The odds of Kamala Harris winning the 2024 US presidential election have surpassed those of Donald Trump on Polymarket. Meanwhile, the US Commodity Futures Trading Commission (CFTC) is facing backlash from the crypto industry over a proposed rule to ban political prediction markets like Polymarket. Additionally, recent actions by the Federal Reserve against crypto-friendly banks have raised questions about Harris’ true stance on crypto, while the IRS has updated its digital asset tax filing form for 2026.

Harris takes lead over Trump

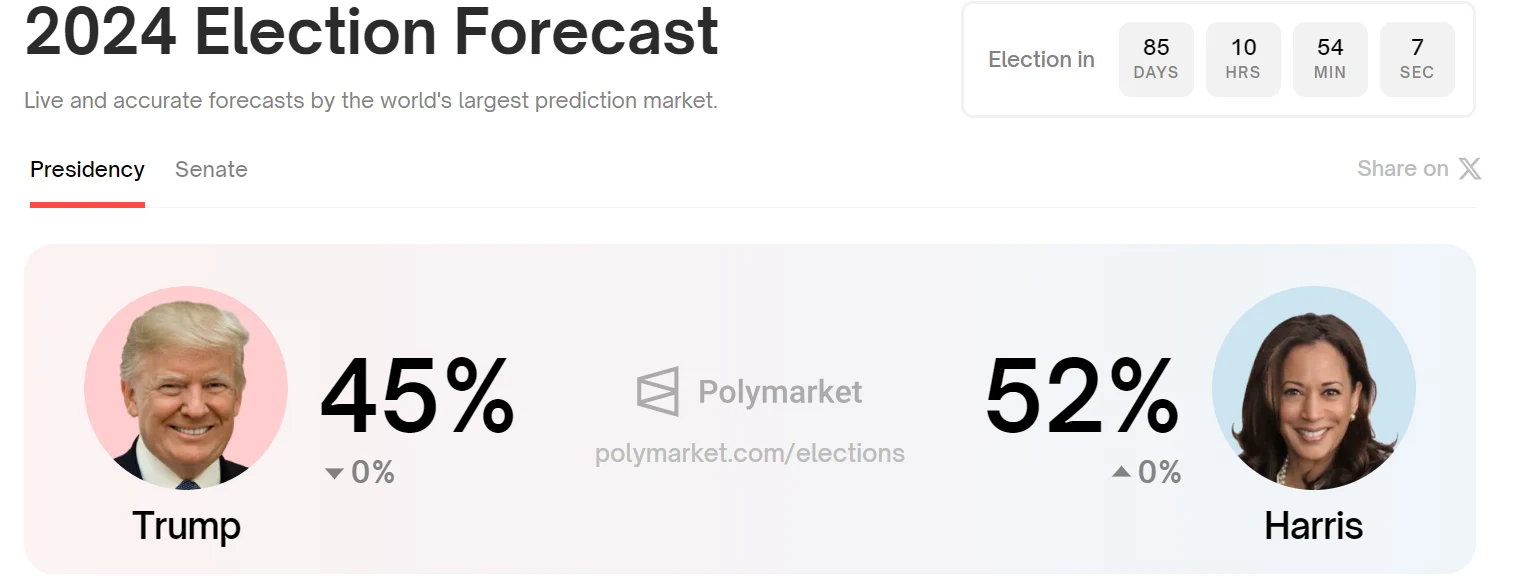

Over the weekend, the Vice President of the United States Kamala Harris saw that his chances of winning the next presidential election exceeded those of Donald Trump. MultimarketHarris’ chances of winning the presidency rose to 52%, while Trump’s fell to 45%, a sharp drop from 70% in mid-July. The shift came on Saturday and was a pivotal moment in the race.

2024 election forecast (Source: Multimarket)

The US election results have become the largest prediction market on Polymarket, with its volume exceeding 572 million dollarsAs cryptocurrencies have begun to play an increasingly important role in the election, Harris’ team has begun Reaching out to the cryptocurrency industry. Trump has also recently reiterated his stance Support for Bitcoin.

While Harris and her running mate, Tim Walz, have yet to publicly address the topic of cryptocurrencies, legislation to strengthen regulation of cryptocurrency kiosks was enacted during Walz’s tenure as Minnesota governor. Grassroots organization Crypto4Harris is also gaining momentum, with plans to host a town hall featuring the likes of Crypto Council for Innovation CEO Sheila Warren and billionaire Mark Cuban.

Meanwhile, Trump recently expressed his opinion that the United States should focus on developing cryptocurrencies. Instead of selling And he warned that other countries like China are already making progress in this industry. To add to the political drama, Elon Musk is planning to have a live conversation with Trump on X.

