In a letter to SEC Chairman Gary Gensler, Tom Emmer and Patrick McHenry questioned the classification of airdrops as securities and pointed out some of the potential negative economic consequences. Meanwhile, the SEC has charged two fraudulent cryptocurrency platforms and reached a settlement with accounting firm Prager Metis over allegations of misconduct over its audits of cryptocurrency exchange FTX. Additionally, former Alameda Research CEO Caroline Ellison’s cooperation with authorities may lead to a reduced sentence for her role in FTX’s collapse.

SEC under pressure over cryptocurrency airdrop rules

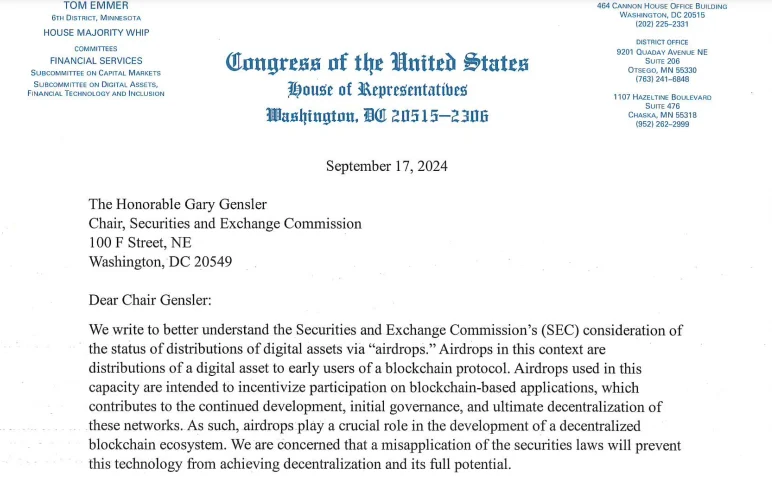

Two Republican lawmakers, Rep. Tom Emmer and House Financial Services Committee Chairman Patrick McHenry, raised some concerns about the U.S. Securities and Exchange Commission’s decision (SECOND) treatment of cryptocurrency airdrops. They demand that the SEC chairman Gary Gensler Address your questions at the end of the month.

In a letter In a Sept. 17 article, Emmer and McHenry pointed to recent SEC lawsuits as examples of the agency’s claims about airdrops. They fear this approach could stifle innovation in the cryptocurrency space.

An excerpt from Emmer and McHenry’s letter to Gensler

Lawmakers are especially concerned about SEC lawsuits against Hydrogen Technology Corporation in September 2022 and Justin Sun in March 2023. In both cases, the SEC alleged that the companies distributed tokens through unregistered airdrops and classified them as securities. Emmer and McHenry believe that the SEC’s stance may harm the ability of U.S. citizens to interact with new and emerging blockchain technologies and hinder the process of decentralization.

In their letter, the lawmakers also questioned how the SEC could classify Cryptocurrency Airdropswhich are very often distributed for free, according to the Howey test. This is a legal framework for determining what constitutes a securityThey also asked about the potential economic consequences of treating airdropped tokens as securities, and believe this could impact on-chain applications, economic growth, and tax revenues.

Emmer and McHenry argued that the SEC’s actions could prevent U.S. cryptocurrency users from fully reaping the benefits of blockchain technology and could allow other countries to take the lead in shaping the future of the internet. They also criticized Gensler’s leadership, saying his policies could ensure that the next generation of internet technologies will not be developed by Americans or reflect American values.

This was the second time in just over a week that Republican lawmakers examined Gensler’s management of the SEC. On September 10, several Republican lawmakers questioned whether Gensler’s political affiliation Influenced hiring practices at the agency. They even accused the SEC of favoring people from left-leaning organizations for high-level positions.

The SEC has not responded to the latest letter.

