Tron meme coin developer SunPump has attracted a lot of attention by generating over $1.1 million in revenue days after its launch. Despite the platform’s success, there is still growing skepticism about the sustainability of meme coins, particularly as data shows that most traders on similar platforms like Solana’s Pump.fun are losing money. Meanwhile, Solana’s Dumpy.fun is launching a new tool to capitalize on tokens with large short positions.

SunPump gains ground

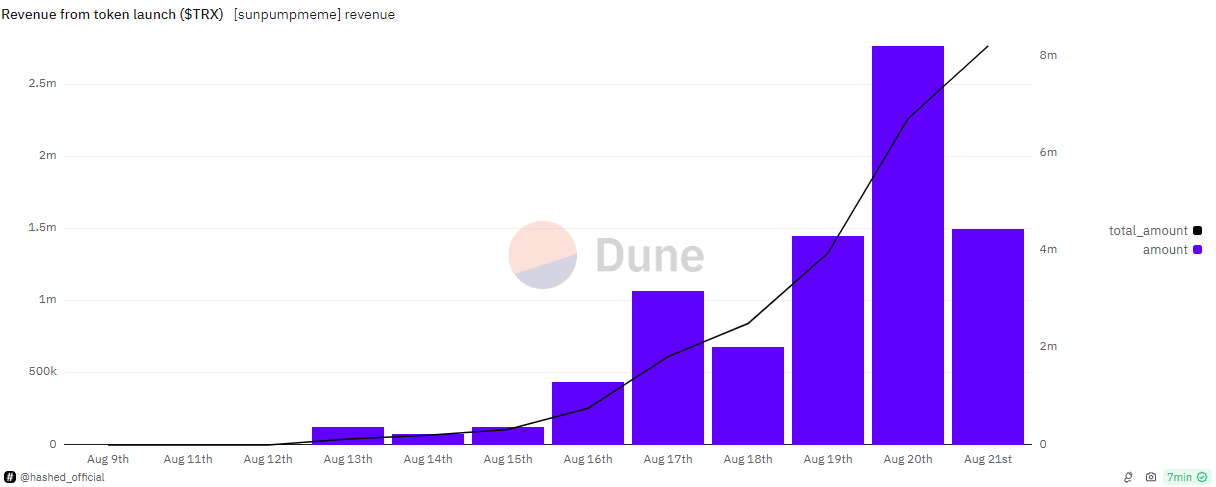

SunPump, a new meme coin implementer on the Tron The blockchain platform has quickly gained attention in the cryptocurrency space by generating over $1.1 million in revenue just 11 days after its launch. According to data from Dune, the Justin Sun-backed platform has generated a total of 8 million Tron (TRX) since its debut on August 9.

SunPump revenue since launch (Source: Dune)

SunPump’s highest earning day so far was on August 20, when he earned almost 2.78 million TRX, which is equivalent to $400,000. In addition, over $6,000 meme coins were created that day. On the same day, Sun also announced at X that SunPump was temporarily out of service due to “unprecedented traffic,” but the platform was up and running about an hour later.

The launch of SunPump has led to a surge in liquidity on the Tron blockchain, which was also boosted by a $10 million allocation from the Sun Meme Ecosystem Boosting Incentive Program. Tether also coined another billion USDT tokens on the Tron blockchain on August 20.

DefiLlama indicates that Tron has seen its revenue skyrocket in recent days. In fact, Tron generated $3.84 million in the past 24 hours, which is more than double the $1.06 million from the previous day.

Despite the success, the value of meme coins remains a topic of debate in the cryptocurrency community. Specifically, skeptics point to things like the fact that most traders on the platform are not Solana meme coin The Pump.fun launchpad has been losing money. More than 1.7 million tokens have been launched on Pump.fun since January, but very few of them have reached a total value of more than $63,000.

During a round table held on August 13 in Canadian Futurists ConferenceJelena Djuric, CEO of Appchain Noble, shared her own skepticism about the longevity of meme coins, despite their continued popularity. However, Justin Sun It remains very optimistic about the future of meme coins and recently stated in a social media post that their success is no fluke. He believes that when developers can build communities through fair launches and gain widespread support, these communities can share in the success of cryptocurrency.

