruptcy proceedings initiated by the BCCI against Byju’s after an agreement between the two parties.

Fine print: Solicitor General Tushar Mehta, appearing for the BCCI, opposed the appeal against the NCLAT order. He said the earlier agreement with Byju’s will not stand in light of the stay. The Supreme Court bench, headed by Chief Justice DY Chandrachud, asked the cricket administrator to keep the settlement amount in a separate account till August 23, the next date of hearing.

Appeal to the High Court: The NCLAT order It was appealed by Glas Trustthe trustee for lenders to whom Byju’s owes $1.2 billion. Glas Trust had alleged that money paid to the cricket authority by Riju Ravindran, brother of the company’s founder Byju Raveendran, was tainted.

Ravindran’s lawyer had said would be using personal funds to make the payment.

Background: The BCCI had moved NCLT under the Insolvency and Bankruptcy Code (IBC) over non-payment of Rs 158 crore by Byju’s parent company Think & Learn.

The company had signed a jersey sponsorship deal with BCCI in March 2019 for three years, which was extended by one year. The company made the payments till September 2022 and the dispute is due to non-payment during the period from October 2022 to March 2023.

Other featured stories from our reporters

Explained: China’s bet with Jimeng and other GenAI models: TikTok parent company ByteDance last week launched a new text-to-video generative AI app called Jimeng AI, said to be a rival to OpenAI’s Sora, which has yet to be made publicly available. We take a closer look at it Jimeng and other Chinese GenAI models and its place in the global AI race.

Swiggy changes service fee policy; restaurants outside metropolitan area will pay more in commissions: Food delivery company about to go public Swiggy has started charging its service fee on the gross value of the order.which also includes GST and packaging charges, from restaurants outside metro cities. This will effectively increase the commission paid by their restaurant partners in such markets.

Ecom Express gets board approval for Rs 2,600 crore IPO: The board of directors of Ecom Express has approved the plan for a Rs 2,600 crore IPO. According to internal company documents accessed by the RoC, Ecom Express is considering a fresh issue of up to Rs 1,284.5 crore and an offer for sale (OFS) component of up to Rs 1,315.5 crore.

Flexiloans to raise $35 million in new capital: Flexiloans, a digital lending platform for small businesses, is in talks with a group of large global companies and Domestic investors will raise around Rs 300 crore ($35 million) In a new round of capital, two people familiar with the matter said.

Global Picks We’re Reading

■ Amazon, Meta and Big Tech bet on rewriting the rules on net zero emissions (FOOT)

■ The tech job that pays six figures and doesn’t require a college degree (WSJ newspaper)

■ The ACLU is fighting for its constitutional right to make deepfakes (Cabling)

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.