SEC accuses fake cryptocurrency platforms

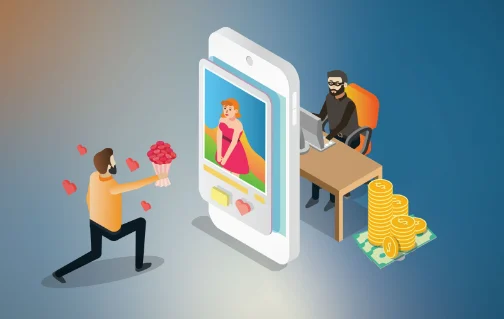

Even though the SEC is operating under scrutiny, it shows no signs of slowing down. compliance actions against the cryptocurrency sector. In fact, the regulator recently… loaded Two alleged fake cryptocurrency platforms, NanoBit and CoinW6, defrauded investors and stole their money. These are the agency’s first charges related to this type of scam.

The SEC filed two complaints against five entities and three individuals in the U.S. District Courts for the Eastern District of New York and the Central District of California. According to the complaints, the scams were promoted through social media platforms such as WhatsApp, LinkedIn and Instagram as part of a “relationship investment scam.”

Gurbir S. Grewal, Director of the SEC’s Division of Enforcement, shared that there is a growing threat posed by these types of scams, which involve targeting retail investors with promises of lucrative returns from investments in crypto assets. The SEC’s legal action against these companies is part of a broader plan to fight romance scams.

These scams have become a very serious problem in the cryptocurrency space. It is estimated that victims lost around $75 billion due to these scams between 2020 and early 2024.

From October 2023 to June 2024, the alleged scammers behind NanoBit posed as financial professionals and used WhatsApp groups to lure investors to the fake platform. NanoBit falsely claimed that its subsidiary, NanobitUS Securities, was an SEC-registered broker and promised huge returns through fake accounts. Initial Coin OfferingsHowever, instead of making money, investors’ funds were channeled to the scheme’s participants, who transferred more than $2 million to Hong Kong.

In the case of CoinW6, the SEC alleges that the scammers posed as wealthy professionals and used LinkedIn and Instagram to initiate relationships with victims. The scammers also used WhatsApp to build romantic connections while falsely promoting returns of up to 3% daily through CoinW6. Stake and mining products.

In reality, the investments were completely fake, and when investors tried to withdraw their funds, they were either required to pay back more money or told that their assets were frozen due to law enforcement investigations. Sadly, some victims were even blackmailed through romantic communications exchanged on WhatsApp.

Prager Metis agrees to settle SEC charges

Meanwhile, accounting firm Prager Metis agreed to reach an agreement with the SEC on charges of misconduct related to its audits of now-defunct cryptocurrency exchange FTX. According to a Sept. 17 announcement, the firm will pay $1.95 million in penalties to settle two actions.

The SEC alleges that Prager misrepresented its compliance with auditing standards and failed to assess the risks associated with FTX’s connection to its sister hedge fund, Alameda Research. The deal is still subject to court approval.

The SEC alleges that between February 2021 and April 2022, Prager issued two audit FTX reports that falsely stated it complied with Generally Accepted Auditing Standards (GAAS). The firm allegedly failed to follow these standards and its own policies by failing to determine whether it had the necessary competence and resources to perform FTX’s audits.

The complaint also accused Prager of negligent fraud. While the firm neither admitted nor denied the findings, it agreed to pay the fine and implement corrective measures, including hiring an independent consultant to review its audit procedures and complying with restrictions on accepting new audit clients.

Gurbir Grewal believes Prager’s shortcomings left investors without essential protections when making investment decisions. He said the ruling, which limits Prager’s ability to accept new business, will improve investor protection and serve as a warning to other audit professionals about the importance of complying with their gatekeeping obligations.

FTX was once one of the largest cryptocurrency exchanges, but collapsed in November 2022 due to a severe liquidity crisis and allegations of fraud. The crisis was triggered by revelations that FTX used its native token, FTX Token (FTT), as collateral for risky loans to Alameda Research.