Skepticism about meme coins grows

Skepticism about meme coins has further intensified this week due to the drop in Solana-based meme coin trading volumes and the fact that most traders on Pump.fun are actually losing money. In an August 19 newsletter, messer Data engineer Mike Kremer has added his voice to the ongoing debate, calling meme coins the “most extractive crypto phenomenon” since the ICO boom of 2017.

According to Kremer, speculative bubbles have always been part of the crypto ecosystem, and past fads like DeFi The summer left behind some residual value, as projects like Uniswap Labs launched protocols that provided real utility. In contrast, Kremer believes meme coins have a “much more destructive dynamic,” where insiders create tokenspromote them and attract retail investors to buy them. Once the price inflates, insiders dump their holdings, leaving the tokens with no real value or utility. Overall. This leads to a zero-sum game where value is not only redistributed but destroyed.

Kermer shared his thoughts as concerns have grown over Solana’s meme coin implementer Bomb.Funwhich has been accused of making meme coins more treacherous and dilutive than before. Since its launch in January, millions of new tokens have been deployed on the platform, but less than 1.5% managed to reach a total value of more than $63,000.

Recent data also suggests that 60% of Pump.fun traders lost money and only 3% ended up making profits of over $1,000. However, there is an ongoing debate over the accuracy of this data, with some arguing that it does not take into account realized profits.

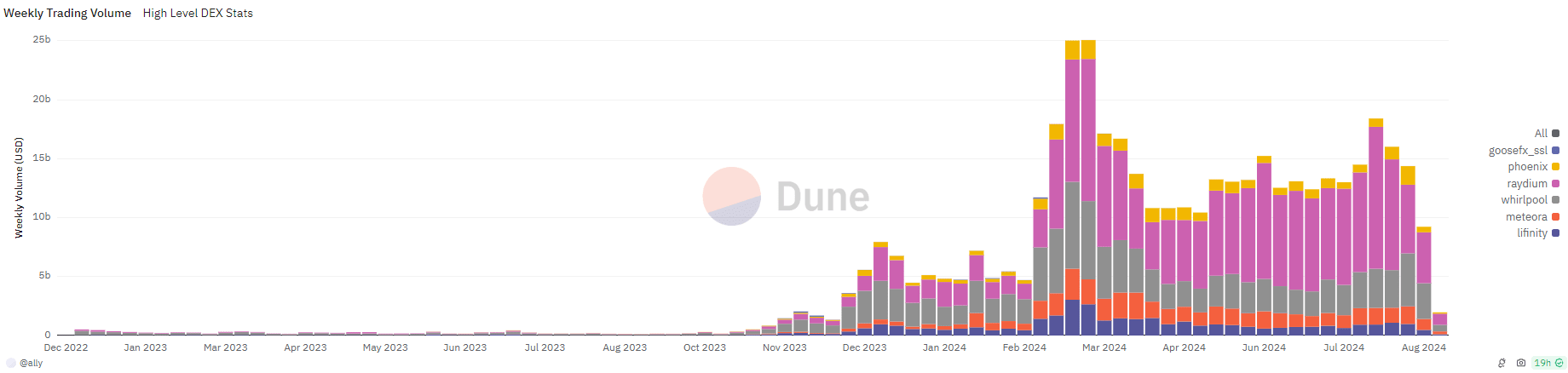

There has also been a sharp drop in the Solana-based meme coin. trading volumeswhich have fallen by up to 80% in the past two weeks. In addition, a CoinShares report revealed that Solana listed products experienced a record outflow of $39 million.

Solanan Meme Coin Weekly Trading Volume (Source: Dune)

The jury is still out on whether meme coins are actually beneficial to the crypto ecosystem. OnlyAlon, the pseudonymous developer of Pump.fun, argues that the market sees the lower implementation costs of meme coins as a positive, which is certainly supported by the high activity of the platform. Alon believes that meme coins are becoming more accessible, making it much easier for outsiders to join the cryptocurrency market. He also claims that each iteration of new meme coin technology reduces the risk of scams and prepares the sector for mass adoption.