Cryptocurrency leaders oppose US ban on prediction markets

A rule change proposed by the U.S. Commodity Futures Trading Commission (Federal Trade Commission (CFTC)) that could potentially Ban political prediction markets In the United States, the rule has generated a lot of opposition from leaders in the cryptocurrency and fintech industries. Some well-known companies such as Gemini, Crypto.com, Robinhood and influential blogger Scott Alexander have shared their concerns about the rule, which seeks to clarify that prohibited “event contracts” include betting or risking something of value on the outcome of political contests, prize competitions or sports games.

This new rule is supported by the Senator Elizabeth Warren as well as other Democrats, and aims to prevent these contracts from being negotiated by entities registered with the CFTC. The lawmakers argue that as the 2024 election approaches, the political environment is already rife with challenges, including dark money in campaigns, the threat of violence and foreign interference. They believe that allowing bets on election results could further destabilize the political system.

However, individuals and companies in the cryptocurrency industry have opposed the proposal. Cameron WinklevossGemini co-founder, urged the CFTC to reconsider its stance and suggested the agency should work with industry stakeholders to build trust rather than denying Americans access to prediction markets. Steve HumenikCrypto.com senior vice president, also criticized the CFTC for potentially overstepping its authority.

Dragonfly Capital Associate General Counsel Jessica Furr and Bryan Edelman, discussed that the CFTC may not have jurisdiction to regulate choice event contracts and that such a determination should be made by the courts. This sentiment was echoed by other opponents, including Robinhood and the founder of BettingElections.com.

Fed action fuels doubts about Harris’ stance on cryptocurrencies

The recent Compliance action by the United States Federal Reserve against Cryptocurrency friendly Customers Bank has sparked much speculation about Vice President Kamala Harris’s commitment to repair relations with the cryptocurrency industry. On August 9, Tyler WinklevossGemini co-founder took to X to share details about the Federal Reserve’s actions and suggested that “Operation Choke Point 2.0” is still active and that the Harris campaign’s crypto reboot is disingenuous.

Screenshot of Tyler Winklevoss’s x post (Source: unknown)

The Federal Reserve’s 13-page enforcement measure requires Customers Bank to provide 30 days’ notice before entering into any new banking relationship with a cryptocurrency firm. According to Winklevoss, this could have significant consequences, as Customers Bank is one of the few banks that remain crypto-friendly in the U.S. He also criticized the Federal Reserve for centralizing decision-making power over which cryptocurrency firms can access banking services, and argued that decisions like these should be made independently by each bank.

Charles Hoskinson, the founder of Cardano, fully agrees with Winklevoss’ concerns, and recently stated that the current US administration, led by President Joe Bidenis hostile towards the cryptocurrency industry. He warned that Harris’ election could further harm the US cryptocurrency sector and even hinted that her administration will continue what he perceives as a “War on cryptocurrencies.”

In July, a group of US lawmakers and congressional candidates sent a letter to Democratic National Committee Chairwoman Jaime Harrison urging the party to take a more progressive stance on digital assets and blockchain technology. This came during a difficult period for the US banking sector, which saw the collapse of several banks that served cryptocurrency companies, including Silvergate Bank, Bank of signaturesand Silicon Valley Bankbetween March and August 2023.

IRS Updates Cryptocurrency Tax Form for 2026

Meanwhile, the United States Internal Revenue Service (IRS) updated Its draft form for reporting digital asset transactions, and is scheduled to be implemented in 2026. On August 8, the IRS published a draft of Form 1099-DA, titled “Digital Asset Income from Broker Transactions,” which will allow US taxpayers to report cryptocurrency transactions beginning in 2025, with a filing deadline of April 2026.

The latest version of the draft was compared with the previous one. Released in Apriland included several changes. It removed the requirement for taxpayers to identify the “type of broker” for digital asset transactions, eliminated the need to report the exact time of day for transactions, and omitted spaces for wallet addresses and transaction IDs.

IRS Commissioner Danny Werfel The updated form was created to provide more clarity to taxpayers and serve as a tool to help them accurately report their digital asset transactions, he said.

Drew Hinkes, an attorney at K&L Gates, praised the revised Form X, describing it as “vastly improved,” “less burdensome” and requiring “considerably less” data reporting. Ji KimLegal and policy director at the Crypto Council for Innovation, agreed and noted that the changes were in line with what the industry was advocating.

The IRS has invited comments on the draft form over the next 30 days. The previous version, from April, received some criticism from industry for being too strict, particularly in its requirements to report transaction timing and a broad range of activities.

In June, the IRS finalized its reporting requirements for cryptocurrency brokers, clarifying that decentralized exchanges and self-custody wallets would not be subject to these rules. According to Werfel, these requirements are part of the IRS’s plans to shut down the cryptocurrency market. tax loophole by preventing filers from hiding taxable income.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.