When FTT’s value fell, the exchange faced a massive shortfall of customer funds, which then led to a run on withdrawals that it was unable to meet. FTX filed for bankruptcy and its founder, Sam Bankman-FritoHe was convicted of fraud in November 2023.

Jorge Tenreiro, acting head of the SEC’s Crypto and Cyber Assets Unit, also commented on the case, stating that Prager’s failure to comply with the law is just another example of an entity taking shortcuts in the crypto asset market, a strategy that does not yield results.

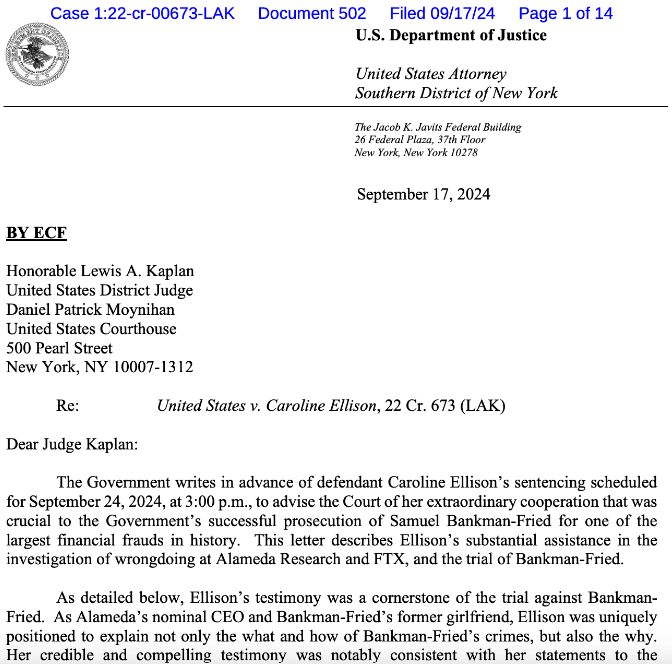

Ellison’s cooperation could lead to a reduced sentence

Carolina Ellisonformer chief executive of Alameda Research, is due to face sentencing on September 24. There is a possibility she could receive a more lenient sentence following a recommendation from US prosecutors.

In a Sept. 17 filing, prosecutors told Judge Lewis Kaplan of Ellison’s “extraordinary cooperation” in prosecuting Bankman-Fried, as well as his help in uncovering wrongdoing at both Alameda Research and FTX. They also highlighted his credible testimony against Bankman-Fried and his candor about his own misconduct in the collapse of FTX.

While prosecutors acknowledged Ellison’s involvement in the schemes, they steadfastly maintained that Bankman-Fried was responsible for all aspects of the crimes. Ellison, who never worked at FTX, had no role in creating the encryption systems that allowed Alameda to withdraw FTX customer funds. He did, however, admit to borrowing billions of dollars of FTX user funds at Bankman-Fried’s direction to pay off Alameda’s lenders.

Following the collapse of FTX in November 2022, Ellison began cooperating with U.S. officials and pleaded guilty to seven counts of fraud and money laundering. During the Bankman-Fried trial in October 2023, he admitted to creating fraudulent balances to conceal the $10 billion loan Alameda received from FTX. Bankman-Fried was convicted of all seven felony counts and sentenced to 25 years in prison.

Ellison’s whereabouts have remained largely unknown since his testimony, but his lawyers have… requested time fulfilled and three years of supervised release. Prosecutors also said Ellison provided valuable assistance in civil cases brought by the SEC and the Commodity Futures Trading Commission (Federal Trade Commission (CFTC)), which were postponed until after the Bankman-Fried criminal trial.

While Bankman-Fried received a large long prison sentenceOther FTX executives who cooperated with prosecutors, including Ryan Salame, Gary Wang and Nishad Singh, have also pleaded guilty and are awaiting sentencing.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.