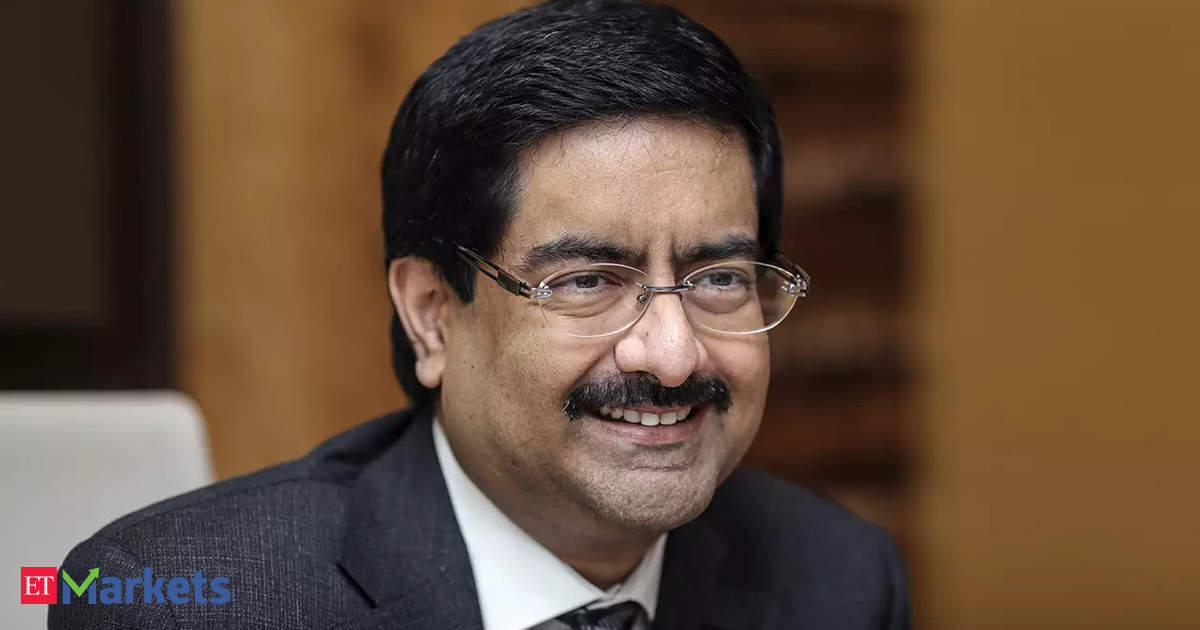

On September 6, Birla bought 1.86 million shares of Vi, according to data available on the National Stock Exchange. Birla’s investment vehicle Pilani Industries and Investment Corporation He also bought 30 lakh shares of the operator on the same day.

Shares of Vi opened at Rs 14.74 apiece on September 6 and closed at Rs 13.35. However, the purchase price for the aforementioned transaction was not available.

But at the closing price on September 6, the purchase would be worth Rs 24.8 crore to Birla and Rs 4 crore to Pilani Investment and Industries.

Vodafone Idea shares rose 2.88 per cent to close at Rs 13.58 on Tuesday.

ET had reported on Tuesday that Vi had approached state-owned lenders in recent weeks. Power Finance Financial Corporation. (PFC) and REC Ltd for loans to cover medium-term financing needs. The telecommunications company is also discussing partial financing of its needs with the State Bank of Indiawhich can lead to a consortium of lenders covering the majority of the financing.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.