During the recent US presidential debate between Kamala Harris and Donald Trump, neither candidate mentioned cryptocurrencies. The debate focused more on issues such as the economy and immigration. The price of Bitcoin fell after the debate, which undoubtedly reflected the disappointment among crypto investors over the lack of policy debate. Analysts still suspect that a Harris win could negatively impact the cryptocurrency market, while a Trump win may result in huge gains for Bitcoin. While cryptocurrencies are expected to influence voters’ decisions, neither candidate has made any concrete promises regarding cryptocurrencies.

No mention of cryptocurrencies in the presidential debate

During the first debate between the Vice President of the United States Kamala Harris and former President Donald Trump on September 10, neither candidate even mentioned cryptocurrencies. debate He focused more on other important issues such as the economy, abortion rights, immigration and foreign policy.

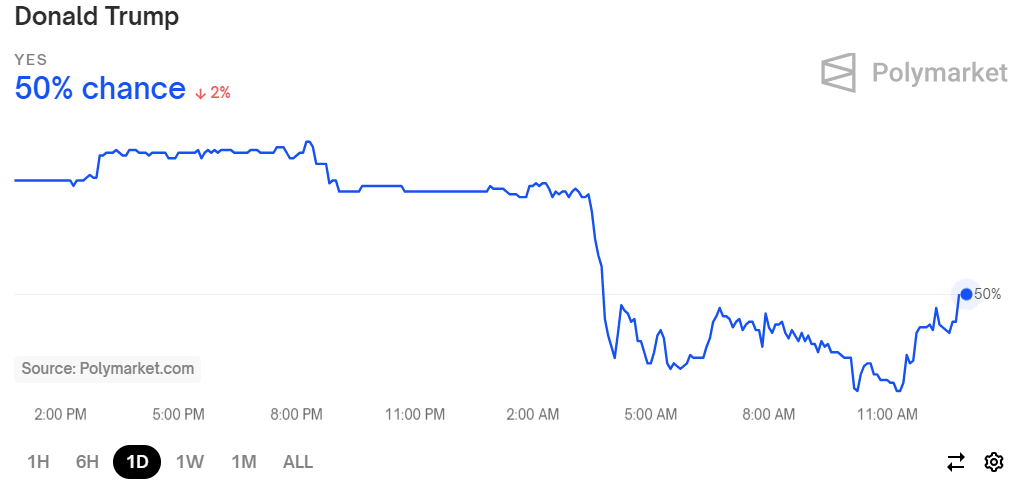

During the debate, Trump odds of winning Upcoming elections delayed by up to 3% on decentralized betting platform Multimarketwhich reduced her chances to 49%. This drop left Harris and Trump tied in terms of their election odds on the platform. Trump’s odds of winning recovered slightly to 50% at the time of publication.

Trump’s odds of winning the presidency during the final day (Source: Multimarket)

Throughout the debate, Harris maintained her composure, while Trump at times seemed a bit agitated and made several inaccurate claims, according to the fact-checking agency PolitiFact. Shortly after the debate, the pop star Taylor Swift Swift also supported Harris, describing her as a “steady-handed” leader to her millions of Instagram followers, contributing to the public momentum Harris gained during the debate.

Several market analysts have speculated that a Harris win could have big implications for the cryptocurrency market. Bernstein previously predicted that a Trump win could push the Bitcoin price to $90,000 by the end of the year, especially since Triumph He has made his support for the cryptocurrency industry very clear. He also promised to dismantle current anti-cryptocurrency regulations and turn the United States into a global hub for cryptocurrencies.

On the other hand, Harris unclear position Interest in cryptocurrencies has led some people to believe that his victory could cause the price of Bitcoin to fall to $30,000.

The lack of crypto-related discussion in the debate comes despite the crypto industry’s impressive influence on the 2024 election cycle so far. Cryptocurrency-backed supermarkets political action committees Political action committees (PACs) have raised more than $202 million. The largest PAC, Handshakespent more than $70 million, mostly on Democratic candidates.

Despite this financial involvement, cryptocurrencies have not become a priority issue for American voters. Polls indicate that the economy, inflation and immigration are more pressing concerns.

Harris’ campaign focuses on the economy and ignores cryptocurrencies

Democratic presidential candidate Kamala Harris is described New details of the policy ahead of the 2024 US presidential election. He mentioned economic innovation, but also Did not explicitly address digital assets or blockchain technology. An update to the “issues” section of the Harris-Walz campaign website put a heavy emphasis on a “fairer” tax system and policies aimed at benefiting the middle class.

While Harris’s platform plans to support innovation, including in sectors such as artificial intelligence and semiconductors, there is no direct mention of cryptocurrencies, which contrasts with the Republican platform led by Donald Trump’s campaign, which advocates for innovation through cryptocurrencies.

The Democratic candidate entered the presidential race on July 21 after President Joe Biden announced he would not seek reelection. Some experts suggest Harris can’t stray too far from the The Biden administration’s approach to digital assets, which has faced much criticism for its regulatory stance on cryptocurrencies. Despite this, several Democratic lawmakers who support pro-cryptocurrency policies have united behind Harris and see her campaign as an opportunity to reframe the party’s perception of the digital asset industry.

Brian Nelson, a senior adviser to Harris’ campaign, said the candidate supports policies that encourage the growth of the industry. In addition, some former members of the Biden administration officials with crypto backgrounds have joined the Harris campaign or related political action committees.

Bitcoin price falls as debate disappoints

Bitcoin Price On September 11, the cryptocurrency market crashed after the US presidential debate left crypto enthusiasts quite disappointed. In just one hour, Bitcoin lost $1,000 in value and fell to a local low of $56,099. At the time of writing, the price of BTC stood at $56,609.16, according to CoinMarketCap.

