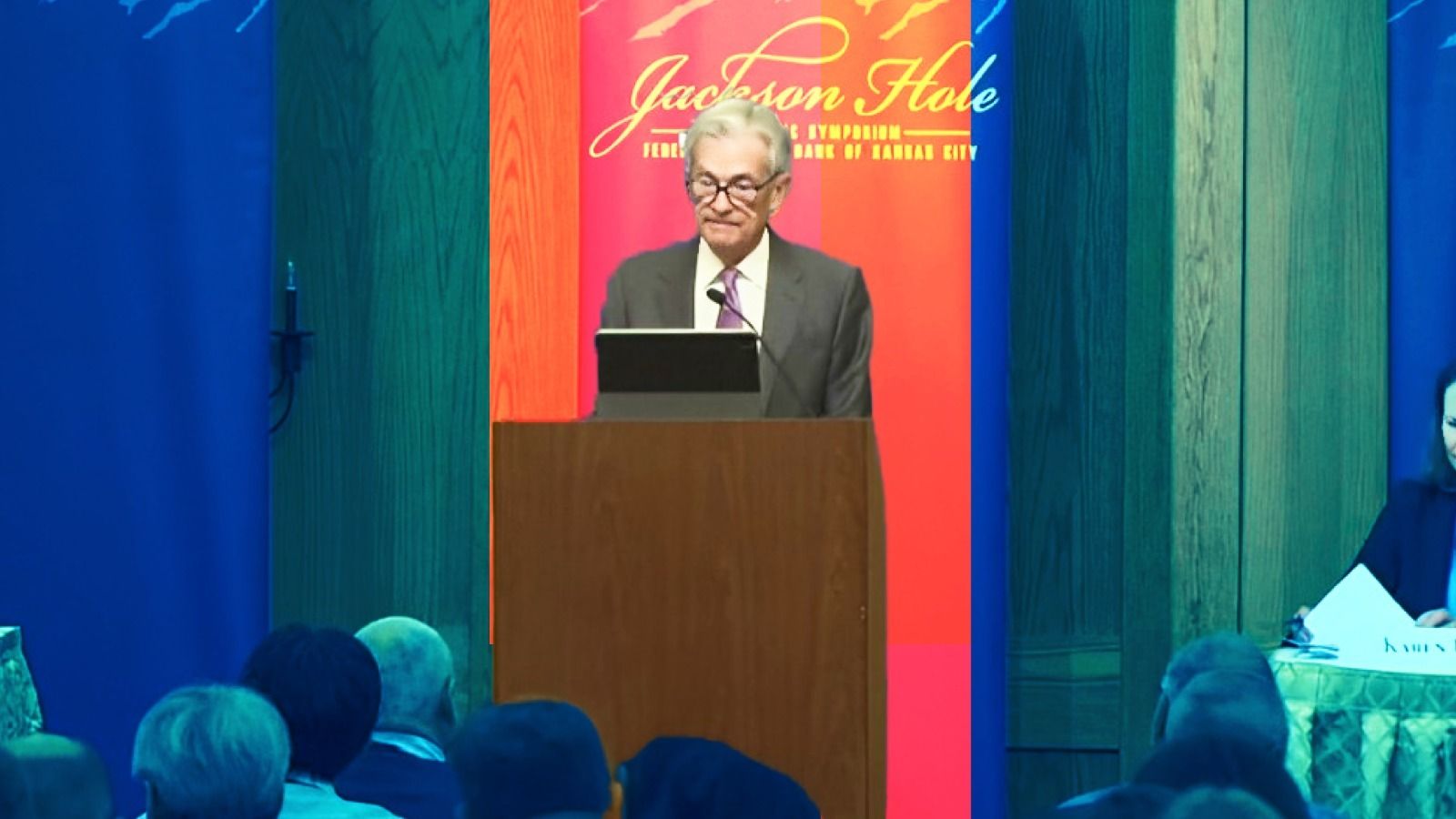

Rate cuts: Federal Reserve Chairman Jerome Powell said Friday that “the time has come” for the U.S. central bank to cut interest rates as rising risks to the labor market leave no room for further weakness and inflation is near the Fed’s 2 percent target, offering explicit backing for an imminent policy easing.