Others also argue that meme coins offer an “easy” entry point for newcomers, despite the risks involved. In April, Avalanche Founder Emin Gün Sirer shared that while meme coins may be inherently useless, they still serve a function of “social signaling” and forming strong crypto communities.

He believes that meme coins are beneficial to the space as they attract and engage people. In December, Avalanche even announced that it will begin using its $100 million community fund that was originally launched to support NFT artists, to buy meme coins.

Meanwhile, a Solarium The protocol that was initially designed to short meme coins is launching a new app that will allow users to go long on popular cryptocurrencies. short circuit tokens. The Chubby Fun Protocol is well known for its profitable meme coin short selling platform. On August 20, it announced that it will be launching a short selling tool called “Squeezing. Hahaha” on August 27. This new tool is set to usher in a “new era of PvP,” referring to the aggressive player-versus-player trading style fostered by meme coins.

Squeezy.lol will allow meme coin traders to take advantage of tokens with large short positions by using the “short position explorer,” a feature that points out meme coins with the most short positions. This tool will help investors identify these assets and potentially trigger a “short position” by mobilizing meme coin communities.

TO Short squeeze occurs when the price of a heavily shorted asset increases rapidly, forcing short sellers to buy more of the asset to cover their positions.

Dumpy.fun has been allowing users to short Solana meme coins with small amounts of leverage, which has been quite profitable for many traders given the recent sharp drop in Solana-based meme coin prices. Traders short sell tokens by betting that the price of an asset will decrease. However, when the price rises rapidly, it can result in severe losses for short sellers. This was the case in 2021 with the GameStop sagawhere retail traders forced hedge funds to liquidate their short positions.

Dumpy.fun currently supports 11 meme coins, including Dogwifhat (WIF), Wen (WEN), and Bonk (BONK). The platform has also announced plans to introduce permissionless listings, allowing users to short newly created tokens of their choice.

DOGS token generation event postponed

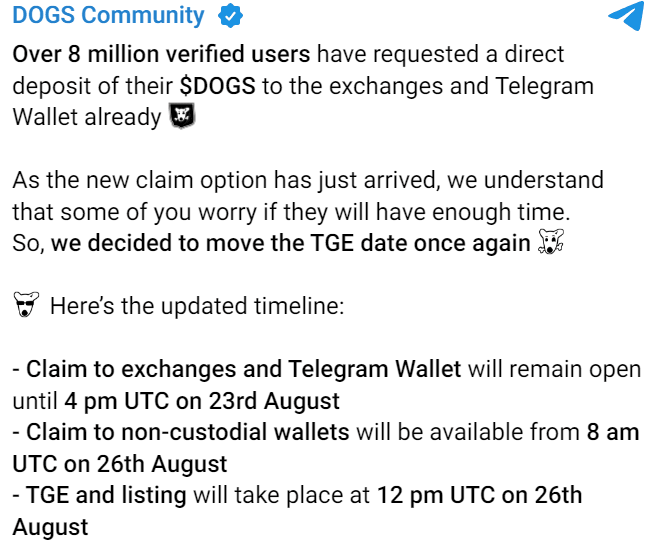

The token generation event (TGE) for the DOGS meme coin has been postponed from August 23 to August 26 due to overwhelming demand and a record number of claim requests. The delay came after more than 8 million verified users registered for direct deposits to your exchange house Wallets and Telegram Wallet. The TGE was originally scheduled for 12pm UTC on August 23, but was delayed to ensure that all users had enough time to claim their tokens.

Telegram message from DOGS (Source: Telegram)

DOGS has been trending on X as important cryptocurrency exchanges are preparing to list the token. However, this latest delay is already the second postponement of the TGE due to high demand. It was previously delayed after 6 million applications led to the addition of more withdrawal options.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.