The lack of discussion on crypto policies by Trump and Harris dampened hopes for progress in favor of cryptocurrencies. QCP Capital He commented on the market reaction and noted that crypto investors were very dissatisfied with the lack of attention to digital assets. They also shared that the overall market sentiment could become risk-averse ahead of the US crisis. choice in November.

Attention has now shifted to the release of the Consumer Price Index (CPI) for August. Markets are anticipating a lower figure of 2.55% compared to 2.9% previously. Despite the CPI event, QCP Capital downplayed its potential impact on the market and instead stressed the importance of the unemployment data as previous jobless reports have caused short-term volatility for the market. Bitcoin.

Cryptocurrency analyst Michaël van de Poppe suggested that the ongoing correction in Bitcoin price is typical before major CPI events. He remains optimistic and stated that Bitcoin price could stabilize if support holds at $55,000 to $56,000.

Meanwhile, technical patterns on the 4-hour chart revealed resistance at key moving averages. According to the trader Daan Cryptocurrency TradingBitcoin is struggling to break above both the 200-period simple moving average (SMA) and the exponential moving average (EMA), set at $59,200 and $58,840, respectively. These levels are considered indicators of market strength or weakness. The bulls must reclaim them to initiate a stronger price recovery.

Cryptocurrencies will influence voters’ decisions in 2024

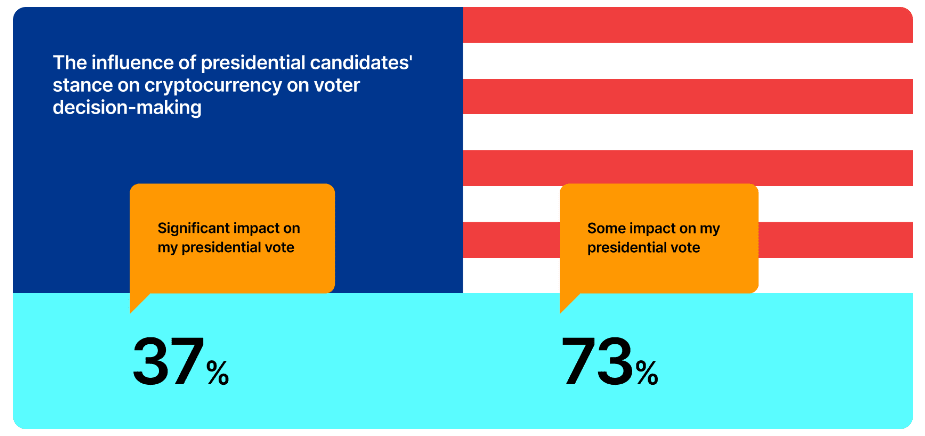

Cryptocurrencies are expected to play a major role in the upcoming US presidential election as many American cryptocurrency investors are concerned about candidates’ approaches to regulating the industry. According to a new study, report of GeminiMost US cryptocurrency owners plan to consider a candidate’s stance on cryptocurrency regulation when they vote in November.

The report is based on a survey of 6,000 adults across multiple countries and found that 73% of US cryptocurrency holders said a candidate’s position on cryptocurrencies will influence their vote. 37% said it would have a major impact.

Influence of presidential candidates’ stance on cryptocurrencies (Source: Gemini)

Gemini noted that this is the first time in US history that cryptocurrencies have become a serious issue in a presidential electionThe report also revealed growing concerns about regulatory uncertainty as a barrier to investing in cryptocurrencies. In 2024, 38% of U.S. respondents cited regulatory concerns as a reason for hesitating to enter the cryptocurrency market, up from 28% in 2022.

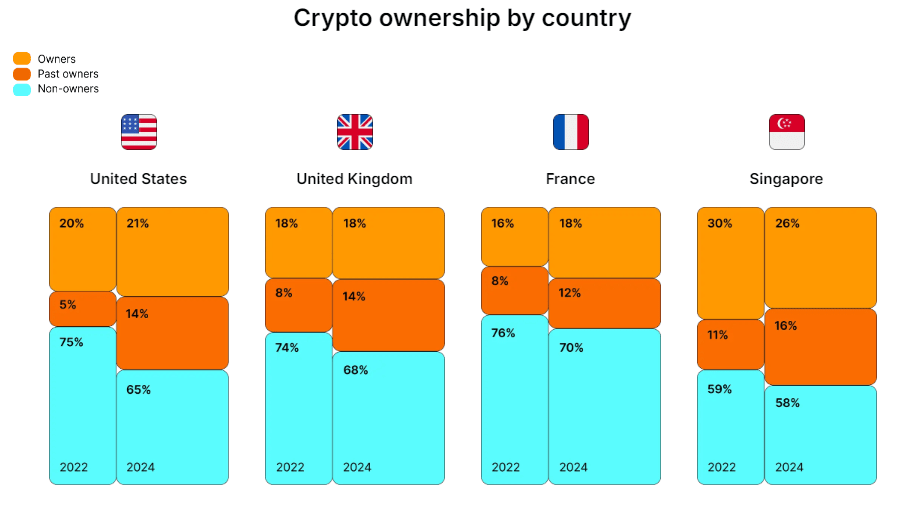

Despite these concerns, US investors appear to be gradually moving towards cryptocurrencies. The percentage of respondents with no exposure to cryptocurrencies dropped from 75% in 2022 to 65% in 2024. In addition, the number of previous respondents cryptocurrency holders increased from 5% in 2022 to 14% in 2024.

Cryptocurrency ownership by country (Source: Gemini)

While some reports, such as one from the U.S. Federal Reserve, suggest a decline in cryptocurrency use among American adults, Gemini’s findings indicate a growing awareness of the role of cryptocurrencies in economics and politics.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.