“Upside risks to inflation have diminished, and downside risks to employment have increased,” Powell said in a highly anticipated speech at the Kansas City Fed’s annual economic conference in Jackson Hole, Wyoming. “The time has come for policy to tighten. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Powell validated market expectations for a rate cut in September, while continuing to rely on data dependence and the economic outlook going forward.

“The FX market is a relative game, so the expectation that the Fed will soon join the other major banks in cutting rates is pushing the dollar lower. Although the dollar is under pressure, implied rate cut estimates have not moved significantly: the expectation for the September meeting remains around 30 basis points and total expected cuts by year-end have only increased from around 95 basis points to 100 basis points at this point.

“With inflation on track to target, employment risks take on a more important role going forward following the large negative revision to payrolls, and the Fed’s reaction to the employment figures will continue to drive the dollar.”

STEVE ENGLANDER, DIRECTOR OF GLOBAL CURRENCY RESEARCH AND MACROECONOMIC STRATEGY, STANDARD CHARTERED BANK, NEW YORK

“I think the reaction of the markets, which has been a slightly weaker dollar and slightly lower bond yields, is the right one. It’s not like I’m saying, ‘Yeah, we’re going to do three 50% interest rates to start the easing cycle.'”

“What he did was focus a lot on the fact that the inflation target is in sight, that they’re concerned about the labor market, saying the labor market doesn’t have to weaken any further. So he’s implicitly opening the door to a level of 50 at some point without giving a timeline for that. We don’t think 50 is going to be the first step yet, but it could come quickly if the labor market continues to weaken.”

DAVID DOYLE, CHIEF ECONOMIC OFFICER, MACQUARIE GROUP, TORONTO

“Powell has set the stage for rate cuts to begin in September. The extent of easing in the coming months will depend on upcoming data, and the labor market will play a major role in this.”

SAM STOVALL, CHIEF INVESTMENT STRATEGIST, CFRA RESEARCH, ALLENTOWN, PA

“I was a little surprised that he was quite clear in his statement that inflation is coming down. They are confident that inflation will continue to come down and that employment has not been negatively affected.”

“He wants markets to know that the Fed is not far behind. By being so clear about the likelihood of a rate cut in September, he is actually cutting rates a month early.”

“Powell was clear about the first rate cut, but not so clear about the subsequent ones, so I don’t think he’s going to go for a 50 basis point cut. But I think the Fed wants to move this first part of easing forward slowly and steadily.”

ELIAS HADDAD, SENIOR MARKET STRATEGIST AT BROWN BROTHERS HARRIMAN, LONDON

“The reason Powell’s message is dovish is because he is increasingly concerned about the US labor market. There is reasonably strong growth in the US now that the central bank is about to ease policy. It’s the perfect cocktail sauce for a rally in stocks. This will continue into next week or at least until we see the next jobs numbers. A stronger than expected increase in nonfarm payrolls is needed to turn this around.”

ANDRE BAKHOS, MANAGING MEMBER, INGENIUM ANALYTICS LLC, PLAINSBORO, NEW JERSEY.

“I now expect a 50 basis point cut, but the caveat would be that if the labor market numbers are very weak in early September, that could certainly turn a 50 basis point cut into a 75 basis point cut.”

“Long-term trends in stocks are strong and any weakness is an opportunity to increase exposure. But again, in the short term, we are going to have volatile, erratic and choppy moves because no one really knows what will happen now that (Powell) has shown his cards and said what everyone expected. We will have to see how this plays out.”

GLEN SMITH, INVESTMENT DIRECTOR, GDS WEALTH MANAGEMENT, TEXAS

“Powell’s comments at Jackson Hole virtually lock in a 25 basis point rate cut in September, as the Fed has been announcing for quite some time now. The September meeting is three weeks away and there are only a handful of jobs and inflation data due out until then and these upcoming data are unlikely to change the Fed’s plans to cut rates by 25 basis points next month.”

“While a September rate cut is pretty much a done deal at this point, the bigger question is whether this will be a one-time rate cut or the start of a more substantial rate-cutting cycle, and that will be determined by economic data over the next two to three months. The market is pricing in multiple rate cuts over the next 12 months, though we remind investors that the market has a history of being overly optimistic about rate cuts.”

“We have now seen more evidence than ever that a soft landing has been achieved. Since the post-COVID inflation rebound, consumer prices are now closer than ever to the Federal Reserve’s 2% target. While there has been a slowdown in economic data, that is very different from a recession.”

KARL SCHAMOTTA, CHIEF MARKET STRATEGIST, CORPAY, TORONTO

“He has signaled growing concerns about the labor market and that is really helping to reinforce market expectations for multiple cuts over the fall months. I think the key line is that they will ‘do everything they can to support a strong labor market as we move toward price stability. ’ So, to me that suggests that he is acknowledging the growing concern among policymakers about the direction of labor markets.”

“It does not put on the table a 50 basis point cut for September, and I think that is somewhat in line with what the markets have been anticipating as well.”

WASIF LATIF, PRESIDENT AND CHIEF INVESTMENT OFFICER, SARMAYA PARTNERS, PRINCETON, NEW JERSEY

“We see from the price action that the markets are happy. They are finally getting the sugar they were hoping for from the Fed. As far as rate cuts go, the forward projections have been a bit mixed, depending on who’s speaking at the Fed. But obviously when you listen to the chairman, he’s speaking for the entire committee. And now it’s clear, the projections are that rate cuts are coming. The markets are rejoicing about that. The markets have been waiting for these sugars and now they’re getting them. But as with many sugars, there’s an immediate sugar rush and then there’s the reckoning that we still have to get through.”

PAUL CHRISTOPHER, DIRECTOR OF GLOBAL STRATEGY, WELLS FARGO INVESTMENT INSTITUTE, ST. LOUIS, MISSOURI

“There’s no question that they’re going to cut rates, but the question is how much… It’s more dovish than I would have expected because the labor market is really not at a level that’s anywhere near recessionary based on the data we’ve seen. After all, we heard Fed officials yesterday advocating for gradual, methodical approaches.”

“Today we heard the Fed Chairman begin by saying that he neither seeks nor welcomes a further cooling in labor market conditions.”

“This indicates that they are definitely going to cut rates. Can they continue to be gradual? Yes. It’s a positive message. It’s a clear message. Is it a signal to throw all the money into the market? No. They will continue to be gradual and the market may be getting ahead of itself as to how quickly the Fed will follow through on its promises.

Therefore, we believe that there will be more volatility in this market towards the end of this year.”

PETER CARDILLO, CHIEF MARKET ECONOMIST, SPARTAN CAPITAL SECURITIES, NEW YORK

“Powell is showing restraint and says there is ample scope to respond to any risks we might face. I think that is the key.”

“What he’s suggesting here is that if the labor market continues to weaken, we’re looking at a 50-basis-point rate cut in September rather than a 25-basis-point cut.”

“The time has come for monetary policy to tighten and we neither seek nor welcome a further cooling of labor market conditions. That is another key point and tells me that we are looking at a 50 basis point cut in September.”

“Looks like it’s responding to the big reference check we had the other day.”

“He also says that confidence has grown that inflation is coming back down to 2%. Powell is sounding dovish today and we see markets responding accordingly.”

“I think we will have two cuts, a total of 75 basis points this year, especially if the August jobs report indicates further weakness.”

MARC CHANDLER, CHIEF MARKET STRATEGIST, BANNOCKBURN GLOBAL FOREX, NEW YORK

“I think the market is going to be very dovish initially, which will push interest rates and the dollar lower. I’m not sure yet if this will last. I don’t think it’s going to tell us anything that we don’t already know.”

“He’s basically saying the magnitude will be determined by the data, and if you look at what’s likely in the jobs and CPI data before the Fed meets, and the overall tone, I don’t see a strong sense of urgency or panic that a 50 basis point cut would seem to imply.”

KIM FORREST, CHIEF INVESTMENT OFFICER, BOKEH CAPITAL PARTNERS, PITTSBURGH

“Looking back at the history of the economy over the last few years, it seems that we have reached a point where the Fed needs to be more accommodative and the markets are reacting to that.”

“All he has told us is that it is all based on data. They are not going to lower rates immediately.”

“Especially with regard to Bostic’s comments, and they all know what the script is and stick to it. He was pretty dovish, especially on the actual rate. He said it’s restrictive. These comments indicate that cuts are starting and the market is nodding in agreement.”

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.